Hello there! This article will give you our honest review of the biggest Robo-Advisor in Spain: Indexa Capital.

The business model incentivises a long-term approach by using Index Funds in an automated and efficient way. On the downside, its website is only in Spanish and French, and the minimum deposit is relatively high for beginners.

The leading Robo-Advisor has over €3.3 billion in AUM and more than 110,000 clients. Over the years, it has received rewards from reputable entities such as Rankia, Wealthtech 100, and Allfunds.

That’s Indexa Capital in a nutshell. If you want to find out what our research team has to say after carefully analysing Indexa Capital, keep reading.

Overview

Founded in 2015, Indexa Capital was the first automated online investment manager in Spain. Through a passive investment approach, investors can obtain a diversified and transparent investment portfolio with low commissions compared to traditional wealth management services.

You will need at least €2,000 (or €3,000 for international investors) to open an account directly with Indexa Capital. We think these are relatively high minimum amounts for people not yet comfortable in the investment world.

The management fee, the only revenue stream of Indexa Capital, is pretty low (up to 0.41%). From our experience, it is below the average cost in the robo-advisor industry. Also, it is well below what you would be charged in the traditional money management firms. So, no hidden costs (no rebalancing fees or reporting fees).

From +2,200 opinions, it currently sits at a 4.8/5 score in TrustPilot, an incredible achievement. The comments highlight the platform, customer support and investment strategies.

Finally, the FAQ for Indexa Capital is well-organised and has helpful information! We even came across an important but “uncomfortable” topic: “What happens to my investments if I die?”.

Highlights

| 🗺️ Supported Countries | European Union (Except Cyprus, Gibraltar and Malta), United Kingdom and Switzerland. |

| 💰 Fees | 0.15%-0.41% (per year) |

| 🎮 Demo Account | No |

| 📈 Portfolio Rebalancing | Yes |

| 💵 Minimum Deposit | €3,000 (€2,000 for Spanish investors only – in some portfolio types) |

| 📍 Investment Instruments | Index Funds |

Pros and cons

Pros

- Automatic rebalancing

- Low fee structure and transparency

- Access to Vanguard Index Funds (usually accessible for large institutions only)

- 4.7/5 score in TrustPilot

- Annual consolidated summary activity for tax purposes

- Tax Loss Harvesting

Cons

- A minimum deposit of €3,000 (for international investors)

- The website is only in Spanish and French

- The portfolio management fee is calculated per account, not per client (in case you have multiple accounts)

- Only investment in Equity and Bonds. No cryptocurrencies, alternative investments, and/or Forex.

Investment platform

The Indexa Capital platform is very straightforward and user-friendly. It does not have a “modern” look and feel, but it includes all the relevant tools for a robo-advisor. The menus are where you expect them to be, and there are no customisation options.

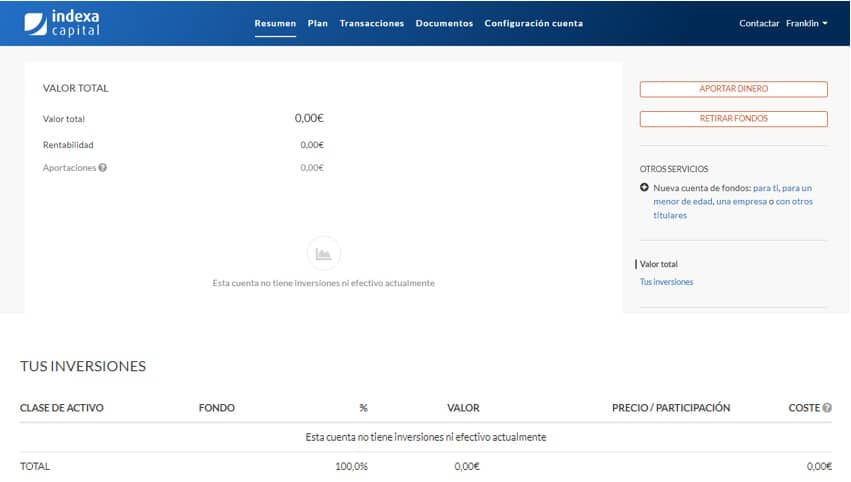

In “Resumen” (dashboard), you will immediately observe a summary of your investment value at the top and a desegregation per asset class at the bottom.

