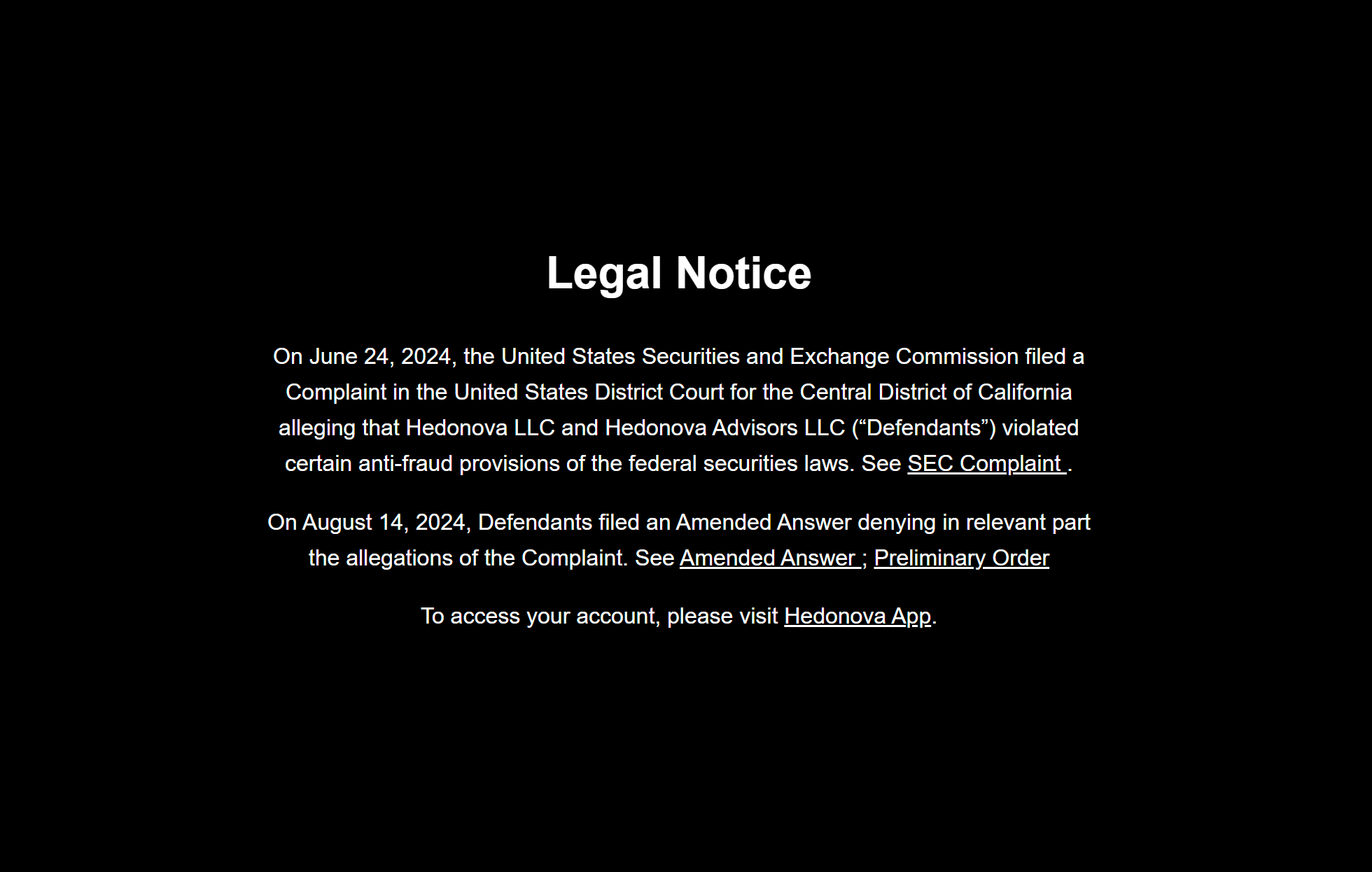

[Update]: As of June 2025, the website of Hedonova has been suspended due to a legal notice:

Have you come across Hedonova on the internet? With some controversial information available online, you might be curious to figure out more about this hedge-fund company.

Hedonova is an investment firm with the mission of democratizing investment for everyone because, according to the company, “anyone, anywhere in the world, can invest in anything they want”.

It has +$800M in AUM and a +400% return in only 3 years!

Here are some of the reasons why we do not recommend investing with Hedonova in a nutshell:

- On July 2024, the U.S. Securities and Exchange Commission (SEC) filed charges against Hedonova LLC and Hedonova Advisors LLC, alleging that the companies engaged in a fraudulent scheme to mislead investors about their operations and financial status.

