Hello, fellow investor! In this review, we’ll delve into N26 Invest, a fast-growing investment app integrated within the N26 digital bank, to help you decide if it aligns with your investment goals!

We recommend N26 Invest for beginners looking for a straightforward, low-cost way to invest in stocks, ETFs, and cryptos, particularly if you’re already a customer of N26 and enjoy seamless integration with their banking services.

However, the range of available investment options is limited compared to dedicated investment platforms, and there are a few trade-offs to be aware of.

Let’s dive into the details and see if N26 Invest is the right fit for your investment journey!

Overview

Founded in 2013, N26 is a fully licensed digital bank headquartered in Germany, offering a seamless mobile-first approach to banking. With more than 8 million customers across 24 countries, N26 continues to expand its services, including its latest feature: N26 Invest, which allows users to invest in stocks, ETFs, and cryptocurrencies directly from the app.

In October 2024, N26 expanded its Stocks and ETFs trading feature to 12 new markets, namely Belgium, Denmark, Estonia, Finland, Greece, Latvia, Lithuania, Norway, Poland, Portugal, Slovakia, and Slovenia. With this expansion, users can manage their investment portfolios within the N26 app alongside their regular banking activities.

Through N26 Invest, users can access over 800 stocks and ETFs, invest in fractional shares starting from just €1, and take advantage of low trading fees. N26 also offers cryptocurrency trading, allowing users to buy and sell a range of popular cryptocurrencies like Bitcoin and Ethereum seamlessly within the app. This makes N26 a comprehensive platform for those looking to manage their banking and investments in one place.

With competitive fees (starting at €0.90 per trade) and free trades available for “N26 You” and “N26 Metal” customers, N26 is an appealing option for both beginner and experienced investors. Automated investment plans are also available at no extra cost, helping users set up recurring investments effortlessly.

As a fully licensed bank, N26 ensures that all deposits are protected up to €100,000 under the German Deposit Protection Scheme.

Highlights

| 🗺️ Supported countries | Most Eurozone countries |

| 💰 Stocks, ETFs fees | €0.90 per trade (with free trades for N26 You and N26 Metal members) |

| 💰 Cryptocurrency fees | 1.5% for Bitcoin, 2.5% for other coins |

| 💰 Inactivity fee | €0 |

| 💰 Withdrawal fee | €0 |

| 💵 Minimum deposit | €0 for SEPA transfers, €20 Debit/Credit card, €20 Apple/Google Pay |

| 📍 Products offered | Stocks, ETFs, Cryptocurrencies (fractional shares available) |

| 🎮 Demo account | No |

| 📜 Regulatory entities | BaFin |

Pros and cons

Pros

-

Easy-to-use and intuitive interface

-

Fully integrated with the N26 banking app

-

Fractional shares of European and US stocks

-

Free trades for N26 You and Metal customers

-

Ability to set up recurring investment plans

-

Integrated cryptocurrency trading directly in the app

-

Interest on uninvested cash balances

- Has a banking license, meaning that deposits are insured up to €100,000 under the German Deposit Protection Scheme

Cons

-

Limited product range (No option for investing in commodities, derivatives, bonds, options, or other assets)

-

Lack of advanced features for seasoned investors

-

No desktop trading platform, only mobile

- Limited access to research tools and market analytics

Fees

N26’s pricing is structured into trading fees and non-trading fees.

Fees can vary between plans, depending on the N26 subscription plan that you choose, which could be one of these four:

- N26 Standard: Basic account for everyday banking needs.

- N26 Smart: Includes additional features like dedicated sub-accounts.

- N26 You: Offers free monthly trades and premium customer service.

- N26 Metal: Premium account with the highest number of free monthly trades.

