The forex market is one of the most active in the world, and accessing it starts with choosing the right broker.

At Investing in the Web, we help users find the platform that best suits their needs.

If you’re looking for the best UK (FCA-regulated) forex brokers, this guide is for you.

Best forex brokers in the UK

Here’s the list of our top picks for the best forex brokers in the UK:

- Interactive Brokers: Best overall

- Pepperstone: Best for MT4 and MT5 trading

Disclaimer: 74–89% of retail CFD accounts lose money. - XTB: Best for customer service

Disclaimer: 69–80% of retail CFD accounts lose money. - Plus500: Best for demo account

Disclaimer: 79% of retail CFD accounts lose money. - CMC Markets: Best for CFD trading

- Forex.com: Best for professional traders

- IG: Best for a wide range of markets

- eToro: Best for social trading

Disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

For a list of brokers we do not recommend, you can visit our full list of broker reviews and filter by “Not recommended”.

Comparison table

Spreads are not fixed: they vary depending on the currency pair, liquidity, and market events. The above spreads are mentioned as presented on the broker’s website.

Safety & regulation

Before diving into a deeper analysis of each broker, it is important to know your safeguards:

When choosing a forex broker in the UK, regulation and client protection should always come first. The UK remains one of the most strictly regulated financial markets in the world, with brokers supervised by the Financial Conduct Authority (FCA), a top-tier regulator known for its transparency, enforcement, and investor safeguards.

- FCA regulation: All legitimate forex brokers operating in the UK must be authorised and regulated by the FCA. This ensures they meet strict requirements on capital adequacy, client fund segregation, transparent pricing, and fair dealing

- Financial Services Compensation Scheme (FSCS): If a regulated broker becomes insolvent, UK clients are protected under the Financial Services Compensation Scheme (FSCS). This scheme compensates eligible traders up to £85,000 per person, per firm, offering peace of mind that your deposits are safeguarded even in extreme scenarios.

- Negative balance protection: Another crucial safeguard under FCA rules is negative balance protection. This means that traders can never lose more money than they deposit, even during periods of high market volatility or sudden price movements. Your account balance will not fall below zero, which is essential for retail traders using leverage.

Additional security measures: UK brokers also use encryption protocols, two-factor authentication (2FA), and secure account verification processes to protect your data and prevent unauthorised access.

Detailed broker analysis

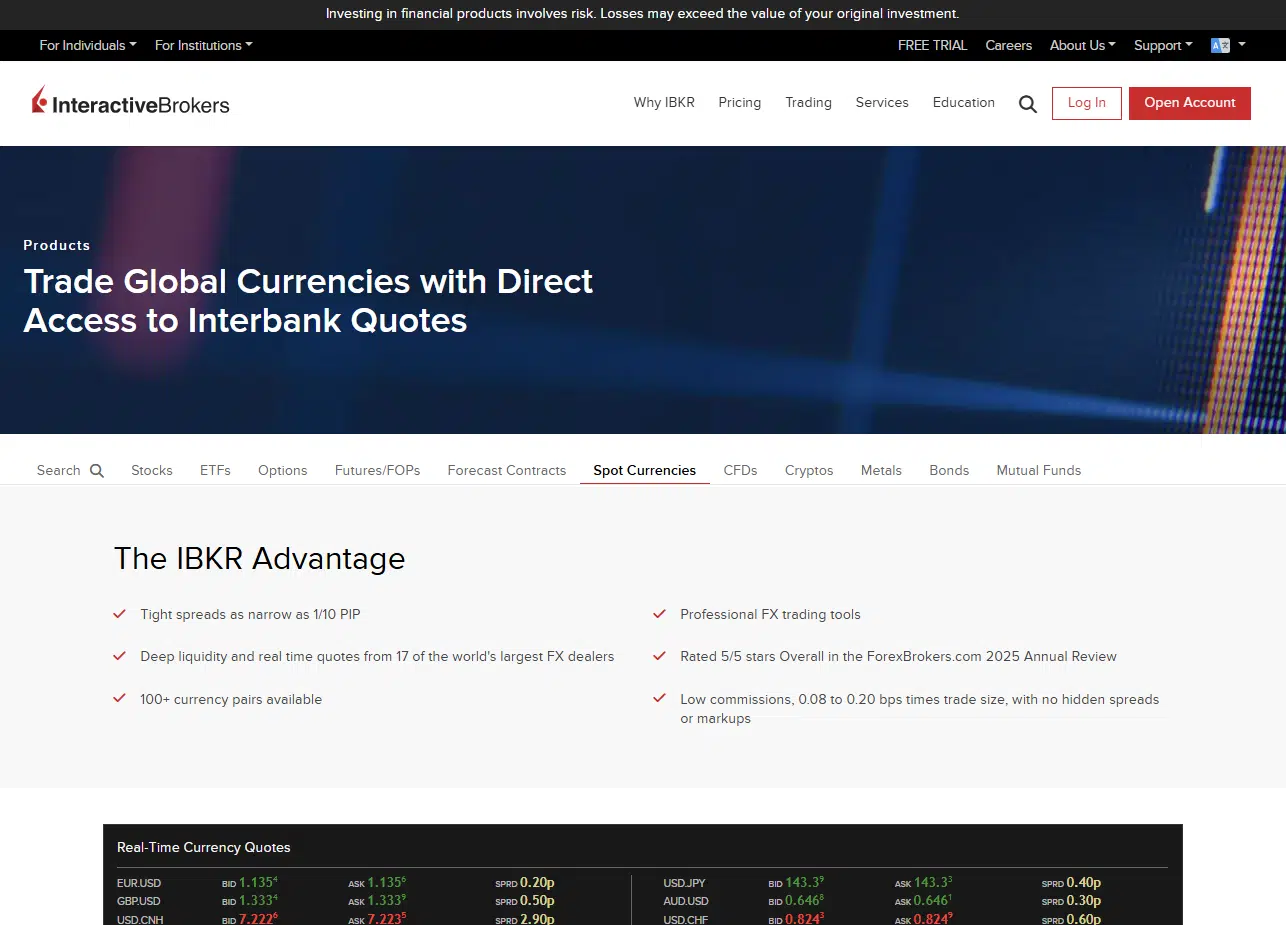

#1 Interactive Brokers at a glance

Founded in 1978 and listed on the NASDAQ (ticker: IBKR), Interactive Brokers is regulated by several top-tier authorities worldwide, including the UK’s Financial Conduct Authority (FCA) through its subsidiary “Interactive Brokers (U.K.) Limited” (FNR: 208159).