- Most of the company employees’ social profiles seem artificial. We have found the use of stock images and other warning signs.

- None of the Chief Officers have given video interviews where we could confirm their identities.

- Lack of information and transparency about the investments made. The information on Hedonova’s website is very vague and does not display details about the vehicles/assets invested, making it hard to confirm some of these investments.

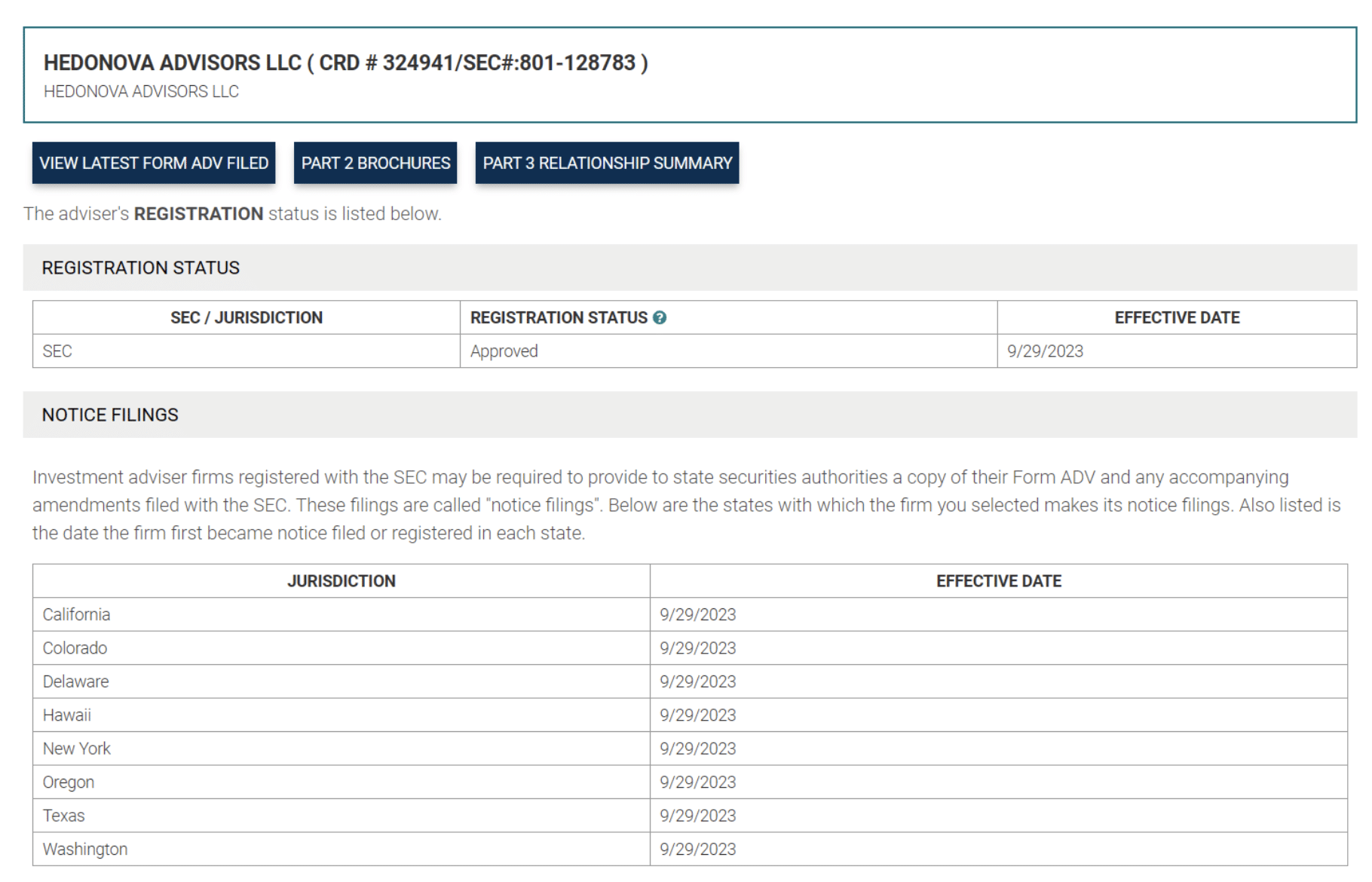

- Despite Hedonova being registered as an investment adviser (RIA) with the Securities and Exchange Commission (“SEC”), this does not suggest any endorsement or recommendation by the SEC or any other regulatory body;

- Other users have shared their concerns online (1, 2, 3, 4).