Trading fees

| Products | N26 Standard | N26 Smart | N26 You | N26 Metal |

| Stocks | €0.90 per trade | €0.90 per trade | 5 free trades/month | 15 free trades/month |

| ETFs | €0.90 per trade | €0.90 per trade | 5 free trades/month | 15 free trades/month |

| Crypto | 1.5% for BTC 2.5% for all other coins |

1.5% for BTC 2.5% for all other coins |

1.5% for BTC 2.5% for all other coins |

1.0% for BTC 2.0% for all other coins |

To illustrate how the fees work in practice, we bought fractional shares of NVIDIA and later decided to sell them.

In the example below, we are selling ≈ 0.15 NVIDIA shares valued at €19.82, with an incurred fee of €0.90 under the N26 Standard plan:

Please note that the €0.90 fee is a brokerage service charge, as detailed in the N26 cost disclosure document shown below:

Non-trading fees

N26 Invest is fully transparent, with no hidden charges or unexpected costs, ensuring a clear understanding of all associated fees.

However, it’s worth noting that deposit and withdrawal fees may vary depending on your country and the specific subscription plan you select.

Below is a table summarizing the non-trading fees:

| Type of fee | N26 Standard | N26 Smart | N26 You | N26 Metal |

| Subscription | €0.00/month | €4.90/month | €9.90/month | €16.90/month |

| Inactivity | €0.00 | €0.00 | €0.00 | €0.00 |

| Custodian | €0.00 | €0.00 | €0.00 | €0.00 |

| Bank transfer | €0.00 | €0.00 | €0.00 | €0.00 |

| Debit/Credit card | 3% | 3% | 3% | 3% |

| Apple/Google Pay | 3% | 3% | 3% | 3% |

| ATM withdrawals | Variable | Variable | Variable | Variable |

Products and markets

N26 Invest offers a limited range of investment products, focusing on stocks, ETFs, and cryptocurrencies.

Users can invest in fractional shares of over 800 stocks and ETFs, including popular indices like the S&P 500 and MSCI World, as well as sector-specific ETFs. On the cryptocurrency side, N26 allows trading in nearly 200 coins, including Bitcoin and Ethereum.

However, the platform does not support bonds, forex, CFDs, options, or other more complex financial products. This makes it an excellent option for those looking to build a simple, diversified portfolio but may leave advanced investors wanting more.

If you’re looking for a broker that supports more financial products, head over to our BrokerMatch tool – it will help you find other platforms for more experienced investors.

| Products | Availability |

| Stocks | ✔ |

| ETFs | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✘ |

| Forex | ✘ |

| CFDs | ✘ |

| Options | ✘ |

| Futures | ✘ |

Furthermore, N26 also offers interest on uninvested cash (savings account), and as a fully licensed bank, your deposits should be protected up to 100k€ – more details below.

Stocks and ETFs

Users can easily explore and invest in a broad selection of stocks and ETFs directly through the N26 app under the “Investments” tab.

This feature offers access to global stocks, including US stocks and ETFs tracking well-known indices. With fractional shares available starting from just €1, investing becomes accessible to all users, regardless of their budget.

Cryptocurrencies

N26 Invest also provides access to cryptocurrencies, enabling users to trade a diverse range of digital assets such as Bitcoin, Ethereum, and many others.

This feature is seamlessly integrated into the banking app under the “Finances” tab, offering a convenient way for users to explore crypto trading without needing an additional platform.

N26 Investment plans

N26 also offers Investment plans, which allow users to set up recurring investments in stocks or ETFs at no extra cost.

This feature enables users to build wealth over time through automated monthly contributions, making it simple for even novice investors to benefit from dollar-cost averaging.

How to create an investment plan on the N26 App?

1. Access investment plans:

- Open the N26 app and navigate to the “Investments” tab.

- Tap on “Start a healthy habit” to begin setting up a recurring investment plan.

- For illustrative purposes, we selected the VWCE ETF, although you can opt for stocks or other ETFs of your choice.

2. Configure and activate the plan:

- Set the investment amount (e.g., €300) and the frequency (e.g., monthly).

- Review the plan details, including fees (€0 – Free) and the start date.

