Hello, fellow investor! In this review, we’ll delve into Moomoo, a rapidly growing trading platform, to help you decide if it aligns with your investment goals!

Moomoo is gaining popularity in regions like Australia, Malaysia, Singapore, and the United States, offering a diverse range of financial products, educational resources, and advanced trading features that cater to both beginners and advanced traders.

In this review, we’ll explore Moomoo’s offerings, fee structures, pros and cons, and its suitability for different types of investors. We’ll also cover crucial aspects such as account opening procedures, supported currencies, and regulatory safety to help you decide if Moomoo aligns with your trading goals.

Let’s dive into the details and uncover what Moomoo has to offer for investors in 2025!

Overview

Moomoo, established in 2018, is a fintech platform developed by Futu Holdings Ltd. The platform aims to provide users seamless access to various financial markets through its advanced trading tools and user-focused features.

With over 26 million users globally, moomoo continues to expand its reach, offering services in countries including Australia, Malaysia, Singapore, and the United States.

Highlights

| 🗺️ Supported countries | Australia, Malaysia, Singapore, United States, and more |

| 💰 Stock and ETFs fees | Low, competitive rates (specific fees vary by region) |

| 📈 Options fees | Low, competitive rates |

| 💰 Inactivity fee | None |

| 💰 Withdrawal fee | Varies by region and method |

| 💵 Minimum deposit | $0 |

| 📍 Products offered | Stocks, ETFs, Options, Futures, Warrants, ADRs |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | ASIC (Australia), CIRO (Canada), SC (Malaysia), SEC and FINRA (USA), MAS (Singapore) |