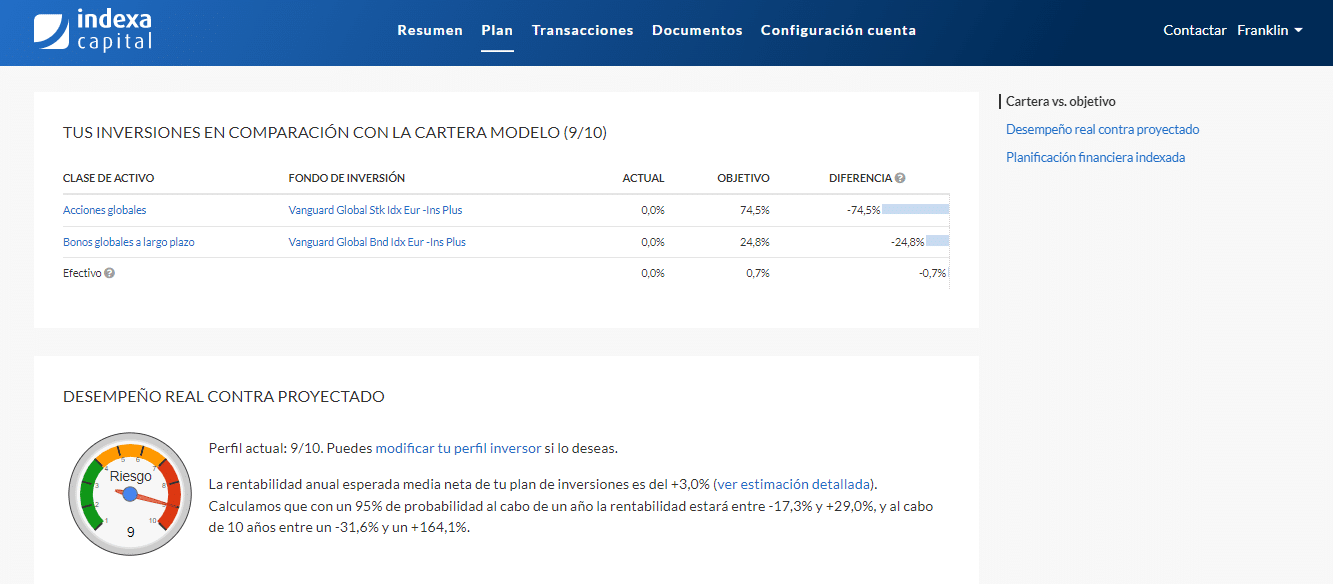

In the tab “Plan”, you can quickly revisit your target asset allocation, the instruments used and the expected returns:

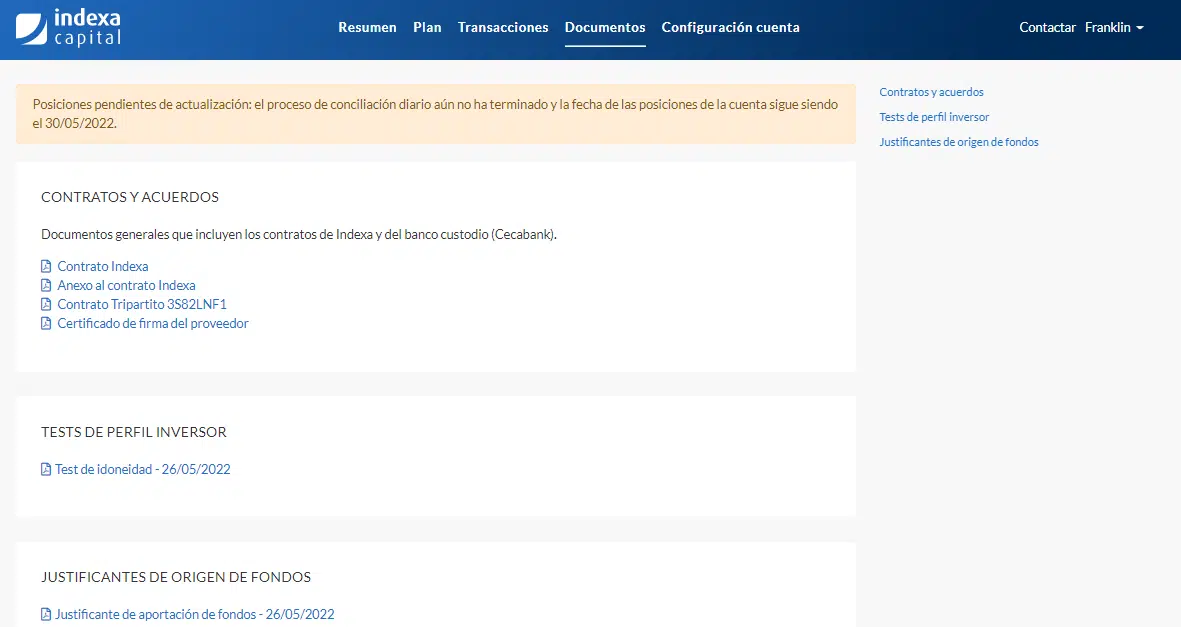

In the “Documentos” tab, you will find all the signed contracts plus the adequacy test to arrive at your risk profile.

Investment strategy

Since Indexa Capital only uses Index Funds, its main job is to optimise asset class allocation, which combines assets to achieve maximum return for a given level of risk. Once the asset classes are identified, they need to see how to define the weights of each class for each investor profile, as explained in the next paragraph.

Indexa Capital’s portfolio selection is based on the Modern Portfolio Theory (Markowitz, 1952) and the Black-Litterman model.

The Markowitz model establishes a relationship between the expected return within each asset class and the risk that its inclusion brings to the portfolio. As such, for a predetermined level of risk, find the highest expected return.

On the other hand, Black-Litterman “improves” the MPT by taking additional input from investors’ views to determine how the ultimate asset allocation should deviate from the initial portfolio weights.

Therefore, the ingredients to find the proper allocation for your needs are:

- Your investor profile

- The long-term expected return of each asset class

- The variance-covariance matrix of asset classes (risk)

The Indexa Capital Advisory Committee’s role is to analyse the data from past market behaviours and include market expectations for the different asset classes. So, there is a human element in the decision-making process.

The investment portfolios

The Indexa Capital offering depends on your country of residency (Spain or another) and your investment amount (not to mention the Social Responsible Investments options). All include the essential services of Indexa Capital: Passive investing, automatic rebalancing, global diversification, low management costs and security.

The investment structures are different for Spanish and non-Spanish (international) investors.

Spanish Investors

As a retail Spanish resident, your investment options are the following: “Cartera de fondos de inversión”, “Cartera de planes de pensiones” and “Cartera de planes de EPSV” (only for País Vasco).

- Cartera de fondos de inversión

From €3,000, you are offered 30 diversified portfolios for different investor profiles. The types of portfolios available will also depend on the amounts invested (<€10k, €10k to €100k and >€100k). The higher the money invested, the higher the number of asset classes offered.

- Cartera de planes de pensiones e ESPV

From €2,000, you can access a portfolio with passive instruments in Equity and Bonds from providers such as Vanguard, iShares (BlackRock) and State Street SPDR. These are tax-efficient for Spanish investors, as explained here. Indexa Capital shows the past performance of these strategies. Be aware that past performances are no guarantee of future returns.

Still, for as low as €5 you can invest in strategies managed by Indexa Capital, namely: Indexa Más Rentabilidad Acciones (N5138) and Indexa Más Rentabilidad Bonos (N5137). For that purpose, you must invest through third parties like Caser, Selfbank and MyInvestor.

Apart from the investment side, Indexa Capital also offers an additional life insurance policy that may help your family if something happens to you.

International Investors

As an investor from another country outside Spain, you will access several portfolio investments that use Index Funds in two asset classes: Equity and Bonds. The same kind of portfolio is mentioned in the previous section, “Cartera de fondos de inversión”.

The sub-asset classes used are the following:

- Equity: Europe, US, Emerging Markets, Pacific ex-Japan and small global capitalisation.

- Bonds: European Governments, European Corporate, Emerging Markets – EUR Hedged, European Inflation-Linked, US governments – EUR Hedged and US corporates – EUR Hedged.