- Tap “Confirm” to activate your plan. You can manage your plan anytime – track, pause, or cancel it through the “Investment plans” section.

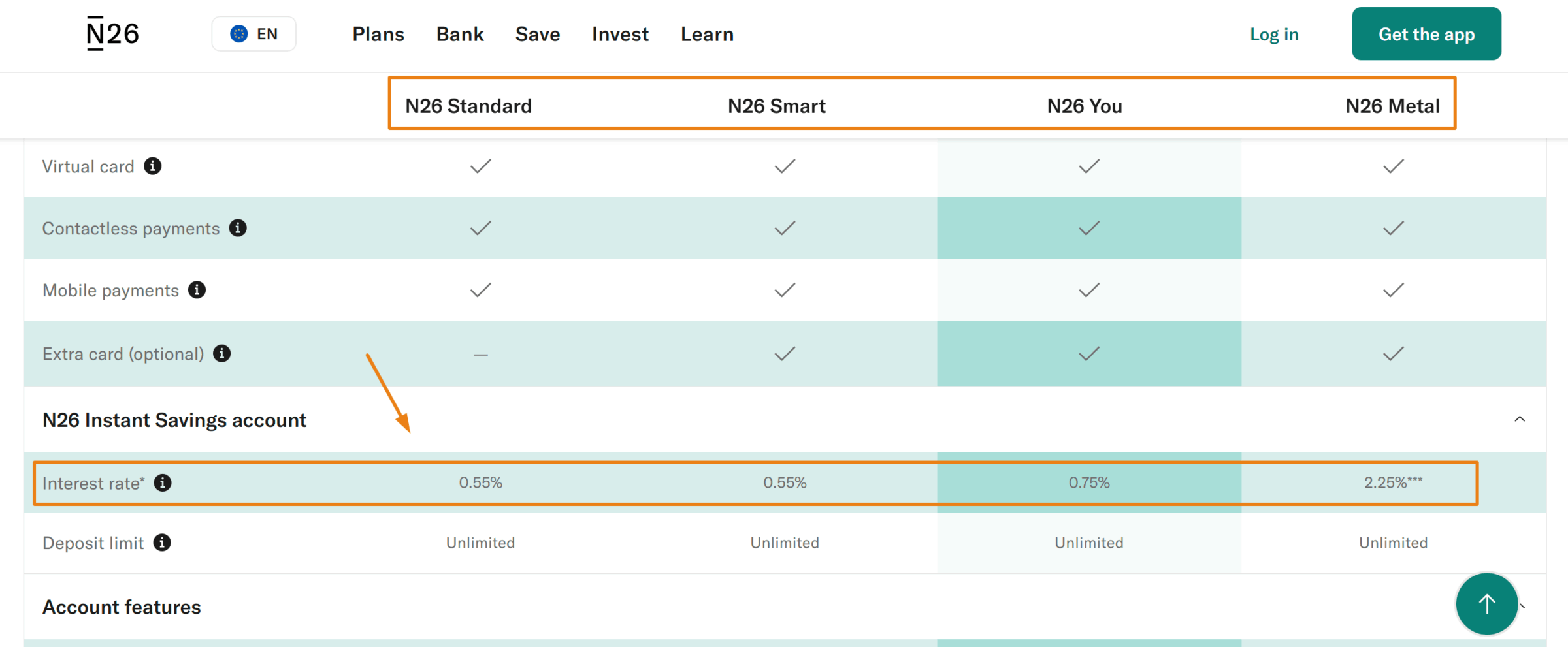

N26 Interest on uninvested cash

For users who prefer to keep funds in their accounts, N26 provides the opportunity to earn interest on uninvested cash through its Instant Savings feature.

The earned interest is paid in euros (€) and is protected up to €100,000 by the German Deposit Guarantee Scheme. Similar to the fees section, the interest rates may vary depending on your plan and location.

Since we’re based in Portugal, the current interest rate offered on uninvested cash for the N26 Standard plan is 0.55%, as shown in the image below:

To learn more about the interest rates available in your country and the specific N26 plan you choose, please visit the N26 website.