It gives UK investors access to more than 150 markets across 33 countries. The broker supports virtually every type of financial instrument, including shares, bonds, ETFs, forex, funds, commodities, options, futures, CFDs, crypto futures, and even penny stocks.

Interactive Brokers offers a robust and professional-grade environment for Forex trading, providing access to over 100 currency pairs across major and emerging markets. With deep liquidity, institutional-grade execution, and low trading costs, it is a top choice for advanced traders seeking efficiency and scale.

Key forex highlights:

- Trade 100+ currency pairs with institutional spreads

- Direct market access and smart order routing for optimal pricing

- Ultra-low commission-based pricing with tiered or fixed structures

- Advanced risk management tools and real-time analytics

- Integrated within the Trader Workstation (TWS), a platform designed for professionals

Interactive Brokers supports multiple base currencies, offers leverage up to 30x (the maximum allowed by regulation), and operates under strict oversight from top-tier global authorities, apart from the FCA. While the platform is best suited for experienced users, its mobile app and web platforms offer simplified access to the Forex market for less advanced traders.

IBKR uses a tiered commission model. For most traders, the cost is about 0.20 basis points (0.002%) of the trade value, with a minimum of $2 per order. The more you trade each month, the lower the rate, large-volume traders can pay as little as 0.08 basis points.

With no minimum deposit, transparent fee structure, and reliable execution, Interactive Brokers is ideal for serious Forex traders who value performance, control, and global market access.

We recommend you check out our comprehensive Interactive Brokers review.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

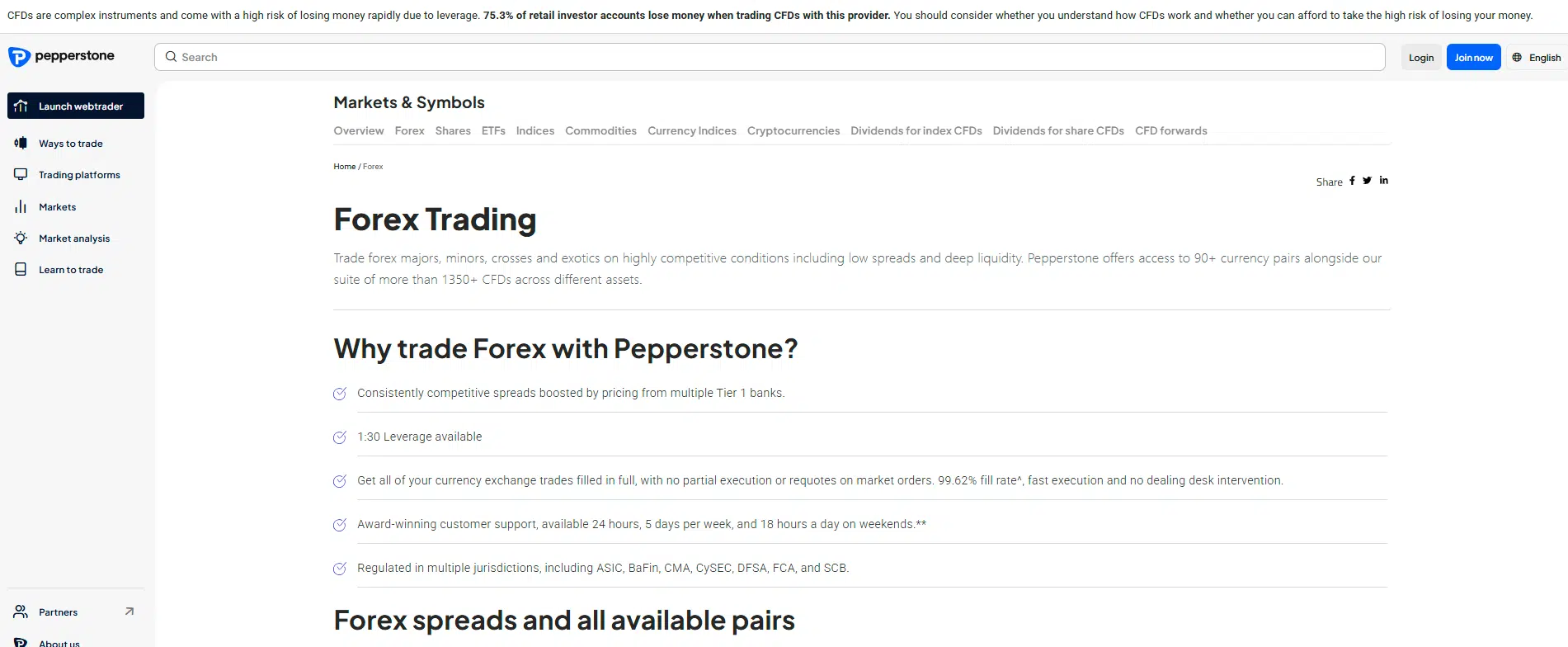

#2 Pepperstone at a glance

74-89% of retail CFD accounts lose money.

