Hello there! In this article, we will give you our hands-on review of Curvo, a Robo-Advisor with a focus on index investing.

The minimum deposit is €50, the investment platform is user-friendly, and the business model aligns well with investors’ goals – to make profits. On the downside, it is a fairly recent investment app (short track record) and is only available in Belgium.

That’s Curvo in a nutshell. Keep reading if you want to discover what came out of our research after carefully analysing Curvo.

Overview

Founded in 2019, Curvo is a recent, Belgian-based robo-advisor with just over 5,000 users and a combined amount saved of +€19,000,000. It is the European equivalent of Betterment or Wealthfront, two US-based Robo-advisors.

Highlights

| 🗺️ Supported Countries | Belgium |

| 💰 Fees | 0.6% to 1% (per year) |

| 🎮 Demo Account | No |

| 📈 Portfolio Rebalancing | Yes |

| 💵 Minimum Deposit | €50 |

| 📍 Investment Instruments | Index Funds |

Many investors are initially drawn by the thrill and allure of single-stock investments, but the higher risk involved oftentimes turns out not to be the best investment decision for most. Several studies (SPIVA reports; ESMA; academic papers) have shown that while it is not the most exciting type of investing, investing with a long-term mindset (no constant trading) is best. This strategy is what Curvo leans into, as their investment philosophy is based on passive investing through Index Funds (only BlackRock and Vanguard).

Index Funds are very similar to ETFs. The only difference between these two is that: ETFs can be bought or sold at any time during the day, whereas Index Funds are only priced at the end of the day (like a mutual fund). In practice, investing through ETFs and/or Index Funds should present roughly the same results.

Curvo wants to help you be more “rational” and less “emotional” in your investment decisions while eliminating specific risks (only exposure to market risk) and saving you a lot of time from getting the technical knowledge to make the investments by yourself.

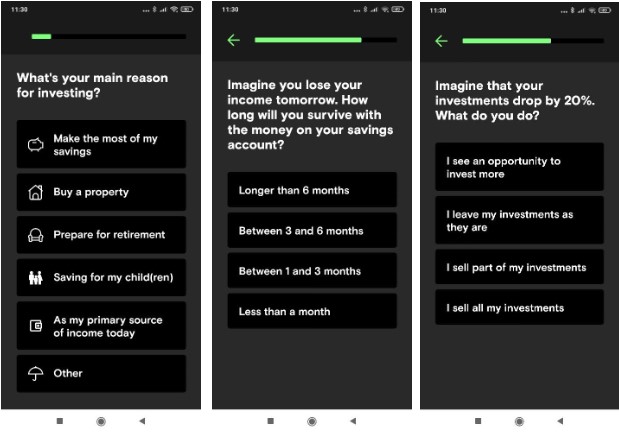

Upon opening a Curvo account, you are guided to answer a few questions to assess your attitude toward risk, your financial goals, your investment horizon, and your financial situation. After that, Curvo will suggest an optimal investment portfolio based on your answers. Here are some examples from the questionnaire:

As stated earlier, Curvo is geared towards longer-term investments so it is not ideal for high-risk investments (newer or riskier assets such as cryptocurrencies), active management (funds managed by professional investors), picking stocks, or making a short-term investment.

From an internal survey, Curvo concludes that most of its users want to “make the most of my savings”, followed by “Prepare for retirement” and “buy a property”.

Pros and cons

Pros

- Fees transparency (an annual management fee and that’s it!)

- Low minimum deposit (€50)

- Use of physical and accumulating Index Funds in the portfolios

- Direct debit top-ups

- Automatic Rebalancing

Cons

- Only available for Belgium residents

- Only invest in Equity and Fixed Income – no Alternatives Investments like Real Estate, Commodities or Hedge Funds

- Company’s short track record

Investment strategy

Curvo’s objective is to ensure that you follow a consistent path to sustainable financial well-being without being emotionally affected by short-term market fluctuations. This strategy requires patience, persistence, and an astonishing capacity to ignore the “exciting” stuff.

