You might have already heard of TriumphFX, and there’s a chance you haven’t heard many positive things about this forex trading platform.

TriumphFX, also known as TXFI, is mainly an online forex trading platform. However, TriumphFX show numerous warning signs, as there have been claims from numerous investors accusing TriumphFX of being a potential scam!

Want to know if TriumphFX is a scam, what regulations it holds, and how it operates? Look no further—this article is your ultimate guide to uncovering the truth about TriumphFX.

Is TriumphFX a scam?

Unfortunately, TriumphFX doesn’t seem to be safe! The company behind the TriumphFX platform is Triumph International Limited (Triumph Int. Ltd), which appears to be regulated and secure. However, concerns arise when considering the subsidiaries associated with the company targeted at non-English speakers in Asia.

Triumph International Limited, the parent company, holds licenses from some low-to-mid tier regulators, such as CySEC (Licence Number: 293/16) and FSA (License Number: SD080).

TriumphFX also had authorisation from the FSC – Vanuatu (License Number: 17901). However, the license was struck off, and the company was deregistered in May 2021. This registration appears confusing and misleading, as TriumphFX has never conducted operations in Vanuatu.

TriumphFX and CySEC

Cyprus Securities and Exchange Commission, CySEC, is known for being a respected regulator in the European Union. So, you probably have one question in mind: How does TriumphFX hold a CySEC License?

TriumphFX has faced accusations from Asian regulators for nearly a decade, yet it maintains a license from CySEC, which was issued after addressing some of the allegations, including those from SFC and MAS (date highlighted in red in the image above). This occurred as Triumph International Limited or its affiliated companies acquired another licensed business from the European Union, enabling legal operations.

Nevertheless, Triumph International Limited’s activities must align with regulations, and the company cannot use this branch to conduct unlicensed activities, as that would raise concerns with the regulator at present. So, this indicates that the approved domain (date highlighted in green in the image above) in the CySEC regulation is not used to conduct suspicious operations.

However, MAS could simply target all the known domains. Our team supposes that this could be true, as the SFC does not target this domain. Furthermore, MAS also targets other domains allegedly used to sponsor suspicious activities aimed at non-English-speaking investors in Asia and not approved by CySEC.

As a matter of fact, we conducted research on various domains associated with TriumphFX, and our findings led us to a conclusion that aligns with our initial expectations. The domain approved by CySEC appears to target Cyprus and other European investors, and seems a legal approach. On the other hand, the domain tfxi.com, which was targeted by Asian regulators, is geared towards non-English-speaking investors, as evident in the language selection shown in the following image. This domain is allegedly among the suspicious ones that we do not recommend for opening an account.

Warning signs

Despite the regulations mentioned earlier, there were already some warning signs about the company that appear to have been ignored by the regulators mentioned before. Most of the problems come from subsidiaries that allegedly directly relate to the company and are targeted at non-English speakers, more precisely Asian investors.

In 2015, the Securities and Futures Commission (SFC), a well-known regulator in Hong Kong, placed Triumph Global (Asia) Limited / TFX Global on their warning list for conducting activities in Hong Kong without the necessary regulation. As a matter of fact, the domain tfxi.com is still in use by TriumphFX today (the other one – tfxglobal.com – is for sale at the time of writing). While this doesn’t conclusively prove anything, it could be considered evidence of a potential relationship between the companies.

However, the SFC was not the first to target Triumph Global (Asia) Limited. In December 2014, the Monetary Authority of Singapore (MAS) had already included the same company in its Investor Alert List.

Furthermore, MAS had also taken action against Triumph International Limited, the company allegedly overseeing the subsidiaries, as Triumph Internacional (Asia) Limited.

The Indonesia Financial Services Authority (OJK) had also targeted TriumphFX or one of the subsidiaries of the company for engaging in illegal forex activities, including it in the register of illegal activities in April 2022.

TriumphFX Asia Branches: A suspicious modus operandi

Allegations suggest TriumphFX’s business model in Asia resembles a Pyramid Ponzi Scheme. The company claims that skilled traders and advanced algorithms make its trades; however, the promised returns may be unrealistic and unsustainable, casting doubt on the legitimacy of TriumphFX.