Pepperstone, founded in 2010, has positioned itself as one of the largest Forex and CFD brokers, helping over 750,000 retail trading accounts worldwide. It has earned several awards for its exceptional services, notably receiving the “Best MT4 and MT5 Broker” award for 2025 from us. With access to over 90 currency pairs and tight spreads starting from 0.0 pips, it particularly appeals to day traders, scalpers, and algorithmic traders.

Pepperstone operates under strict regulations from top-tier authorities such as ASIC and the FCA (FNR: 684312), reinforcing its commitment to providing a secure and trustworthy trading environment. The broker offers various trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, with features such as advanced charting and automated trading.

Account types cater to various trader needs. The Razor account, favoured by scalpers and users of Expert Advisors, offers spreads starting from zero pips with a small commission, while the Standard account incorporates commissions into the spread rate and is suitable for those preferring a straightforward approach to trading.

Key Forex Highlights:

- Trade 90+ major, minor, and exotic Forex pairs

- Low latency execution and spreads from 0.0 pips on Razor accounts

- Commission-based and spread-based pricing models to suit different trading styles

- Regulated by FCA, ASIC, and other top-tier authorities, ensuring a secure trading environment

Pepperstone’s Forex offering is enhanced by strong platform flexibility, fast execution speed, and deep liquidity from multiple tier-1 providers.

Although the broker focuses solely on CFD products (meaning you do not own the underlying asset), it remains one of the best choices for Forex traders seeking cost-efficiency and execution quality.

Read our Pepperstone review for a deeper insight!

Pros

- Quick customer support response times

- No fees for deposits, withdrawals, or account inactivity

- Competitive spreads in the Razor account with active trader rebates

- High leverage options up to 1:500 for Pro clients; Max retail leverage 1:400 (depending on location)

Cons

- Limited to CFD trading; no direct asset ownership

- Higher Forex spreads in the standard account

- Crypto offerings are limited compared to competitors

- Limited educational resources

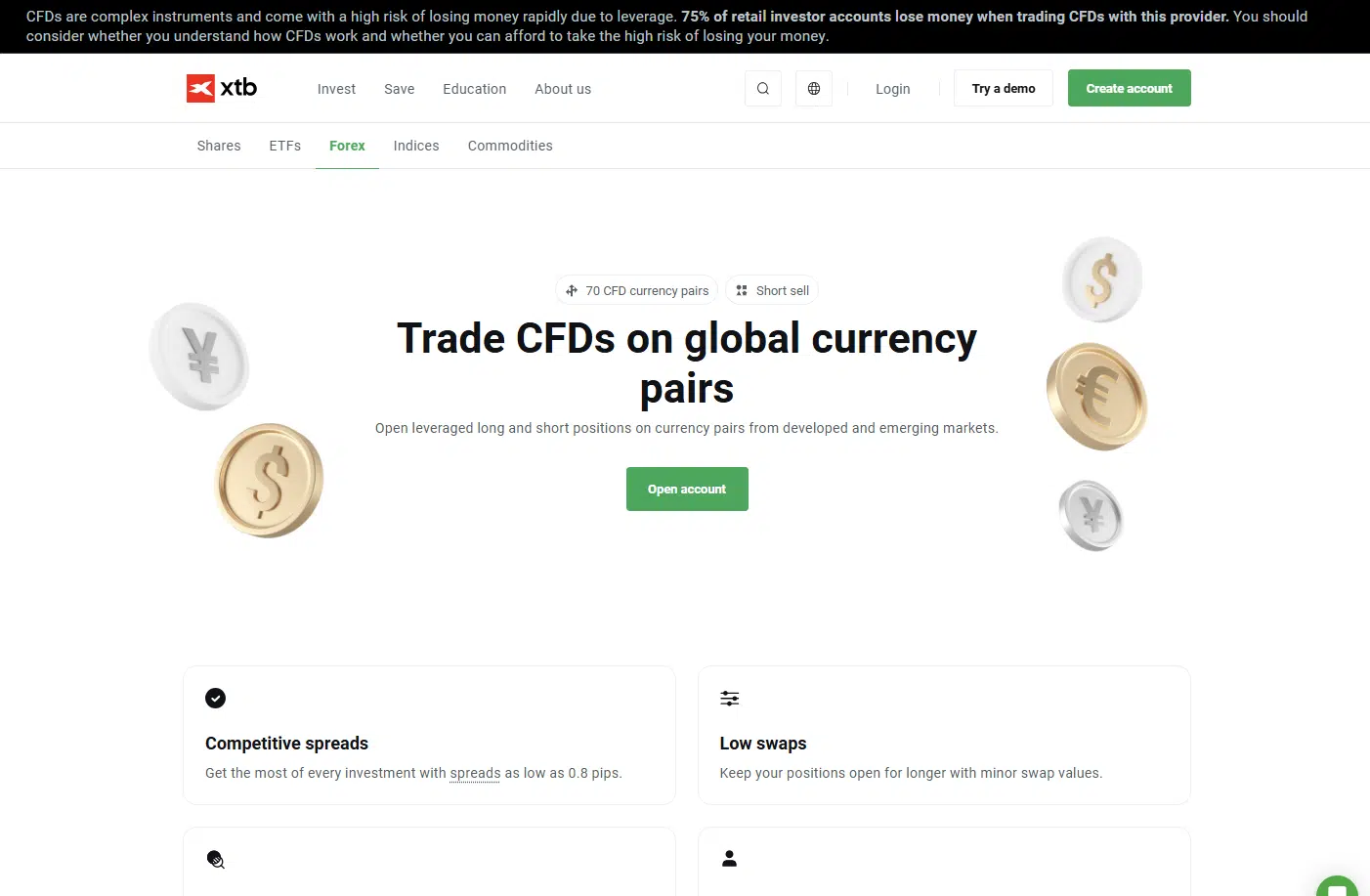

#3 XTB at a glance

69-80% of retail CFD accounts lose money.