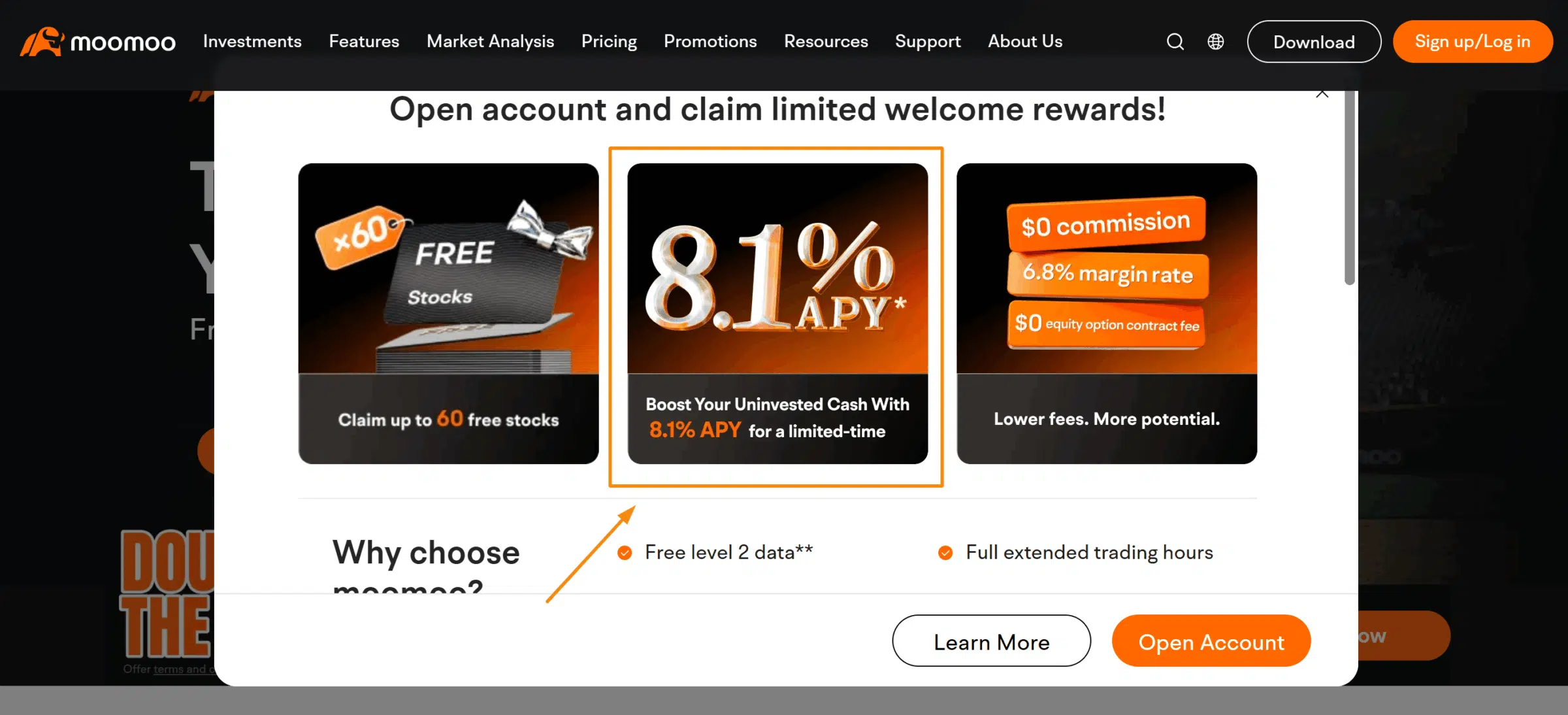

Sign-up bonus

Find out about Moomoo’s newest sign-up bonus in our article, where we explain everything you need to know about the bonus conditions.

Pros and cons

Pros

-

Commission-free trading promotion for stocks, ETFs, and options (Australia currently excluded)

-

Opportunity to earn interest on uninvested cash (the interest on uninvested cash varies based on the country you are registered in)

-

Advanced trading tools provided for comprehensive charting and analysis

-

Social trading features offer community-driven insights and discussions

-

Regulated and secure platform operating under strict oversight

- Educational resources including tutorials, webinars, and market insights

Cons

-

Limited product range, with some asset classes like CFDs, bonds and cryptocurrencies unavailable

-

There are limited options available for deposits and withdrawals

-

Geographic restrictions may limit accessibility

- Significant fee for transferring stocks out

Fees

Moomoo’s pricing is structured into two main categories, ensuring clarity and market competitiveness:

Trading fees

These are fees associated with trade execution and include:

- Commissions: Charges are applied by Moomoo to facilitate each trade.

- Platform fees: Costs associated with utilizing Moomoo’s trading platform.

- Swap rates: Costs for maintaining positions overnight.

- Contract fees: Additional costs for specific trades, such as options or futures contracts.

Moomoo’s fee structure varies depending on your location. Generally, Moomoo offers competitive fees with a straightforward structure in areas such as the Australia, Malaysia, Singapore and the United States.

Below is a table detailing the trading fees associated with Moomoo in different countries:

| Product | Australia | Malaysia | Singapore | United States |

| US Stocks and ETFs | Platform fee $0.99/order | $0 commissionValid for 180 days only. For more information on additional fees and charges, please visit the pricing page on the Moomoo website. | Commission of 0.03% * transaction amount + platform fee $0.99/order | $0 commissionNote: There is a current promotion where platform fees are $0 USD. This offer can end at any time. The broker will notify customers 30 days in advance of any changes. |

| AUS Stocks and ETFs | Commission of 0.01% * transaction amount (min. $1/order) + platform fee 0.02% * transaction amount (min $2/order) | Not available | Not available | Not available |

| Malaysia Stocks and ETFs | Not available | Commission of 0.03% * transaction amount + platform fee 3MYR/order | Not available | Not available |

| SG Stocks and ETFs | Not available | Not available | Commission of 0.03% * transaction amount + platform fee $1 SGD/order | Commission of 0.03% * transaction amount + platform fee $1 SGD/order |

| HK Stocks and ETFs | Commission of 0.03% * transaction amount (min. $3HK/order) + platform fee $15 HK/order | Not available | Commission of 0.03% * transaction amount (min. $3 HK/order) + platform fee $15 HK/order | Commission of 0.03% * transaction amount (min. $3 HK/order) + platform fee $15 HK/order |

| Options | Fixed: commission of $0.10 USD/contract + platform fee $0.40 USD | Not available | Commission of $0.65/contract + platform fee $0.35/contract | Fixed: $0.65 USD/contract (min. $1.99 USD/order) + $0.65 USD/contract + platform fee $0.30/contract; Tiered: varies by contracts |

Non-trading fees

Moomoo is particularly competitive when it comes to non-trading fees, standing out in the industry for its minimal charges.

- Deposit and withdrawal fees: ACH transfers are free of charge, but fees apply for wire transfers.

- Account inactivity fees: Moomoo does not charge any inactivity fees, which benefits traders who may not trade regularly.

- Currency conversion fees: Fees apply when exchanging currencies for trading in international markets.

- Other fees: Small fees such as regulatory fees, service fees, and exchange fees.