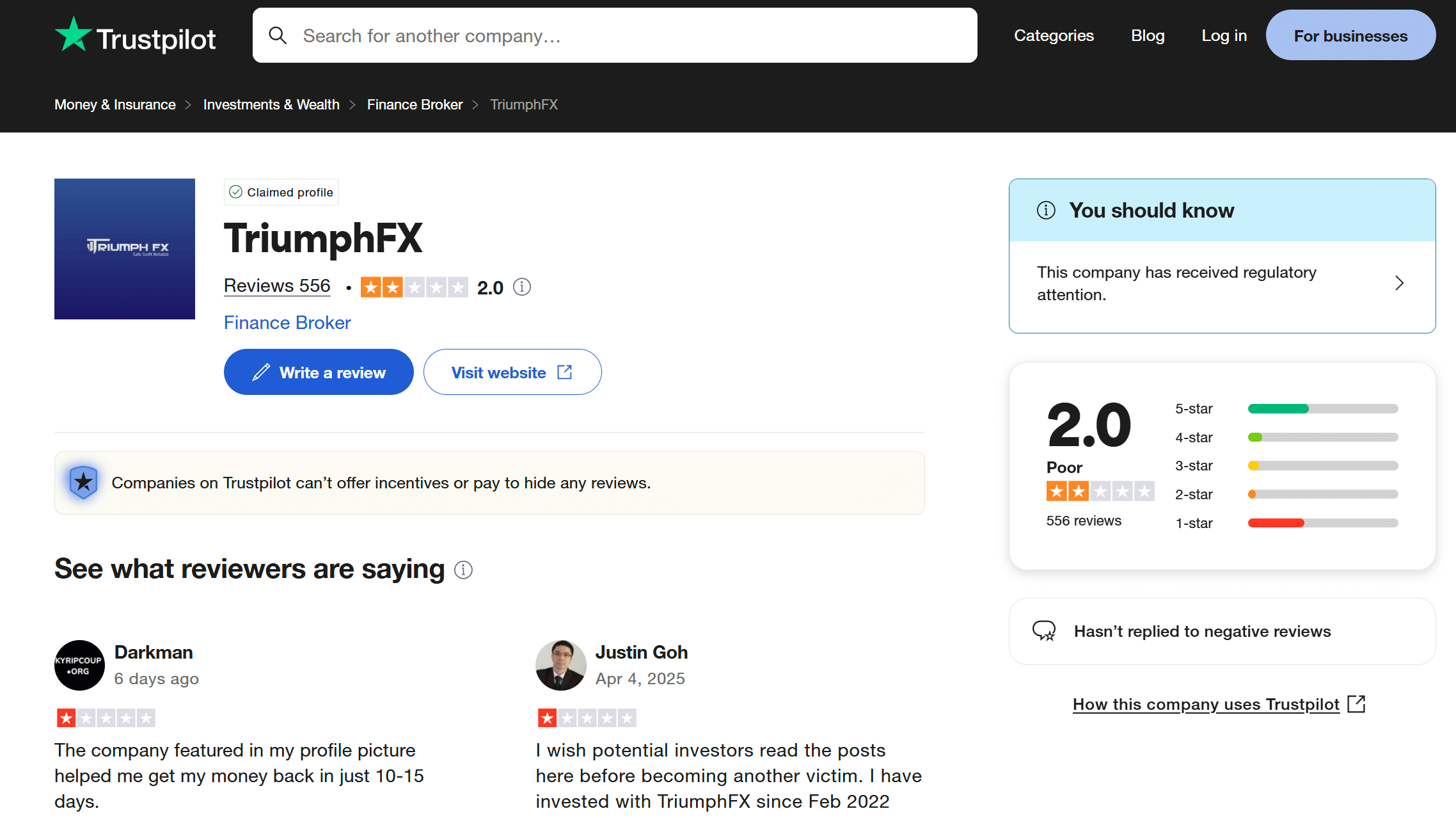

These allegations are documented on Trustpilot, where TriumphFX received a rating of 2.0 based on over 500 reviews. Additionally, a noteworthy trend has emerged within a Malaysian Investment Group on Reddit, where clients share their experiences regarding TriumphFX’s utilization of an MLM structure in Asia. It’s crucial to note that TriumphFX has been the subject of scrutiny by various Asian regulators.

TFX coin

TriumphFX has also introduced a cryptocurrency known as TFX. This initiative was undertaken by TRIUMPH INT. (SC) LIMITED, which is regulated by the Financial Services Authority (FSA) of the Republic of Seychelles. But what exactly is TFX?

Based on our findings, TFX was exclusively launched in the Asian region, where the company operates somewhat dubiously with its subsidiaries. Launched in December 2022, the currency aimed to fuel the TriumphFX ecosystem.

In summary, the promise was that TFX would always be worth a minimum of 1 USDT. However, returns from investments earned in USD couldn’t be paid in dollars; instead, they had to be converted to TFX. What transpired was that, at the coin’s launch, there was a correction to its price, around 0.60 USD, far from the company’s pledge. The price surged, reaching highs of 0.93 USD days after launch. This increase may have been triggered by the major holders of the coin, which happened to be the company itself. This could have been achieved through a sudden increase in supply, but the rise wasn’t sustained because the TFX ecosystem didn’t add value.