XTB is a global CFD broker headquartered in Poland and listed on the Warsaw Stock Exchange, offering access to 48+ currency pairs with competitive spreads, no minimum deposit, and robust trading platforms. With regulation across multiple European jurisdictions and over 20 years of market presence, XTB provides a secure and reliable environment for Forex trading.

XTB’s forex trading fees are mainly built into the spread, with no separate trading commission on standard accounts. Typical spreads start from around 0.9 pips on major pairs like EUR/USD, depending on market conditions. If you trade in a currency different from your account base (for example, funding in GBP but trading USD pairs), a currency conversion fee of about 0.5% applies.

Holding leveraged positions overnight incurs swap or financing charges, which vary by currency pair and direction of the trade.

XTB, through its subsidiary “XTB Limited”, is authorised and regulated by the Financial Conduct Authority (FCA) in the UK (FRN 522157).

Key Forex Highlights:

- Trade 48+ Forex pairs, covering major and minor currencies

- Platforms: xStation 5 (desktop) and xStation Mobile, both user-friendly and feature-rich

- No minimum deposit, making it accessible to all traders

- Funding methods include bank transfers, credit/debit cards, Skrill, and Paysafe

- Regulated by FCA, KNF, CySEC, DFSA and FSC, offering high levels of investor protection

- Competitive spreads, especially on major pairs; commission-free trading model

XTB suits beginner to intermediate Forex traders who value strong educational resources, responsive support, and a seamless trading experience. While the number of Forex pairs is more limited compared to some global brokers, its transparent pricing, regulatory framework, and platform quality make it a solid choice for everyday Forex trading.

On the downside, while XTB doesn’t charge withdrawal fees for amounts over £60, smaller withdrawals incur a £12 fee. In addition, XTB’s product range is mainly limited to CFDs and Forex trading. After 12 months of inactivity, a monthly £10 inactivity fee applies.

Read our XTB review for further insights.

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

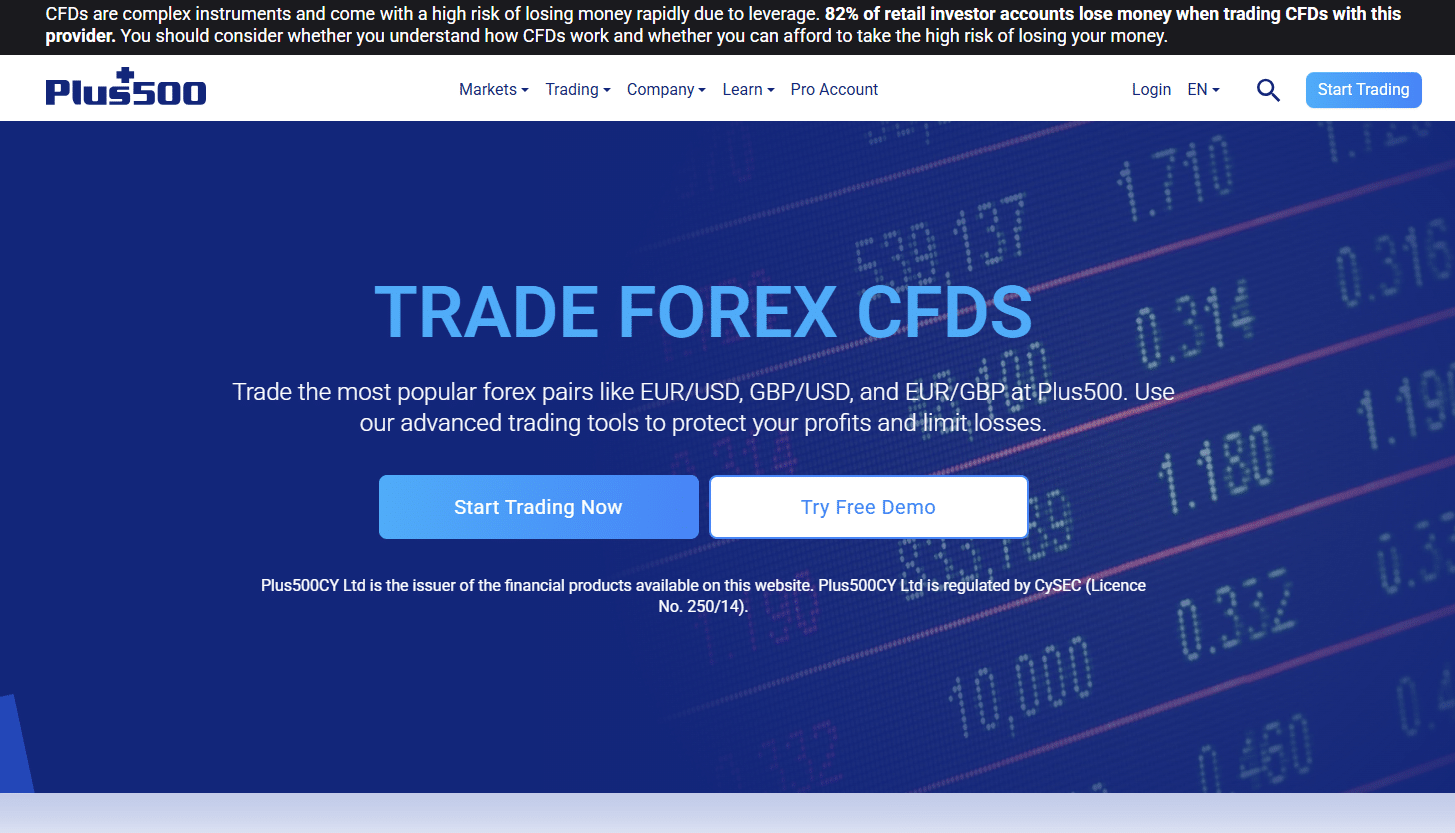

#4 Plus500 at a glance

79% of retail CFD accounts lose money.

