Safety is a top concern when choosing a broker, especially for beginners. XTB is a well-known European broker, and this article examines if it’s a safe choice for investors.

We’ll look at how XTB protects client assets through asset segregation, investor compensation schemes, and deposit protection. We’ll also discuss XTB’s status as a publicly listed company, compare its safety measures with competitors like Interactive Brokers, eToro, and Trade Republic, and offer some investor safety tips. The focus is on European investors, but global users are considered too.

Highlights

- Is XTB safe? All in all, yes, we believe that XTB is a legit broker. For a list of brokers we don’t recommend, check our broker list and filter for “not approved”.

- Regulation: XTB is regulated by top-tier regulators, which is a good sign of safety.

- Investment compensation scheme: covers both cash and assets (securities). Not all XTB users have an investor compensation scheme. It depends on where you are based (explained below).

- Deposit protection: XTB does not have a banking license. As such, your deposits are not covered by any deposit guarantee scheme, only by the investor compensation scheme.

- Asset segregation: Regardless of location, XTB segregates client funds from the company’s own funds. In the event of insolvency, customer funds are not treated as XTB’s assets.

- Reputation: XTB is a publicly-traded company, and has been around for a while now.

- Financials: XTB shows strong financial stability. It had +$200m of profits in 2024 alone. It is unlikely that the company will become bankrupt in the near future.

Regulators

XTB is regulated by several top-tier regulators, which is a good sign of safety.

Regulation plays a critical role in ensuring your money is safe. Brokers in Europe must be licensed by regulatory authorities such as the FCA (UK), BaFin (Germany), or CySEC (Cyprus).

Reputable regulators like the FCA or ASIC in Australia are known for strict oversight, requiring brokers to meet rigorous standards for capital adequacy, client fund protection, and operational transparency.

Investor compensation scheme

Investor Compensation Schemes cover both cash and assets (securities) up to the stated limits, in case the company goes bankrupt and cannot return assets to investors.

Below is a table summarizing XTB’s main entities and the respective investor compensation coverage for clients depending on their country or region:

| Client Country | Investor Protection Amount | Regulator | Legal Entity |

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | XTB Limited (UK) |

| Cyprus and Hungary | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | XTB Limited (CY) |

| Other EU clients (incl. Portugal, Spain, Germany, France, etc.) | €20,100 | Polish Financial Supervision Authority (KNF) | X-Trade Brokers Dom Maklerski SA (Poland) |

| United Arab Emirates | No protection | Dubai Financial Services Authority (DFSA) | XTB MENA Limited |

| Other countries (incl. Latin America, Africa, Asia) | No protection | International Financial Services Commission (IFSC, Belize) | XTB International Limited |

Asset segregation

Asset segregation means keeping client funds separate from the broker’s own money.

This means that, even if XTB goes bankrupt, if there’s no fraud, then your assets should be safe (The investor compensation fund is a “last resort”).

XTB follows this practice strictly. In fact, “all client funds are held in segregated accounts away from the company’s funds”. This means that the money you deposit with XTB is kept in a separate bank account that is ring-fenced and not mixed with XTB’s operational accounts.

Why is this important? If something goes wrong with XTB’s business, your funds should remain untouched because they are segregated. The broker cannot use your money for its own expenses or investments. This adds a layer of safety, as segregated funds would be returned to clients rather than used to pay XTB’s debts.

Many top-tier regulators require brokers to segregate client funds, and XTB complies with these rules. For example, XTB is regulated by the UK Financial Conduct Authority (FCA), and “in line with FCA rules, XTB holds all client money in segregated client bank accounts”. In simple terms, your money is kept separate so that it’s safe even if XTB faces financial trouble.

XTB is a publicly-traded company

XTB isn’t a private, opaque company – it’s a publicly listed company. XTB is listed on the Warsaw Stock Exchange in Poland, which means it has to meet strict financial reporting and transparency requirements.

Public companies must publish regular financial statements, undergo audits, and disclose information that might affect investors. This level of transparency is a positive sign for safety. It allows anyone to review XTB’s financial health. In other words, you can actually check XTB’s balance sheets, profit/loss, and ensure it’s financially stable. If what you find makes you feel reassured, you can use our referral bonus on XTB to start trading anytime.

For investors, XTB’s public listing means additional oversight. Regulators and exchange authorities keep an eye on XTB’s operations. Any major issue with XTB’s finances would likely be spotted and need to be reported. This greatly reduces the risk of hidden problems. In contrast, if a broker is privately owned, you might not know much about its financial condition. With XTB, you have more transparency, which contributes to overall safety.