This prompted many investors to desperately sell their TFX holdings, driving up the supply against scarce demand. As a result, TFX never lived up to its promises, currently valued at 0.000944 USD, as of May 2025. Consequently, numerous investors felt cheated by the company, witnessing their returns being “swallowed” by a cryptocurrency without a foundation, created for the purpose of speculation in favour of its major holders.

Products available

Is important to notice that TriumphFX seems to operate in different ways in Asia and Europe (with CySEC regulation). So, we decided to make a deeper review of TriumphFX (under the triumphfx.com domain authorised by CySEC).

The range of available products is quite limited, falling into just two categories: Forex and Precious Metals.

On the Forex side, you can trade over 60 currency pairs. However, more than half of them are restricted to a select group of clients (VIP clients). The leverage offered is up to 1:100, with leverage above 1:100 available on-demand and subject to specific Equity Maintenance Requirements.

The trades are executed using Ctrader, a reliable platform. It’s important to note that CTrader is not responsible for any potential misconduct by TriumphFX.

When it comes to Precious Metals, TriumphFX enables investors to trade Gold and Silver against USD. For this category of investment, the company uses the same criteria for leverage and utilises the CTrader platform to execute trades.

| TriumphFX Cyprus | Forex | Precious Metals |

| Leverage | 1:30 up to 1:100 (depending on expertise) | 1:30 up to 1:100 (depending on expertise) |

Fees

| TriumphFX Fees | |

| Spread on Forex | From 0.1 to 4.9 (for major pairs) |

| Spread on Precious Metals | 1.7 (minimum) |

| Currency Conversion Fees | Non-Disclosure |

| Deposit Fees | $0 |

| Withdraw Fees | No commission for Bank Wire (up to $12 for other methods) |

The withdrawal fee structure is somewhat complex because you don’t pay any commission when withdrawing money via bank wire. However, if you withdraw through Visa or Mastercard, you may incur a fee of up to 3 USD (or 2 EUR/GBP) with no specified amount limit. On the other hand, opting for Neteller or Skrill will result in a 1% commission, with a maximum withdrawal limit of 12,000 USD/EUR/GBP. This equates to a maximum fee of 12 USD/EUR/GBP.

Safety

This is a controversial point, as we have demonstrated throughout the rest of the article. However, it is important to note that TriumphFX Cyprus is regulated, and the company must adhere to strict guidelines to maintain this regulation. Because of this, clients are provided with a considerable level of safety. However, we do not recommend investors trust the company as they typically would with a broker authorized by FCA, SEC, and other top-tier regulators.

Nevertheless, it is important to mention that TriumphFX is obligated to segregate investor funds from the company’s own funds, providing a higher level of security compared to a situation where this doesn’t exist. This means that in the case of bankruptcy of the firm, your funds will remain safe in a segregated account, in accordance with the Cyprus Securities and Exchange Commission client funds regulations.

In addition to the protection mentioned above, TriumphFX Cyprus is also covered by the Investor Compensation Fund (ICF), a Cyprus investor compensation fund working in conjunction with CySEC. The ICF guarantees compensation payments of up to €20,000 to clients of TriumphFX Cyprus in the event of insolvency.

It is important to note that these types of protections do not extend to TriumphFX subsidiaries operating outside the European Union. Therefore, if you plan to open an account in the Asian region, please be aware that TriumphFX likely operates there under the FSA regulation, which is not as strict as CySEC and does not require brokers to follow funds segregation or include a compensation fund. However, TriumphFX states on its website that it takes measures to ensure clear segregation between the funds of the clients and those of the company.

Demo account

We attempted to open a demo account to showcase the platform and execute some trades. Unfortunately, we encountered issues as the demo account did not function as expected, as evidenced in the screenshot below. This constitutes another significant drawback for the platform, further contributing to the existing trust issues.

TriumphFX alternatives

TriumphFX raises safety concerns, especially for Asian investors! However, there’s no need to worry. Our team has meticulously compiled a set of alternatives that we believe are safer and more suitable for you. In this collection, our emphasis is on alternatives featuring investment products similar to TriumphFX’s primary focus, which is Forex.

69-80% of retail CFD accounts lose money.

82% of retail CFD accounts lose money.

Bottom line

TriumphFX, despite its regulation by low-to-mid-tier authorities such as CySEC and FSA, has raised considerable concerns, particularly in relation to its operations in Asia.

Warning signs, such as regulatory actions by SFC, MAS, and OJK, indicate potential issues. Although TriumphFX Cyprus seems to comply with regulations, the company’s multi-level marketing structure in Asia, reminiscent of a pyramid Ponzi scheme, is a cause for concern.

Moreover, the introduction of the TFX coin contributes to the scepticism. We advise investors to conduct thorough research and investigation on the company independently to make well-informed decisions when selecting a broker. To help you, our team has gathered some alternatives in this article that, in our opinion, are safer, especially for Asian investors who may be more exposed to alleged illegal activities.