Founded in 2008, Plus500 is an online broker offering various financial products, including real shares and CFDs on forex, indices, shares, commodities, options, ETFs, and cryptocurrencies. It is available in over 50 countries and is listed on the London Stock Exchange.

Plus500 offers a straightforward and accessible way to trade the Forex market through its proprietary WebTrader platform. While primarily known for its CFD offering, the platform provides retail traders with access to major and minor currency pairs, backed by user-friendly tools and regulatory protections across various jurisdictions.

Key Forex Highlights:

- Trade major and minor Forex pairs with leverage up to 30:1 (per FCA regulation)

- WebTrader platform is intuitive, stable, and available across devices

- Forex orders supported: market, limit, stop loss, and trailing stop

- Spreads vary by currency pair, depending on liquidity and market conditions

- Regulated by top-tier authorities, including the FCA (UK) and CySEC (EU)

Plus500 is well-suited to beginner and intermediate traders seeking a clean interface and simplified experience. While spreads may be wider than some ECN-style brokers and Forex is only available via CFDs, the platform provides a reliable and regulated environment for retail Forex trading.

Finally, Plus500 is authorised and regulated by the UK Financial Conduct Authority (FCA) – FNR 509909, ensuring that it operates under strict standards of transparency and client protection.

Want to know more about Plus500? Check our Plus500 Review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

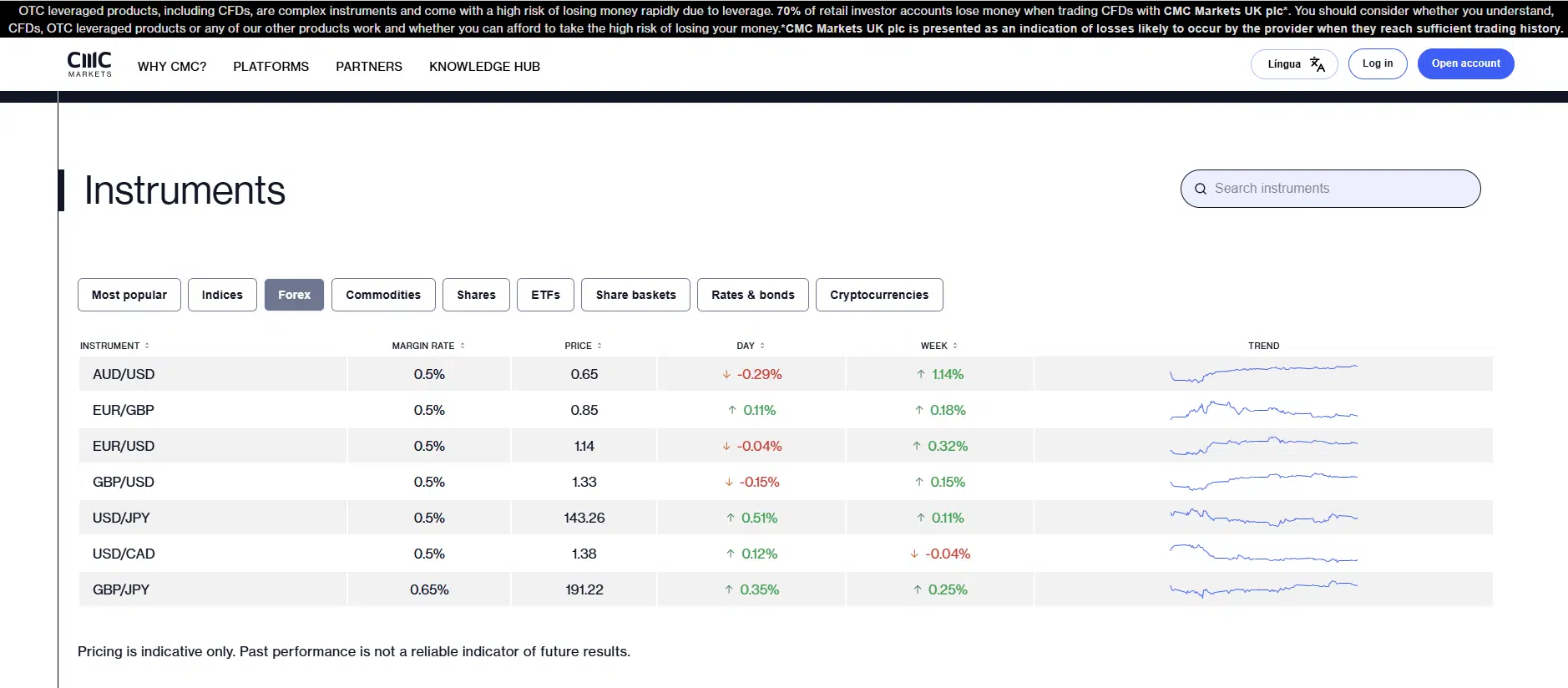

#5 CMC Markets at a glance

69% of retail CFD accounts lose money.

CMC Markets is a global CFD and Forex broker, operating since 1989 and listed on the London Stock Exchange. It is regulated by several international regulators, such as the UK’s FCA (FNR 173730).

CMC Markets is a long-established Forex and CFD broker, offering over 330 currency pairs, making it one of the most diverse Forex selections in the industry. With deep liquidity, competitive pricing, and flexible platforms, it caters to both active traders and those seeking broad market access.