Below are the non-trading fees to help you understand the costs associated with your financial transactions at Moomoo:

| Type | Fees |

| Inactivity fees | $0 |

| Custodian fees | $0 |

| Account maintenance fees | $0 |

| ACH Transfer | Deposit: $0 / Withdrawal: $0 |

| Domestic Wire transferAdditional wire transfer fees may be charged by any originating, intermediary, or recipient bank. | Deposit: $0 Withdrawal: $20 |

| International Wire transferAdditional wire transfer fees may be charged by any originating, intermediary, or recipient bank. | Deposit: $0 Withdrawal: $25 |

| Stock transfer | Deposit: $0 Withdrawal: $75 per transfer |

| Currency exchangeThe amount of the fees varies depending on the currency and may be up to 300 basis points. | Up to 300 basis points |

- Deposits: Moomoo does not charge any fees for ACH deposits. Domestic wire deposits are free of charge. However, for international wire deposits, fees may apply. These fees can vary depending on your bank, so you should factor these into your total transfer amount.

- Withdrawals: Moomoo offers fee-free ACH withdrawals. For wire transfers, domestic withdrawals incur a fee of $20, and international withdrawals cost $25.

Products and markets

The availability of markets and products on Moomoo varies depending on the country you are trading from. Some products, such as U.S. stocks, ETFs, and fractional shares, are available in all supported regions.

Additionally, Moomoo provides access to Hong Kong stocks, U.S. options, and ADRs in multiple countries, depending on each region’s specific regulations and offerings.

Here is a table to help you check the availability of specific products in your country:

| Product | Australia | Malaysia | Singapore | United States |

| US Stocks & ETFs | ✔ | ✔ | ✔ | ✔ |

| AUS Stocks & ETFs | ✔ | ✘ | ✘ | ✘ |

| HK Stocks & ETFs | ✔ | ✘ | ✔ | ✔ |

| JP Stocks & ETFs | ✘ | ✘ | ✔ | ✘ |

| China A-Shares | ✘ | ✘ | ✔ | ✔ |

| SG Stocks | ✘ | ✘ | ✔ | ✔ |

| MYS Stocks & ETFs | ✘ | ✔ | ✘ | ✘ |

| Options | ✔ | ✘ | ✔ | ✔ |

| Futures | ✘ | ✘ | ✔Moomoo does not offer negative balance protection. This means that if your account balance goes negative, you are responsible for covering the deficit. | ✘ |

| Funds | ✘ | ✘ | ✔ | ✘ |

| Warrants | ✘ | ✔ | ✔ | ✘ |

| ADRs | ✔ | ✔ | ✔ | ✔ |

Interest on uninvested cash

Moomoo offers competitive interest rates on uninvested cash through its Cash Sweep program. This feature can significantly benefit traders who prefer to keep some funds liquid while earning a competitive interest rate.

As of June 2025, moomoo is offering the following interest rates on uninvested cash for investors:

- United States: Up to 8.1%

- Australia: Up to 6.8%*

*Moomoo AUS provides increased interest rates on uninvested AUD and USD cash balances for a period of 180 days, applicable to a maximum cash balance of AUD $100,000 and USD $100,000.

- Other countries: Interest rates in other regions may vary depending on local policies and market conditions. For the most current rates applicable to your situation, please consult moomoo’s website or their customer service.

Interest from the Cash Sweep program is calculated daily and paid out monthly, usually at the end of each month, to the designated swept account. You have the option to filter and review all program records within the securities account under “fund details.”

Safety and regulation

Moomoo is regulated by top-tier financial authorities, ensuring a high level of investor protection and compliance. As a subsidiary of Futu Holdings Ltd., which is listed on the NASDAQ stock exchange, Moomoo benefits from additional transparency and oversight.

Futu operates globally through various subsidiaries, ensuring regulatory compliance in multiple jurisdictions, including the U.S., Singapore, Australia, Malaysia and other countries. This extensive regulatory framework provides users with confidence in the safety and integrity of Moomoo’s trading platform.

By operating under these reputable regulatory bodies, Moomoo ensures that investor assets are well protected and that their trading practices comply with high standards of financial oversight and security.

When opening an account with Moomoo, you will register with one of Futu’s subsidiaries. According to Futu Holdings Form 20-F*, the following subsidiaries provide comprehensive investor protections and operate under strict regulatory oversight.

*For more details, you can consult Futu Holdings’ Form 20-F here.

To provide a clear overview of the regulatory and investor compensation schemes, we have created the following table, which details the regulatory bodies, investor protection amounts, and applicable regions for each subsidiary:

| Subsidiary | Regulatory Body | Investor Compensation Scheme | Applicable Regions |

| Moomoo Financial Inc. | SEC and FINRA | SIPC protection up to $500,000 (including $250,000 for cash) | United States |

| Moomoo Financial Singapore Pte. Ltd. | MAS | None | Singapore |

| Moomoo Securities Malaysia Sdn. Bhd. | SC | None | Malaysia |

| Futu Securities (Australia) Ltd. | ASIC | None | Australia |

Trading platform

Moomoo’s trading platform is available on both web and mobile, offering a seamless trading experience across devices. The platform is known for its intuitive design and robust functionality, providing users with real-time data, advanced charting tools, and a customizable interface.