These are the Index Funds that will be present in your portfolio:

| Name | ISIN | Tracking Index | Sub-Asset Class | TER |

| Vanguard European Stk Idx Eur -Ins Plus | IE00BFPM9L96 | MSCI Europe | European Equity | 0.08% |

| Vanguard US 500 Stk Idx Eur -Ins Plus | IE00BFPM9V94 | S&P500 | US Equity | 0.06% |

| Vanguard Japan Stk Idx Eur -Ins Plus | IE00BFPM9P35 | MSCI Japan | Japan Equity | 0.12% |

| Vanguard Emrg Mk Stk Idx Eur -Ins Plus | IE00BFPM9J74 | MSCI Emerging Markets | Emerging Markets Equity | 0.16% |

| Vanguard Pacific Ex-Japan Stk Idx Eur -Ins Plus | IE00BGCC5G60 | MSCI Pacific ex-Japan Index | Pacific Ex-Japan Equity | 0.12% |

| Vanguard Global Small Cap Idx Eur -Ins Plus | IE00BFRTDD83 | MSCI Small Caps | Small Global Capitalization Equity | 0.24% |

| Vanguard Euro Inv Gr Bnd Idx Eur -Ins Plus | IE00BFPM9X19 | Barclays Euro Non-Government Bond | European Corporate Bonds | 0.08% |

| iShares EM Gov Bnd Idx -I2 Eur Hdg | LU1373035663 | JP Morgan EMBI Global Diversified Index | Emerging Markets Corporate Bonds – EUR Hedged | 0.24% |

| Vanguard Eur Gov Bnd Idx -Ins Plus | IE00BFPM9W02 | Barclays GA Euro Government Bond | European Governments Bonds | 0.06% |

| Vanguard Euroz Inf Lk Bnd Idx Eur -Ins Plus | IE00BGCZ0719 | Barclays Eurozone – Euro CPI TR | European Inflation Linked Bonds | 0.06% |

| Vanguard US Gov Bnd Idx Eur Hdg -Ins Plus | IE00BF6T7R10 | Barclays US Government Float Bond Index | US Treasuries Bonds – EUR Hedged | 0.06% |

| Vanguard US Inv Gr Bnd Idx Eur Hdg -Ins Plus | IE00BZ04LQ92 | Barclays GA USD Credit Float Bond Index | US Corporate Bonds – EUR Hedged | 0.08% |

For Social Responsible Investments (SRI), Indexa Capital offers the following Index Funds:

| Name | ISIN | Tracking Index | Sub-Asset Class | TER |

| Vanguard ESG Dev. World Stk Idx Eur-Ins Plus | IE00BFPM9S65 | FTSE All Cap Choice Index | Global Equity SRI | 0.13% |

| Vanguard ESG Emrg Mk Stk Idx Eur-Ins Plus | IE00BNDQ1L38 | FTSE Emerging All Cap Choice Index | Emerging Markets Equity SRI | 0.18% |

| iShares ESG Global Corp Bnd Idx Eur Hdg | IE00BJN4RG66 | BBGA Corporate Index | Global Corporate Bonds SRI | 0.16% |

| Amundi JPM Global Gov Bnd Idx Eur Hdg | LU0389812693 | JPM Global Gov – EUR Hedged | Global Government Bonds | 0.20% |

As you can notice from the column “TER”, the costs in SRI Index Funds are more significant than the traditional Index Funds. Unless you believe these instruments will achieve superior returns, these additional expenses will decrease your portfolio performance.

As of January 2025, Indexa Capital does not allow you to have two separate accounts in SRI and non-SRI investments to decrease your overall management fees.

Fees

Indexa Capital only charges management fees, and it will vary according to the amount invested (from 0.15% up to 0.43%). The custody and Index Funds fees are external costs (unrelated to Indexa Capital), so it is in their best interest to minimise them.

| Portfolio amount | Management fee | Custody fee | Index Funds fees | Total Costs |

| <€10,000 | 0.41% | 0.12% | 0.08% | 0.61% |

| €10,000 – €100,000 | 0.39% | 0.12% | 0.08% | 0.59% |

| €100,000 – €500,000 | 0.36% | 0.12% | 0.08% | 0.56% |

| €500,000 – €1,000,000 | 0.30% | 0.12% | 0.08% | 0.50% |

| €1,000,000 – €5,000,000 | 0.25% | 0.06% | 0.08% | 0.39% |

| >€5,000,000 | 0.15% | 0.06% | 0.08% | 0.29% |

The portfolio management fee is calculated per account, not per client (the volumes of several accounts of the same client are not consolidated). It is calculated on the daily value of the portfolio and is charged quarterly to the client’s cash account at the custodian bank.