You can also find other alternatives of brokers and digital banks offering high interest in our cash interest tool.

Safety and regulation

As a fully licensed digital bank, N26 is regulated by BaFin (Germany’s Federal Financial Supervisory Authority), ensuring that your money is in safe hands.

Cash deposits at N26 are protected up to €100,000 under the German Deposit Protection Scheme, providing peace of mind for your savings.

When it comes to investments in stocks and ETFs, N26 also offers strong security measures. The Investor Compensation Scheme protects 90% of liabilities related to investment business, up to €20,000, adding another layer of financial security for users who invest through the platform.

For cryptocurrency assets, N26 partners with Bitpanda Asset Management GmbH, which utilizes custodial cold storage to securely manage digital assets. However, it’s important to note that cryptocurrencies are not covered by the same deposit/investment protection schemes as cash deposits and traditional investments.

All in all, while N26 is still a relatively new company with a short track record, it is regulated by top-tier institutions and has a banking license, which is a great sign.

Trading platform

Although you can access your N26 account through both the web app and mobile app, the N26 Invest feature is only available on the mobile version. The platform is fully integrated into the N26 mobile banking app, offering a user-friendly and seamless experience for managing both banking and investments. It is highly intuitive, making it easy for users to buy and sell stocks, ETFs, and cryptocurrencies with just a few taps.

The simplicity of the mobile app makes it an ideal choice for beginner investors.

However, one drawback is the lack of a desktop version, which limits access to the mobile platform.

Additionally, more experienced traders might find the platform lacking in advanced tools and analytics, which could make it less appealing to those seeking in-depth research features or more sophisticated trading options.

Account opening

Opening an N26 account is simple and can be done entirely online in just a few minutes. Just follow these steps:

1. Start your application: Go to the N26 website, choose your country of residence, and then click on “Open free bank account” to proceed.

2. Verify and set up: Confirm your email, download the N26 app, and go through the identity verification process. You’ll need to provide some personal and tax information along the way.

3. Create a password and enter a promo code: Set a secure password for your account, and to receive a €30 bonus, simply enter the promo code “brunoema8951” and redeem it.

4. Start investing: After verifying everything, your account will be active, and you’re ready to start investing in N26!

Customer support

N26 provides several ways for you to get in touch with customer support, ensuring help is always within reach. The easiest and most effective way is to open a secure chat directly through the N26 app while logged in. This allows N26 to verify your identity and provide the most accurate support.

You can reach support daily from 07:00 to 23:00 CET, including Sundays and holidays. If you’re an N26 Premium subscriber (Smart, You, or Metal), you also have the option to call the support hotline, as long as you’re calling from the phone number linked to your account.

If you don’t yet have an account and have general questions, you can open a visitor chat or send an email. If you ever lose access to your account or can’t log in, simply open a visitor chat, and the N26 team will help you out.

Countries available

N26 Invest is available in most Eurozone countries, including Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Portugal, Spain, Slovakia, and many others.

However, N26 Crypto is only accessible in a limited number of countries, such as Austria, Germany, Switzerland, Belgium, Portugal, and Ireland.

Bottom line

In summary, N26 Invest provides a seamless way for beginners to start investing in stocks, ETFs, and cryptocurrencies, all within a single mobile app.

Whether you’re interested in building a diversified portfolio with fractional shares or simply managing your investments alongside your everyday banking, N26 Invest makes it possible with minimal fees and straightforward features.

While the product range may be more limited than dedicated investment platforms, N26’s convenience and integration make it an excellent choice for those starting out in the investing world. For investors looking for a simple, accessible option in the Eurozone, N26 Invest is worth considering.

Looking for alternatives? Check our investment platform comparison tool, and our BrokerMatch.

We hope this review has given you the insight to decide whether N26 Invest suits your financial goals. If you need further guidance or have questions, feel free to reach out to us. We wish you the best in your investment journey!