Moreover, Moomoo offers versions compatible with iPhone, Android, Windows, and Mac, ensuring accessibility across various devices. However, one drawback is that the platform is only available in English, Chinese, and Japanese.

Below, we provide an overview of Moomoo’s mobile trading app, highlighting some of the unique features in the company tab. Here, you will find some tools to help you analyze the financials of any stock. For demonstration purposes, we have chosen AAPL (Apple Inc.).

These tools include several indicators and features, such as:

- Financial indicators: This includes metrics such as Free Cash Flow (FCF), Earnings Per Share (EPS), Return on Equity (ROE), Return on Assets (ROA), Gross Margin, Current Ratio and others.

- Institutional and shareholders positions: You can track the distribution and changes in both shareholder positions and institutional holdings.

- Revenue breakdown: You have the ability to analyze the sources of a company’s revenue.

- Operating data: You have access to detailed operating data, including smartphone shipments, smartphone market share and more.

- Insiders’ activity: Here, you can monitor the trading activity of company insiders.

Account opening

Opening an account with Moomoo is straightforward and can be done entirely online. The process involves a few steps:

- Registration: Provide your email address and create a password.

- Verification: Complete identity verification by uploading necessary documents (e.g., ID, Passport, proof of address).

- Funding: In the U.S., you can deposit funds via ACH or bank wire transfer. Deposit methods may vary in other regions.

Minimum deposit

The minimum deposit required to open an account is $0.

Supported currencies

Supported currencies vary depending on your country of residence. Currently, for Moomoo users:

- In the US, only a USD deposit is supported.

- In Malaysia, only MYR deposits are supported.

- In Australia, only AUD deposits are supported.

- In Singapore, you have the flexibility to deposit various currencies including MYR, IDR, AUD, GBP, EUR, SGD, USD, and HKD. It’s important to note that when you deposit funds, the currency in your broker-balance account will either be SGD or USD.

Despite the fact that most countries only accept deposits in their domestic currency (except Singapore), you can utilize the “Currency Exchange” function within the Moomoo App to convert currencies. For example, you can convert AUD into USD. This feature applies to all supported currencies.