- Hedonova has hired influencers to promote their fund (we were also contacted), however some of them have decided to close the partnership and revisit their opinion about the company (example here).

- In 2023, Hedonova announced a $16 million investment into a startup that didn’t exist.

- Some of the employees of Hedonova on Linkedin had no activity (posts or reactions) before their time on Hedonova, despite having important roles in the world’s leading companies, which appears to be a sign of fabricated LinkedIn profiles.

- Very wide range of asset classes invested. Hedonova manages to invest in 10 different alternative asset classes, including real estate worldwide, art, music royalty, agronomy and more. Becoming an expert and profitable in one of these areas is already challenging, which makes us question how Hedonova has managed to have the expertise to invest profitably in all these different asset classes.

- We couldn’t find any independent entity confirmation of the track record.

Want to know if Hedonova is safe and how it operates? Keep reading, we’ve got you covered.

Overview

Hedonova stands out as an investment firm that concentrates on a single hedge fund. The company is relatively new, founded in 2020 by a group of supposedly former UBS and Morgan Stanley employees.

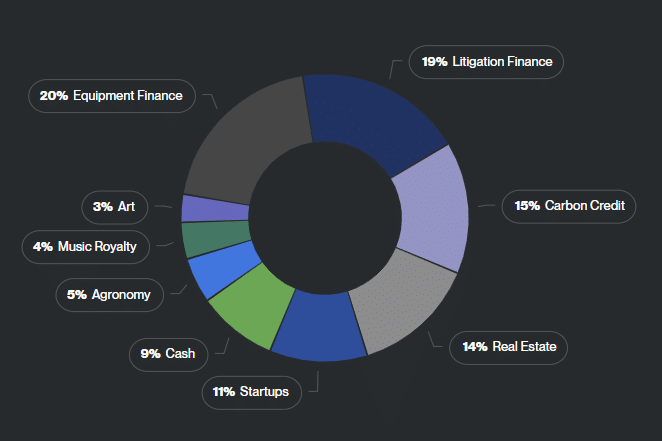

Hedonova focuses on a single fund invested in various alternative assets, diversified across +10 classes, including equipment finance, litigation finance, real estate, startups, and more. These asset classes are sometimes known for having more restricted access than other classes, such as stocks traded on well-known exchanges.

Is Hedonova safe?

At first glance, it is evident that Hedonova is a registered investment adviser (RIA) with the Securities and Exchange Commission (“SEC“). Keep in mind that becoming an RIA does not suggest any endorsement or recommendation by the SEC or any other regulatory body; rather, it signifies that the investment advisor has successfully met all the registration criteria set forth by that specific agency.

As stated on their website footer: “Hedonova’s security offering is SEC qualified under 506(c) exemption of Regulation D of the Securities Act of 1933″ (our bold).

The SEC Regulation D (Reg D) is one of the easiest and quickest ways to collect money from investors with the least amount of compliance. As found on Wikipedia, “A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration”.