Key Forex Highlights:

- Access to 330+ Forex pairs, including majors, minors, and exotics

- Tight spreads and no deposit or withdrawal fees

- Multiple platform options: CMC proprietary platform, mobile app, and MetaTrader 4 (MT4)

- Support for up to 10 base currencies, reducing conversion costs

- Regulated by FCA, BaFin, and other top-tier authorities

Unlike other brokers, CMC Markets supports up to 10 account currencies, and you can fund your account by credit or debit card, bank wire transfer, or PayPal. They do not charge any fees on deposits or withdrawals. However, if your account has no trading activity for 12 months, you will be charged a monthly inactivity fee of £15.

On the downside, you won’t be able to invest in real stocks or cryptos.

Pros

- Listed in the London Stock Exchange (higher financials transparency)

- Spread betting (Ireland and UK only)

- High track record (since 1989)

- Valuable educaiton tools

- Good customer service

- No minimum deposit

Cons

- Doesn't accept US residents

- High CFD spreads for some stocks and indices

- Limited funding methods

- No offer of real stocks and ETFs, options and bonds: only available through "CMC Invest"

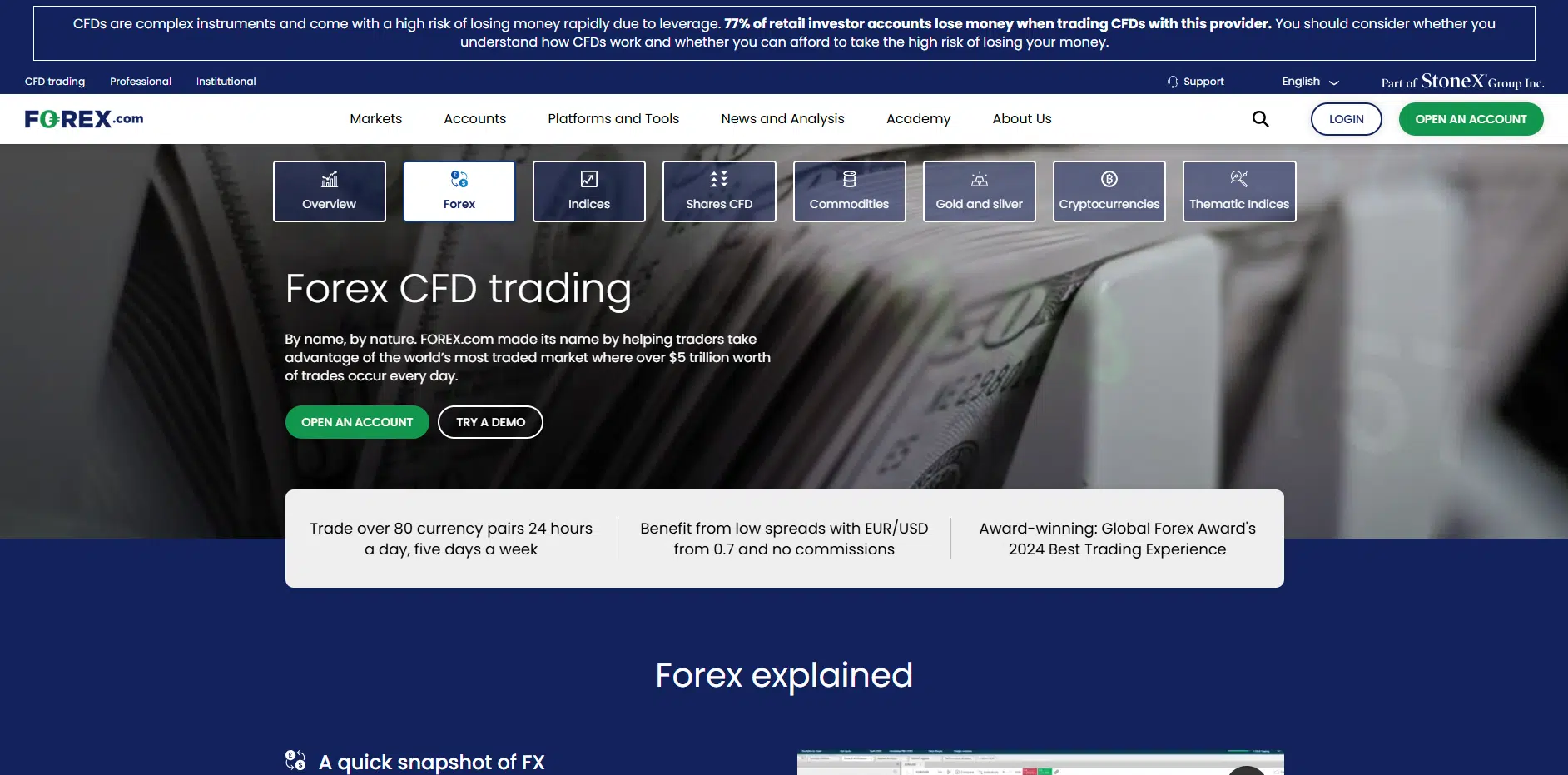

#6 Forex.com at a glance

76% of retail CFD accounts lose money.

Forex.com is a global online broker regulated by several top-tier regulatory authorities, such as the NFA and CFTC in the US, the FCA in the UK (FNR 446717), the IIROC in Canada, and the FSA in Japan.

Additionally, it is a subsidiary of a publicly traded company, StoneX, which makes it a safe broker due to strict requirements regarding its financial information reliability and availability.