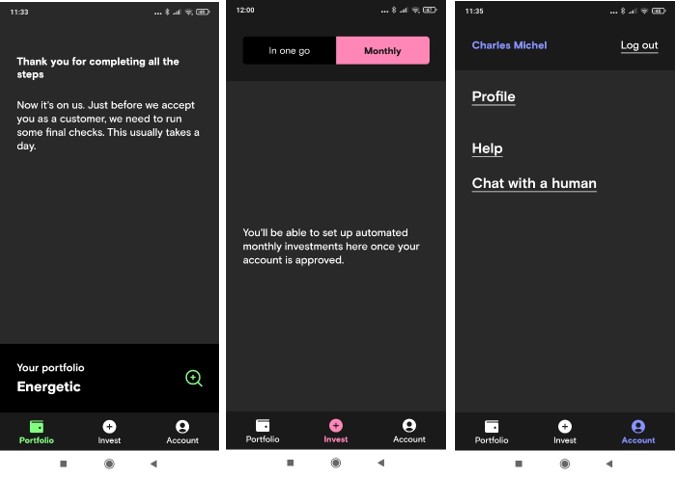

After a questionnaire, you will be allocated to one of the five portfolios: Protective, Calm, Smooth, Energetic, or Growth. These portfolios combine Equity (stocks) and Fixed-Income (Bonds) Index Funds with different weightings. Since stocks are more volatile than bonds, the allocation to the former is lower in the “Protective” portfolio than in the “Growth” one.

After the portfolio attribution, your financial situation and goals (and even your attitude to risk) may change over time. That’s why the Know-Your-Customer (KYC) process is repeated regularly to ensure that your investment strategy always remains aligned with your needs.

Stock Index Funds

The Stock Index Funds used for portfolio construction are:

- Vanguard ESG Developed World All Cap Equity Index Fund: Invests in +4,000 companies in the developed countries. It excludes companies involved in non-renewable energies, vice products and weapons.

- Vanguard ESG Emerging Markets All Cap Equity Index Fund: Invests in +2,500 companies in the emerging markets, and it excludes companies involved in non-renewable energies, vice products and weapons.

| Index Name | Total Expense Ratio (TER) | ISIN |

| Vanguard ESG Developed World All Cap Equity Index Fund | 0.20% | IE00B5456744 |

| Vanguard ESG Emerging Markets All Cap Equity Index Fund | 0.25% | IE00BKV0W243 |

Bond Index Funds

The Bond Index Funds used for portfolio construction are:

- Vanguard SRI Euro Investment Grade Bond Index Fund: Euro denominated bonds issued by companies with maturities greater than one year. It excludes issuers who do not meet the criteria for sustainable investing.

- iShares Euro Government Bond Index Fund: Government bonds from countries in the European Monetary Union (France, Italy, Germany, Spain, Belgium…).

- iShares Euro Government Inflation-Linked Bond Index Fund: Invest in Inflation-linked government bonds (protect against rising inflation). In Europe, only 4 European countries issue these bonds: France, Italy, Germany and Spain.

| Index Name | Total Expense Ratio (TER) | ISIN |

| Vanguard SRI Euro Investment Grade Bond Index Fund | 0.16% | IE00BYSX5D68 |

| iShares Euro Government Bond Index Fund (1) | 0.13% | IE0031080868 |

| iShares Euro Government Inflation-Linked Bond Index Fund (2) | 0.13% | IE00B4WXT857 |

For more details on these funds, check Vanguard, BlackRock, and iShares.

As you can notice by the “ESG” and “SRI” acronyms, these Index Funds consider sustainable investing. To meet these criteria, they exclude several sectors, industries, and companies from their investment universe. This includes no investment in controversial weapons, non-renewable energies, or vice products (e.g. tobacco).

Besides, all the Index Funds are physical (own the underlying assets) and accumulating (dividends are reinvested).

Asset Allocation

The asset allocations within each of the five portfolios are the following:

| Index Names | Protective | Calm | Smooth | Energetic | Growth |

| Vanguard ESG Developed World All Cap Equity | 12% | 24% | 40% | 56% | 80% |

| Vanguard ESG Emerging Markets All Cap Equity | 3% | 6% | 10% | 14% | 20% |

| Vanguard SRI Euro Investment Grade Bond | 34% | 28% | 20% | 12% | – |

| iShares Euro Government Bond | 40.80% | 33.60% | 24% | 14.40% | – |

| iShares Euro Government Inflation-Linked Bonds | 10.20% | 8.40% | 6% | 3.60% | – |

| TOTAL | 100% | 100% | 100% | 100% | 100% |

In addition, Curvo uses fractional shares to make sure every cent is invested in the portfolio (you will have no cash balance, meaning that you will be “fully invested”). In other words, imagine that you wanted to invest €25 in a €20 stock. You would only buy €20 worth of stock, keep the €5 in cash, or reallocate it elsewhere. With fractional shares, your €5 can buy a portion of a single stock. Curvo applies the same logic in their portfolios.