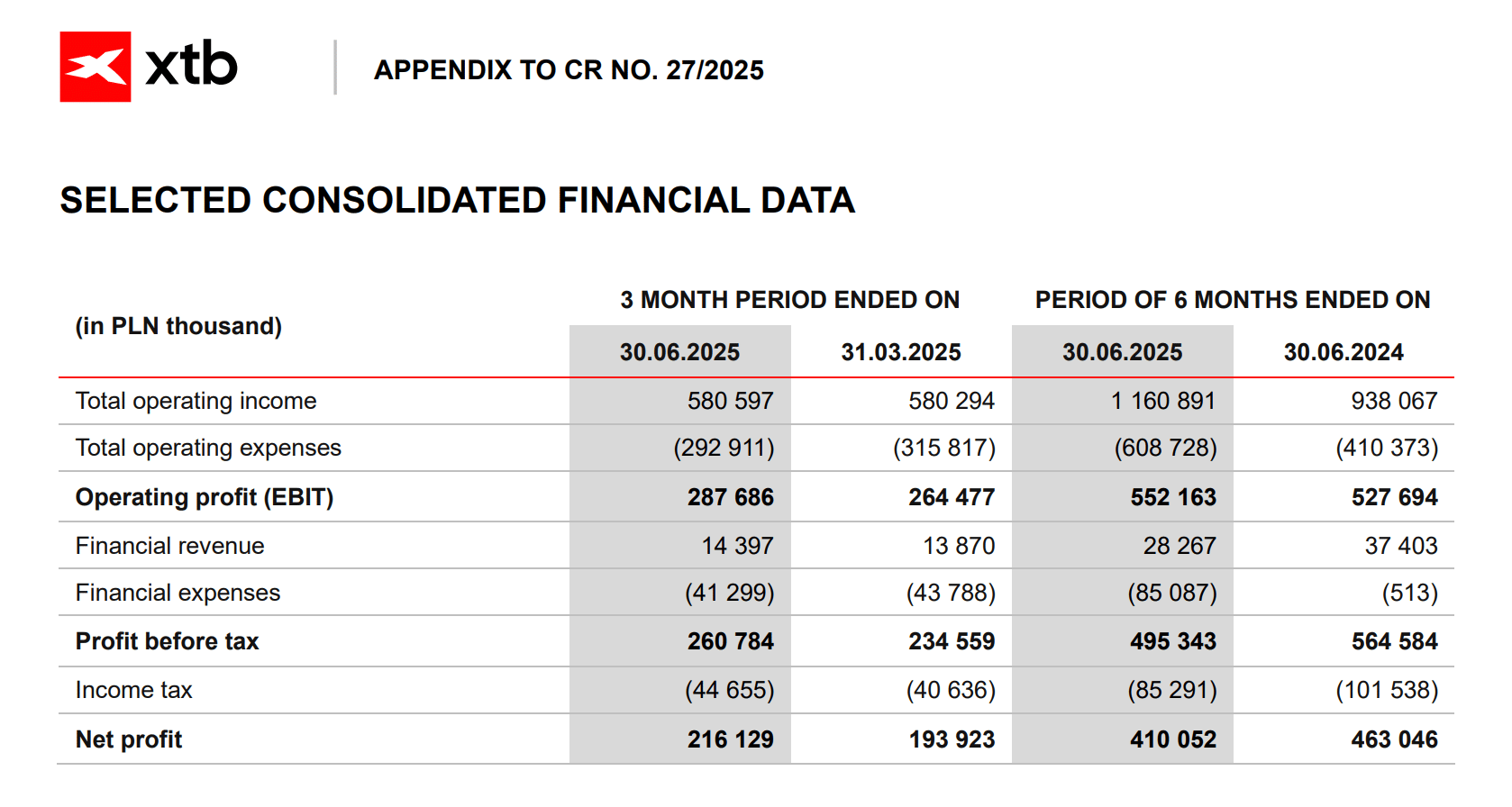

Furthermore, the company was profitable in 2024 and 2025, and shows financial strength in their quarterly reports, with millions in net profit:

Additional security tips

In practice, the real risks you face are operational, fraud-related, and, subsequently, the resolution time, which can take months or years.

What is generally recommended is to:

- Have accounts with at least two stockbrokers. Not because we think you could lose all your money (due to all the protection mechanisms mentioned above), but so that your assets are not blocked indefinitely in the event of one broker’s bankruptcy. This diversification should not be done randomly. For example, it wouldn’t make sense to only have accounts with Trading 212 and Interactive Brokers, as Trading 212 uses Interactive Brokers as its custodian. If the latter fails, you would lose access to your investments in both.

- Export a PDF document of your portfolio every month. It costs nothing and can help regulators locate your assets.

Video summary

If you want to explore more about this security issues and hear about real-life examples of bankruptcies, check out this YouTube video. It’s about the safety of European brokers, but the principles are the same:

Conclusion

So, is XTB a safe broker for investors? For a European investor, the answer is generally yes.

XTB employs all the standard safety practices we expect from a reputable broker: client funds are segregated, there are solid investor compensation schemes in place (protecting deposits up to sizable limits), and the company’s financials are transparent due to its public listing. XTB’s security measures are on par with other trusted brokers around the world.

Of course, no broker is 100% risk-free, but XTB has multiple layers of protection that make it a reliable choice for beginners and experienced investors alike. You can also get more information by reading our review on XTB.

Hope we helped!