Key Forex Highlights:

- Trade 80+ Forex pairs, including majors, minors, and exotics

- Multiple account types: spread-only, commission-based, and active trader discounts

- Platform options: MetaTrader 4, MetaTrader 5, and Forex.com’s proprietary trading platform

- No deposit or withdrawal fees; minimum deposit of £100

- Regulated in the US, UK, Canada, and others

Forex.com is flexible when it comes to trading platforms. They offer three platforms: the two popular MetaTrader platforms, MT4 and MT5, and their exclusive trading platform, accessible via desktop app, web, or mobile app. It offers powerful tools for experienced traders requiring sophisticated functionality and analytic tools.

Forex.com does not charge any commission on depositing or withdrawing funds. The minimum deposit is £100, and you can fund your account through a bank wire transfer, credit or debit card, or Neteller or Skrill. As for pricing, Forex.com offers three account types with different fee structures, ranging from spread-only to commission-based, with special discounts for high trading volumes.

On the downside, Forex.com charges a monthly inactivity fee of £15 if you don’t trade for 12 months, and, as previously mentioned, they have limited financial instruments in some locations.

Pros

- Top-tier regulation

- Wide range of trading platforms (MT4, MT5)

- Part of StoneX Group Inc. (a NASDAQ-listed, financially strong company)

- Large selection of markets

- Excellent execution speed (fast and reliable)

Cons

- High minimum deposits for certain account types

- High fees for some products (e.g., CFDs outside of main FX pairs)

- Inactivity fees for dormant accounts

- Limited product offering compared to full-service brokers (doesn't offer traditional stocks or bonds)

#7 IG at a glance

67% of retail CFD accounts lose money.

IG Group, headquartered in London and listed on the London Stock Exchange, is one of the oldest and largest financial companies to offer brokerage services. Its primary regulator is the FCA (FNR 195355), as well as several other international authorities, such as ASIC in Australia, BaFin in Germany, and FINMA in Switzerland.

Key Forex Highlights:

- 80+ Forex pairs covering majors, minors, and exotic currencies

- Advanced and user-friendly proprietary platform plus support for MetaTrader 4

- Extensive market research, analysis tools, and educational resources via IG Academy

- Multiple funding options: credit/debit card, bank transfer, PayPal

You can fund your IG account using a credit or debit card, bank transfer, or PayPal. For UK clients, the minimum deposit is typically £250, though this may vary depending on the account type or funding method. IG offers its own intuitive web and mobile trading platform, and you can also trade through MetaTrader 4 (MT4) if you prefer.

Pros

- Advanced trading tools

- No minimum deposit

- List on the FTSE 250 index

- No withdrawal fee

Cons

- Limited product portfolio (mostly CFDs)

- High stock CFD fees

- Inactivity fee after 2 years of no activity

- Complex fee structure

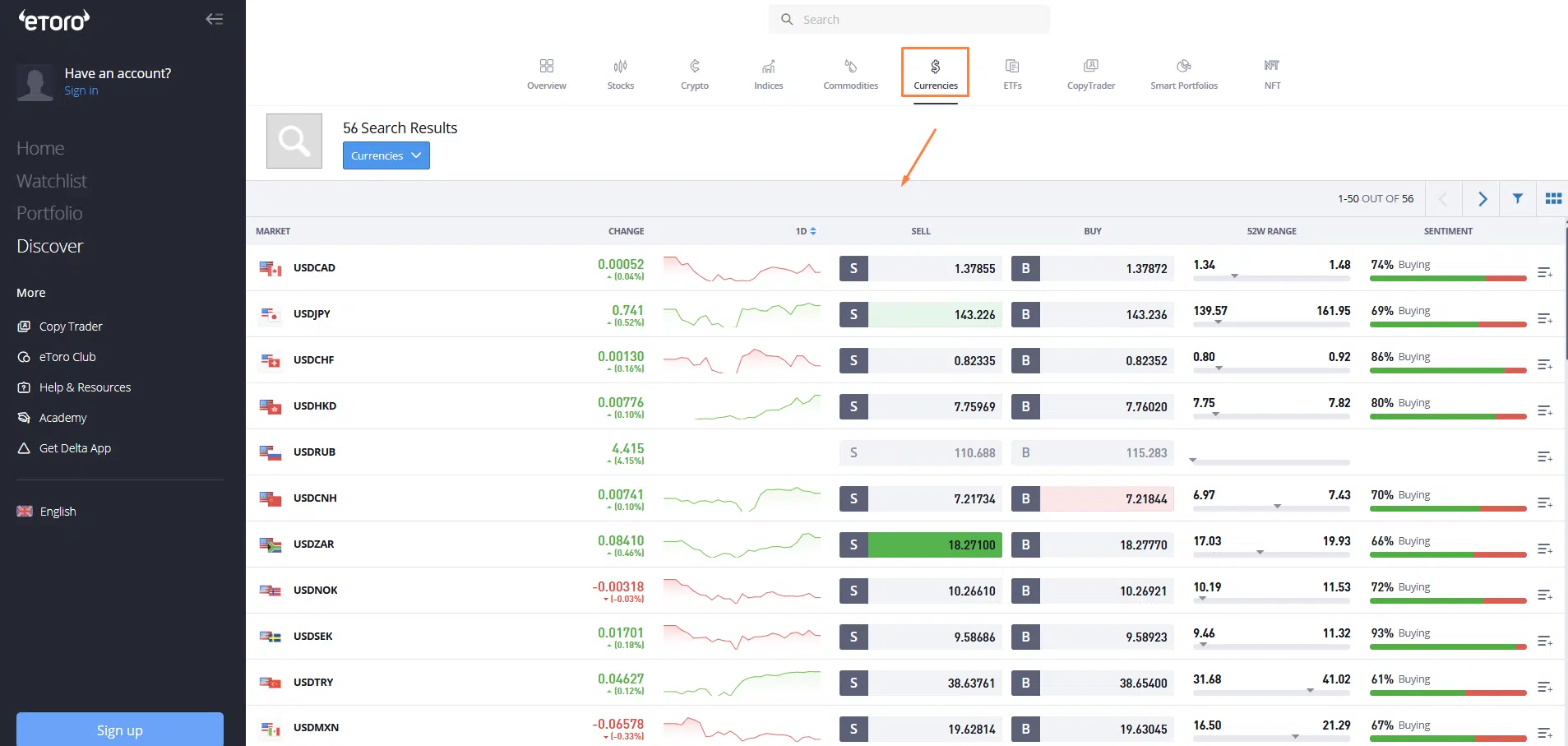

#8 eToro at a glance

50% of retail CFD accounts lose money.