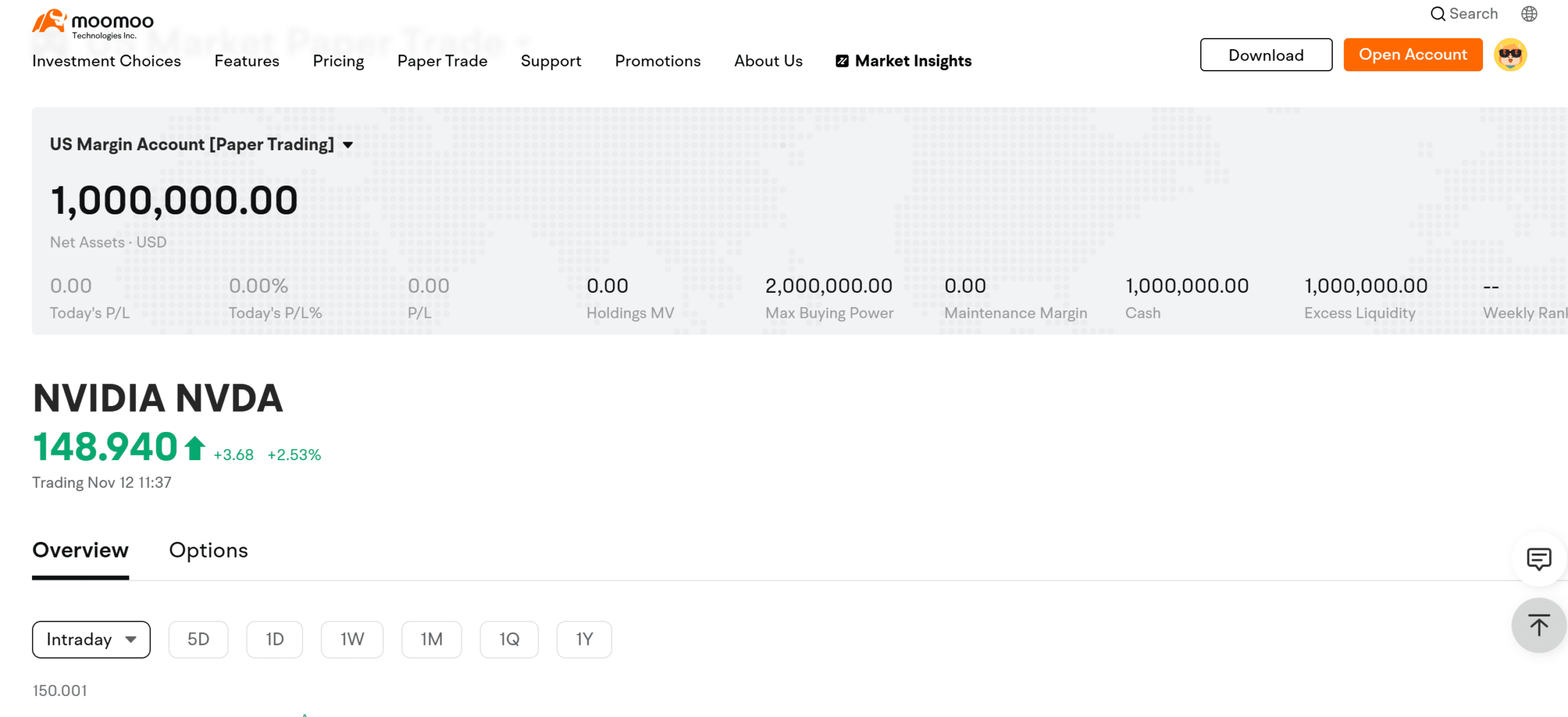

Does Moomoo offer a demo account?

Moomoo also provides a demo account feature (Paper Trading) with $1.000.000 in virtual funds, and we have tried it! This feature is particularly valuable for novice users, enabling them to practice trading and familiarize themselves with the platform without incurring any financial risk.

Social and community features

Moomoo integrates social trading features, creating an interactive community hub where users can share insights, discuss market trends, and track the trades of experienced investors. This collaborative approach is particularly beneficial for new traders, offering them valuable learning opportunities and building confidence in their trading abilities.

Within the “Moo Community” tab, you’ll discover two distinct sections:

- Feed: Allows you to post and explore content shared by fellow users. Here, you can contribute your own insights, engage in discussions, and gain valuable perspectives from other traders.

- Topics: In this section, you can explore and engage in discussions on the most current hot topics with fellow community members.

Moomoo also provides a variety of interactive tools and free content, including courses and live broadcasts. These resources are designed to enhance your trading skills and keep you informed about the latest market developments.

Moomoo’s paperfolio

In addition to the social and community features previously mentioned, Moomoo offers a robust tool on its desktop trading platform: the Moomoo Paperfolio.

This feature allows you to create simulated investment portfolios containing a diverse range of shares from various markets. It helps you simulate trading a basket of stocks, visualize your investment ideas, and potentially explore investment opportunities.

You can create up to 30 paperfolios per account, each containing up to 50 stocks. It’s a cool feature that allows you to create and share your investment ideas on Moomoo’s desktop trading platform.

Customer support

A notable positive aspect of moomoo’s customer support is its 24/7 availability. Customers can contact the support team via email, phone, or live chat, highlighting their commitment to accessibility and convenience. This ensures that users can get assistance anytime, day or night.

However, despite the extensive availability, our experience with email support was less satisfactory. We reached out via email to request additional information but did not receive a timely response.

In contrast, when we used the live chat support through the mobile app, we received prompt and helpful responses, indicating that this might be the best option for users seeking immediate assistance.

Countries available

Moomoo operates globally, serving investors in Australia, Canada, Hong Kong, Japan, Malaysia, Singapore, and the United States. The platform’s reach allows it to support a diverse range of investors across these key markets.

Due to regulatory restrictions, Moomoo cannot offer its services in several countries.

Bottom line

Moomoo is an excellent choice for traders seeking a platform with commission-free trading, robust research tools, and a user-friendly interface. Its advanced features and community-driven approach make it suitable for both beginners and experienced investors.

Moomoo offers a user-friendly mobile app, commission-free trading for stocks and ETFs, and high interest rates on uninvested cash (with some countries excluded and limited-time offers). However, potential users should be aware of the limited product range and the absence of negative balance protection.

Overall, Moomoo is a compelling option for investors in Australia, Malaysia, Singapore, and the United States, offering a blend of affordability, innovation, and quality service. These features make Moomoo an attractive platform for those seeking comprehensive trading tools and social trading features.