Hello, fellow investor! This article is our honest review of the Finax robo-advisor.

What’s a robo-advisor? – you might ask. Feel free to check out our Introductory Guide to Robo-Advisors to get familiar with the concept or refresh your memory.

Upon account opening, you will be asked to complete a customer-oriented questionnaire that determines your goals and risk tolerance. Based on your answers, the platform sets up and executes an investing strategy using computer algorithms through the same methods that traditional wealth management firms use to manage their clients’ money.

It is a good starting point for investing beginners, offering a straightforward registration process, a low minimum deposit (€10), and intuitive apps for both web and mobile.

On the downside, the fees are higher than those of some of its European competitors (more about this in the “fees” section).

That’s Finax in a nutshell. If you want to find out what our research team has to say after carefully analyzing Finax, keep reading.

Overview

Founded in 2017 in Slovakia, Finax is made for investors that wish to simplify and automate their investing experience as much as possible. Its customer base and assets-under-management (AUM) still can’t compare to Europe’s largest Robo-advisors, but both are increasing.

After completing a short survey, which assesses your risk tolerance and investing goals, you will be placed in a portfolio picked among 11 available setups.

Besides the Robo-advisor offering, Finax also offers other features and products:

- Intelligent wallet – a product designed for inflation protection and short-term savings. Expected returns of 2-3%, with a 0.5% fee (including VAT).

- Intelligent annuity (regular withdrawal) – a product designed for regular withdrawals from your portfolio. An asset minimum of €50,000 applies (if you’ve been a Finax client for longer than five years, it goes down to €10,000).

- Brokerage service – a classic brokerage service, including consultancy, financial advice, custody, and access to a wide range of securities, including derivatives. The transaction fees are set at 0.5% of the transaction value, with predetermined minimums.

- Services for companies – Finax also offers custom services for financial agents, employers, issuers, and investors.

Finax is regulated by the National Bank of Slovakia, and your assets are protected up to €50,000 by the Guarantee Fund of Investments in Slovakia.

Highlights

| 🗺️ Supported countries | European Union |

| 💰 Fees | 1% per annum plus VAT |

| 🎮 Demo account | No |

| 📈 Portfolio rebalancing | Yes |

| 💵 Minimum deposit | €10 |

| 📍 Investment instruments | ETFs |

Pros and cons

Pros

- Simple registration process

- Intuitive and user-friendly platform

- Minimum deposit of only €10

- Focus on the tax optimization of your investments

- Use of accumulating ETFs (instead of distributing ETFs, which are tax-inefficient in some countries)

- You can completely automate your investing by setting up recurring payments

- Automatic portfolio rebalancing

- No hidden fees

- Education materials (webinars, podcasts, and blog posts)

Cons

- Higher management fees than some competitors (1.2%, including VAT)

- Bank transfer is the only deposit option

Investment strategy

The investment strategy that Finax uses to build its portfolios is the industry-standard investment in index ETFs (Exchange-Traded-Funds).

Investment Strategy – Asset Allocation

The ETF allocation made by Finax is based on the questionnaire you fill out at the beginning. It takes into account your risk tolerance, goals, and investment horizon.