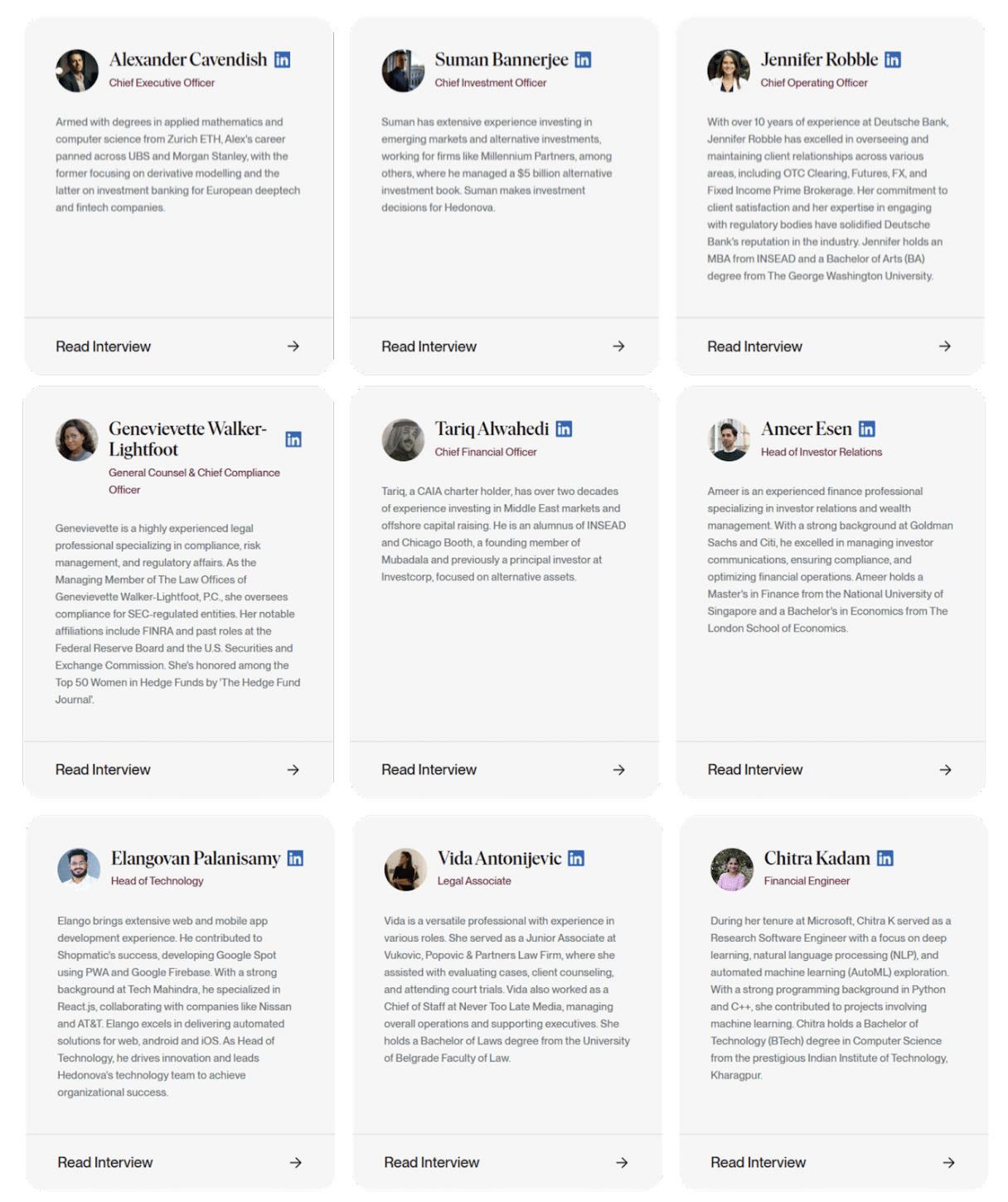

The team

The team presented on the Hedonova website raises some concerns, as explained below:

The CEO

The CEO of Hedonova is Alexander Cavendish, an allegedly former employee of UBS and Morgan Stanley, but some warning signs surfaced during our search. A Google search revealed no apparent connections to his previous companies, despite Alexander supposedly holding the position of Senior Vice President of the Securitized Products Group at Morgan Stanley.

Furthermore, when attempting to locate Alexander on LinkedIn, we discovered two profiles that did not align:

Lastly, Alexander, who professes to be a finance professional and identifies as a neo-economist on his Quora profile, was found to have plagiarized a post from Medium to respond to a thread on Quora.

The CIO

The CIO of Hedonova is Suman Bannerjee, a finance expert with an extensive background in finance. However, there are also notable red flags that deserve attention. Firstly, there is a concern about the picture used in his LinkedIn profile, which, similar to Alexandre’s, appears to have been clearly generated or enhanced by AI.

The image is also a stock photo available on numerous Google sites. This discovery raises concerns about the authenticity and transparency of the information presented in Suman Bannerjee’s profile.