Since 2006, eToro has been a unique broker in the Forex space, offering a social trading platform that allows users to copy the trades of experienced investors. With access to over 50 currency pairs, eToro blends Forex trading with community-driven insights, making it a compelling option for beginners and intermediate traders.

eToro is listed on NASDAQ Exchange, and it is regulated by the FCA (FNR: 583263).

There is no separate commission for opening or closing most forex trades, your cost is built into the spread (the difference between the buy and sell price). When holding leveraged forex positions overnight (or over non-trading hours), you’ll incur overnight/roll-over financing costs. These vary depending on the currency pair, the size of the position, and the funding rate.

Key Forex Highlights:

- Trade 50+ Forex pairs, including majors, minors, and selected exotics

- Social trading features allow you to follow and copy top-performing traders

- Regulated by FCA, ASIC, and CySEC, ensuring strong investor protection

- Minimum deposit from $50

- Intuitive platform focused on simplicity rather than advanced technical tools

eToro is ideal for those looking to learn from others or simplify the trading process through automation. While its Forex offering is less extensive than traditional brokers and spreads may be wider, its community features, low entry barrier, and strong regulation make it a great starting point for aspiring Forex traders.

Recently, eToro introduced a feature allowing UK users to open a GBP account (via “eToro Money GBP”) alongside the traditional USD investment account. This means you can deposit, hold, and trade in GBP, avoiding conversion to USD when you’re trading GBP-based assets.

etoro.com

However, it’s important to understand the nuance: although you can hold GBP and use it when trading assets listed in GBP with no conversion fee, if you trade assets denominated in USD (which is many global stocks/forex pairs), your funds still need to be converted into USD for execution.

Read our eToro review here.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

What makes a good Forex broker?

Many features and benefits should be considered when looking for a good Forex broker, whether you are a beginner or an experienced trader. Among the most critical factors that you might want to check are:

- Regulation

The first and most important criterion is regulation. You should always ensure that the broker is authorised by a reputable financial authority, such as the FCA in the UK, before transferring any funds. Regulation ensures the broker follows strict standards on client fund protection and fair trading practices.

- Commissions and Spreads

Good forex brokers typically offer tight spreads and low commissions, helping traders keep costs under control. Competitive pricing can make a big difference, especially for active traders or those using short-term strategies. However, it’s worth noting that spreads and commissions vary by currency pair, trading volume, and account type, so always compare fee structures before opening an account.

- Deposits and withdrawals

A trustworthy UK broker will make it easy for you to fund and withdraw from your trading account. Look for platforms that support multiple payment options such as bank transfers, debit/credit cards, and digital wallets like PayPal or Skrill. Processing times should be fast, and there should be no hidden fees for deposits or withdrawals.

- Trading platforms and tools

A good forex broker provides a stable, intuitive, and powerful trading platform, whether it’s MetaTrader 4/5, cTrader, or a proprietary web platform. Look for features such as real-time charts, advanced order types, risk management tools, and mobile access, all of which can make trading more efficient and enjoyable.

- Education and market research

For new traders, access to educational resources like webinars, tutorials, and market analysis can be extremely valuable. For experienced traders, professional-grade research tools, economic calendars, and in-depth reports can enhance trading decisions and improve performance.

- Customer support

Reliable and responsive customer service is a must. A good broker should offer 24/5 support (or better) through multiple channels such as live chat, phone, and email. Fast assistance can make all the difference when issues arise, especially in the fast-moving forex market.

Bottom line

Searching for the best Forex broker in the UK and comparing different trading conditions is challenging. Many factors should be considered, and it is time-consuming to gather all the information to choose the best one that fits your needs. Our analysts performed this task and concluded their findings in this review of the “Best Forex Brokers in the UK”, summarized below:

Interactive Brokers

Best overallPepperstone

Best MT4 and MT5 brokerXTB

Best for customer servicePlus500

Ideal for a demo accountCMC Markets

Best for CFD tradingForex.com

Best for professionalsIG

Best for all-inclusive productseToro

Best for social trading

You can always try our “BrokerMatch” tool to know which broker might be best for you or you can also check our comparison table for an in-depth overview of the main features of several global brokers. You can also read our reviews for more information about the products and services offered by each broker.

Whether you’re a beginner trader looking to start your trading journey or an experienced investor searching for enhanced brokerage services, we hope this article saved you some time while searching for UK Forex brokers. We recommend you do your own research to assess which online broker will be better for you (a demo account might be helpful).

FAQs

Can you trade in Forex without a broker?

No, you can’t have direct access to the Forex market without a broker. Still, you can exchange currencies over the counter at any exchange dealer.

Can I trade Forex with £10? And £100?

Yes, you can trade Forex with amounts as low as £100 or even £10. But the trade size will be small.

How to open an account with a Forex broker in the UK?

It is very simple, you just need to visit the broker’s website and sign up by filling the required fields and uploading the needed documents.

What is a PIP (percentage in point)?

Pip stands for “percentage in point”, which is the unit of change in an exchange rate. For example, 1 pip change in a rate is equal to a 0.0001 change.