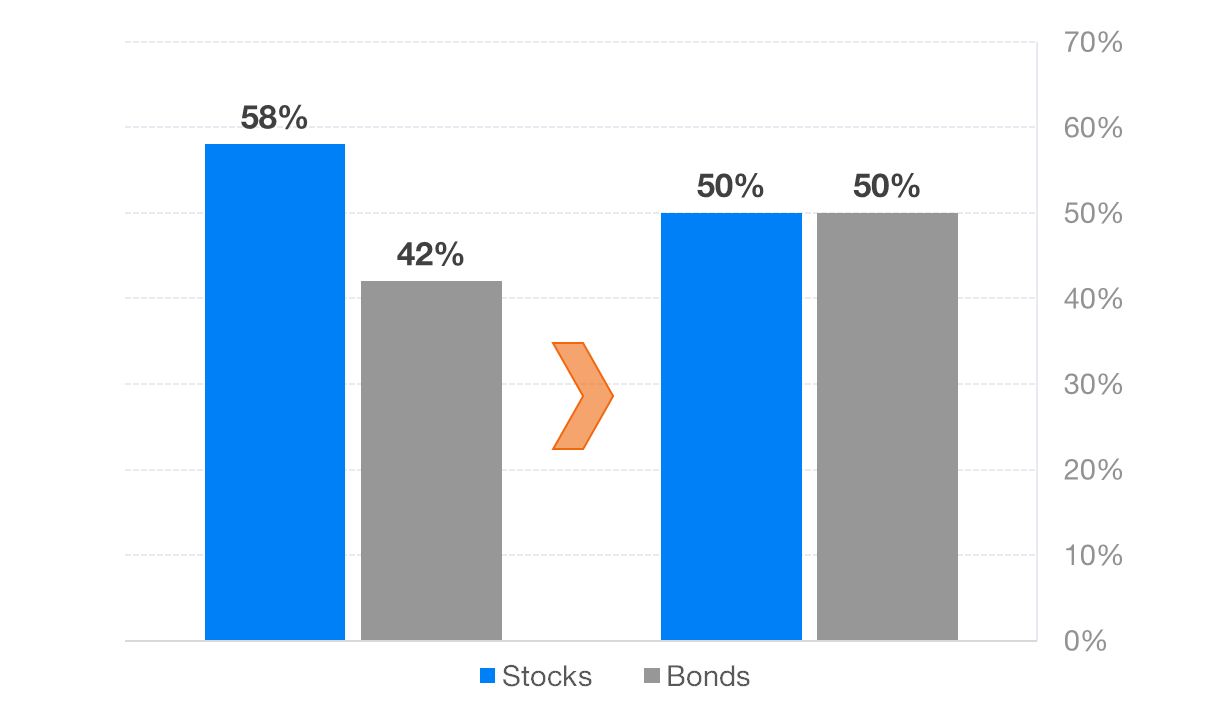

You can choose if you want the suggested allocation or, if you wish, select an even lower volatility allocation (a higher percentage of bond ETFs). You can change the allocation for free once a year if you wish to do so. More frequent allocation changes are not advised and can result in a fee of €200 + VAT.

The portfolio asset class allocations range from 0% stocks and 100% bonds, to 100% stocks and 0% bonds (in 10% increments for each investment class).

Simply put, index ETFs are low-cost funds that are easily traded on the exchange. Their goal is to replicate the underlying index (market) returns passively. Learn more about ETFs here.

With that choice, Finax aims to earn you the average market returns (minus fees) while somewhat boosting expected returns with exposure to mid- and small-cap companies, automatic portfolio rebalancing, and consideration of tax implications.

Investment Strategy – Asset Selection

The investment portfolios are built from 10 different physical ETFs (6 stock ETFs and 4 bonds ETFs).

Physical ETFs contain the actual securities of the index they are tracking. Compared to synthetic ETFs (a combination of financial derivatives that promise to pay the return on the benchmark), they provide higher transparency and limited counterparty risk. You can find more info on physical and synthetic ETFs here.

The Finax ETF list is as follows:

- US stocks of large companies (SXR8)

- US stocks of medium-sized companies (SPY4)

- US stocks of small companies (ZPRR)

- European large and mid-sized companies (XSX6)

- European small companies (XXSC)

- Stocks of companies from emerging countries (IS3N)

- Global government bonds (DBZB)

- European corporate bonds (XBLC)

- European high-yield bonds (XHYA)

- Government bonds of emerging countries (FRCK)

The mentioned ETFs are issued by some of the most reputable investment companies in the world, such as BlackRock, State Street, and Deutsche Bank. Alongside accumulating dividends, they offer very low fees (TER), high liquidity, and large fund size.

The ETF choice is tax-efficient in most European countries since all the ETFs are accumulating (they don’t distribute the dividends to the shareholders, but reinvest them back to the ETF). This is usually desirable since distributing dividends is often viewed as a taxable event in most countries.

Investment Strategy – Portfolio Rebalancing

Automatic portfolio rebalancing means that Finax will try to keep your portfolio’s asset allocation close to the predetermined ratios, by rebalancing it periodically (eg: imagine that a portion of your portfolio, like US stocks, have increased a lot in value. Then, at a later stage, the Robo-advisor will rebalance the portfolio to its original allocation, using dividend payments and additional contributions).

Rebalancing is free of charge and, in some countries, it also considers tax implications based on local tax regulations (source). Tax considerations have priority over rebalancing, which means that rebalancing could be postponed for several months if it would result in a tax liability.

However, if a taxable event occurs, it is your responsibility to calculate and pay capital gains taxes in your country of residence. More on the Finax rebalancing process here.

Following the initial setup, there is little to be done afterwards. If you wish to set up recurring payments to your Finax account, there is no need to even log in to the platform at all!

Fees

- Annual portfolio management fee of 1% per annum plus VAT for assets under management (AUM). Calculated and deducted monthly. It is higher than some of its competitors, like InbestMe.

- Lower fees for Finax Elite clients. To be a Finax Elite client, you need to have a minimum portfolio of €100,000.

- Additional fees apply if you wish to use their classic brokerage service, if you don’t execute the fund transfer correctly, or if you change the portfolio allocation more than once a year (more on those below).

Full Finax pricing can be found here.

Investment platform

The Finax platform is available in both web and mobile app versions.

The interface is simple and intuitive on both platforms. Both offer access to your investment platform, along with settings, notifications, and education material (podcasts, webinars, and blog posts).

You can easily observe your investment performance across different ETFs separately and for the total portfolio as a whole.

Safety and reliability

Finax is regulated by the National Bank of Slovakia (permission can be found here). Your assets are protected up to the amount of €50,000 by the Slovakian “Guarantee Fund of Investments”. The company’s assets are separated from the client’s assets, which is especially important in the event of default.

Like most Robo-advisors, Finax is a recent company, so the company’s track record is still short.

Supported countries

Finax is available in all countries of the European Union.

The app supports six languages: English, Slovensky, Magyar, Česky, Polski, and Hrvatski.

Bottom line

To sum it up, Finax offers a very simple way to start your investing journey. The fee structure is as simple as it gets, and there are no hidden fees you should worry about.

However, there is no free lunch, so expect to pay a somewhat higher management fee than you would at some other competitors: 1% per annum plus VAT. There are announcements from the company towards lowering the fees in the future, as their investment base grows.

Finally, Finax’s education materials are a good starting point to learn about investing.

Looking for Finax alternatives? Check our full list of Robo-advisors available by country.