The Technology Director

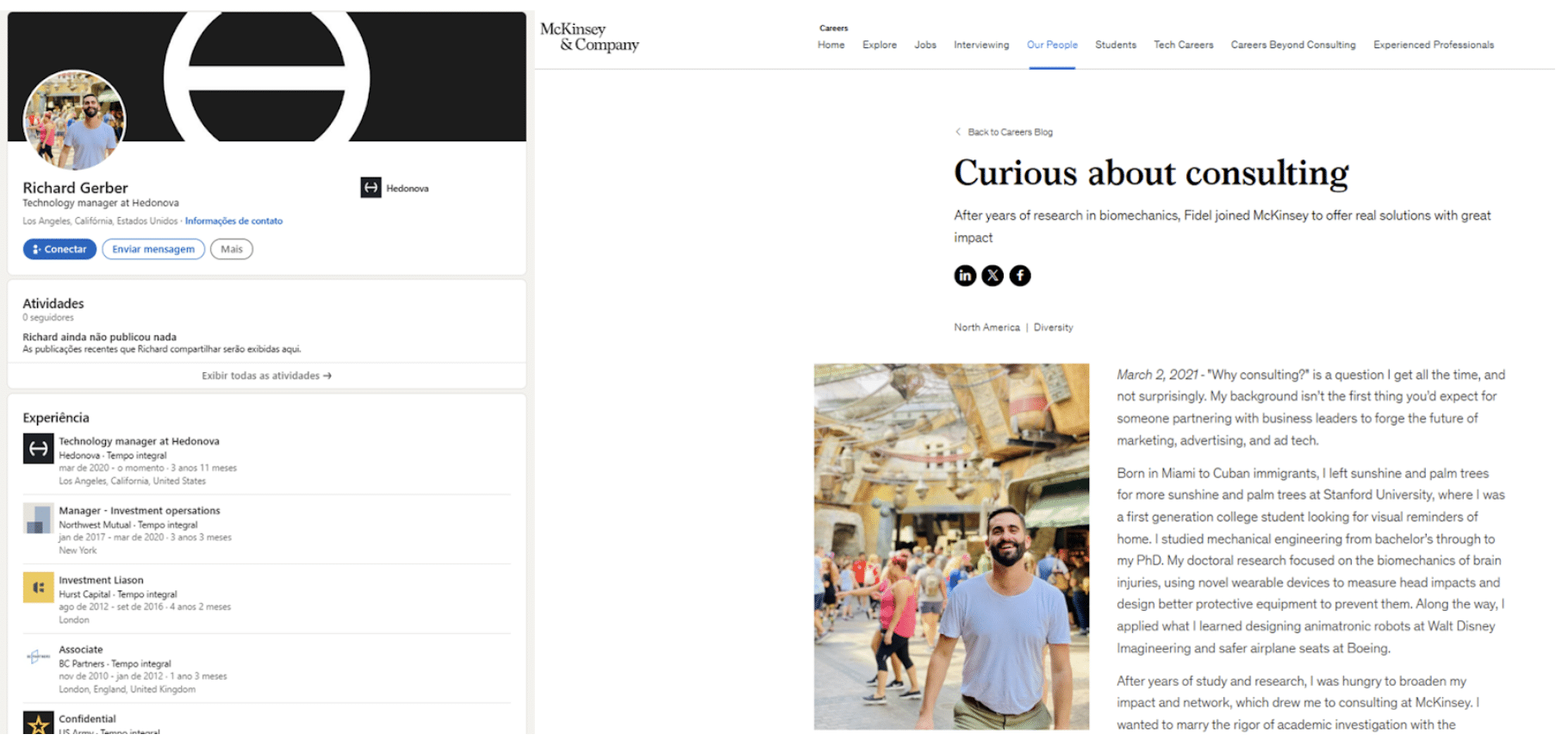

Alledaldy Richard Gerber is the Technology Director of Hedonova. However, the photo displayed on his LinkedIn profile is that of a former McKinsey & Company employee, which was used in a company article. It’s worth noting that Richard Gerber does not have any experience with McKinsey & Company, as indicated on his LinkedIn profile.

User reviews

The Trustpilot page of Hedonova highlights a warning about the removed reviews, which the platform detected as fake. This is a clear red flag, suggesting that it could be an indication of review manipulation with an obscure purpose.

Products and markets

Hedonova invests in alternative asset classes. With this approach, Hedonova believes it has greater adaptability, actively works towards risk mitigation, and offers the potential for superior returns in dynamic markets compared to more established ones.

Hedonova manages to invest in 10 different alternative asset classes, including real estate worldwide, art, music royalty, agronomy and more. Becoming an expert and profitable in one of these areas is already challenging, which makes us question how Hedonova has managed to have the expertise to invest profitably in all these different asset classes.

Fund Performance

Hedonova claims an annualized return of 48.52% (as of 14/11/2024) since its inception in 2020. These returns are undeniably quite attractive. Since its beginning, the fund has stood out for its outstanding performance in 2021, with a gross return of around 118%, and a solid performance in 2020 (gross return approximately equal to 17.32%), especially considering the state of the stock market, for instance.

Fees

Hedonova applies only two fees to its clients: a 1% management fee calculated on the total investment amount, and a 10% performance fee on profits generated through the fund and the investor’s invested capital.

| Fee Structure | |

| Minimum Deposit | $10,000 |

| Management Fee | 1% (of capital invested) |

| Performance Fee | 10% (of profits) |

| Exit Fees | $0 |

Hedonova’s fee structure is favorable, being lower than the standard 2 and 20% strategy commonly adopted by the majority of hedge funds (comprising a 2% management fee and a 20% performance fee).

Bottom line

Despite being an investment adviser registered with the SEC, Hedonova raises significant warning signs, particularly regarding the authenticity of its management team.

While Hedonova boasts impressive annualized returns, the lack of transparency and concerns about the team and the authenticity of investments raise serious doubts about the company’s legitimacy and the safety of investments.