Finally, even if you want, Curvo does not allow you to trade by yourself, which is the sole purpose of a Robo-Advisor (it does that job for you). If you prefer to choose what to invest in actively, we suggest opening an account with a broker.

Investment platform

Curvo is only available through their mobile app (no desktop version), which we feel is sufficient.

We have tested the mobile investment platform, which is straightforward to navigate. Since the investments are automated, a simple and intuitive tool is expected.

Once you deposit, the money is automatically allocated to your pre-defined portfolio within a short time frame. You can even set up monthly contributions through direct debit, so there is no need to transfer the money manually.

Fees

Curvo is highly transparent in its fee structure. You will only be charged an annual management fee of 0.6% to 1%, depending on your investment amount. That’s it:

| Your investment | Fee |

| Less than €50,000 | 1% |

| €50,000 to €100,000 | 0.85% |

| €100,000 to €250,000 | 0.70% |

| +€250,000 | 0.60% |

The management fee is charged every quarter in advance. More precisely, the day before a quarter begins, 1/4th of 1% is calculated based on the total value of your portfolio on that day.

Curvo provides you with a full breakdown of costs in your quarterly report (accessible within the app).

Belgium taxes

In Belgium, you have four taxes to consider when investing in the financial markets, namely:

- In transactions (“beurstaks” or “taxe boursière”)

- In dividends (“roerende voorheffing” or “précompte mobilier”)

- In capital gains for bonds (“Reynders-tax”)

- In investment accounts (“taks op effectenrekeningen” or “taxes sur les comptes-titres”)

However, with Curvo, you do not need to worry about them (or even pay them!).

- The transaction taxes will not apply since it does not affect the Index Funds used by Curvo.

- There is no dividend tax rate because Curvo uses accumulating Index Funds, not distribution ones.

- The 30% tax on capital gains for bonds is the only tax you will have to pay since it applies to funds with more than 10% of their bond holdings (Curvo cannot escape this tax). It is charged when you sell parts of your investments and when your portfolio is rebalanced. So, this is the only cost not covered by the 1% management fee. Curvo helps you declare this tax if it applies to you.

- Finally, the investment account tax was reimplemented as a tax on the wealthiest Belgian investors. It is a 0.15% tax on any investment account of more than €1,000,000 (the total value of cash and securities combined).

For more information, please consult Curvo’s detailed tax page.

Safety and reliability

The Curvo platform is not regulated by itself. So, you may be wondering, “How can it legally operate?”. Well, Curvo has partnered with NNEK to manage your investments. NNEK, a Dutch investment firm, is authorised by the Belgian financial regulator (FSMA) and is licensed by the Dutch regulator (AFM).

Curvo acts as a middleman between you and the NNEK investment firm.

Your investments are not held by either Curvo or NNEK. It uses a custodian, an independent entity called “Stichting Noordnederlandse Beleggersgiro (NNBG)”. Its only objective is to administer and safeguard your assets (by law, it cannot perform any commercial activities). In other words, NNBG is the legal owner because it is responsible for your assets, but you are the beneficial owner of those assets (you are the actual owner).

However, one thing to note is that NNEK manages the custodian account, so an operational risk does exist.

Finally, you are also protected by the European Investor Protection Scheme for up to €20,000 in your assets. The European deposit guarantee of €100,000 would apply to your cash amount, but since Curvo makes sure every cent is invested, this protection may not apply. When we say “may not,” we mean “most likely”. Why? Because it takes some days between the time you deposit and the moment your money is invested. During that short period, your money is in Rabobank, where the €100,000 protection pertains.

Supported countries

Curvo is only allowed for residents in Belgium aged 18 or above, with an itsme account and a Belgian bank account.

We are aware that Curvo’s founders want to expand within the European Union. However, there is no public date for that expansion yet.

Bottom line

To sum it up, Curvo offers a very simple way to start your investing journey. There are no hidden fees, and the business model is aligned with investors’ goals (to make profits).

Not a Belgian resident? Check our full list of Robo-advisors available by country.