Economies of scale will allow Indexa Capital to reduce the management fees, and they have already done it several times in the past! So, the more clients they get, the lower the expected commissions.

Safety and Reliability

Indexa Capital is regulated by the National Securities Market Commission (Spanish: Comisión Nacional del Mercado de Valores – CNMV) with the registration number 257.

There are a set of ringfences to protect you from the unfortunate event of Indexa Capital going bankrupt or any other institution that works with them.

First, you choose between two Spanish custodial banks: Inversis and Cecabank. Both present good levels of solvency ratios (Above 25%). The account in any of these entities is in your name, so you are not dependent on any trouble in those banks. If any of these banks cease to operate, you would only be required to transfer your asset to another custodian.

Indexa Capital sets a structure that we consider safe. Still, there are risks that you cannot control (e.g. fraud), and financial market regulators want to make sure you are well protected in severe circumstances. As such, additional security layers are applied:

- When you open an account at Indexa Capital, they automatically open an account in a bank to deposit your cash. That account is protected for up to €100,000 per client by the Spanish Guarantee Fund. In practice, less than 1% of your money is expected to be in cash since the remaining is invested.

- Regarding your investment portfolio (money invested in the Index Funds), you are protected for up to €100,000 per client by the Spanish Investor Protection Scheme (FOGAIN).

These protections apply to any client (Spanish or non-Spanish) and work separately, so if you have €120,000 invested, you will only be protected for the first €100,000.

Customer Support

The customer support is quite good. You can quickly contact them through the homepage in the box chat in the right bottom corner. We have talked several times with an assistant called Monica, and her answers have been relevant and precise.

Besides, you can contact them through [email protected] (you get an answer up to 48h) and phone at (+34) 900 431 282 – a free number from Spanish networks.

Account opening

As soon as you click the sign-up bottom, these will be the steps you will need to take to complete your registration:

- Choose the type of investment. As a non-Spanish investor, you must choose the first one: “Portfolio of Index funds: long-term investment, but liquid and redeemable at any time”. As a Spanish investor, you have more options available to you.

- Answer a questionnaire to learn your risk tolerance and investment objectives, including choosing the custodian bank where you want to deposit your assets: Inversis Banco (only for Spanish residents) or Cecabank (for international investors).

- Get your recommended plan: You get your recommended investment plan with details regarding the portfolio’s constitution, the expected returns and cost analysis.

- Open an account: Now, you can “Open an account” and fill in your personal details;

- Deposit a minimum of €3,000 (€1,500 for Spanish investors in other than the “Cartera de fondos de inversión“), and the funds will be automatically invested according to your investor profile.

Companies in Spain (only) can also create an account, a pension plan, for their employees. More info here.

Supported countries

Indexa Capital accepts residents of the European Union (Except Cyprus, Gibraltar, and Malta), the United Kingdom, and Switzerland.

Bottom line

Indexa Capital is definitely a major player in the Robo-Advisor space. It is suitable for “buy and hold” investors who want to enjoy the long-term growth of their savings without dealing with the constraints of choosing and monitoring their investments.

Indexa will likely continue to benefit from economies of scale in the future due to its high AUM, allowing the company to offer a lower than average fee structure and maintain a competitive edge over its rivals. The automatic rebalancing and tax loss harvesting features shape a stress-free investment journey.

Despite desirable features, not everything is a bed of roses. The website still lacks an English version, which will drag on the attractiveness of non-Spanish or French speakers (we have given our feedback directly to them on this issue). Plus, a minimum of €3,000 for the first deposit will make international investors think twice about opening an account.

All in all, the customers seem to be pretty satisfied with their services, so it is only a matter of reassessing if the pros outweigh the costs in your particular case.