Hello, fellow investor! This article is our honest review of the Trine platform.

It does so by collecting funds from individuals or companies (lenders) through crowdfunding, which are funding solar projects for their partners (borrowers).

The company’s motto “It’s easy to invest in a greener future” sums up the vision of the Trine company. By using developing world’s largely untapped solar potential, Trine looks to make profit for itself, the investors (lenders), and have a positive impact on communities and the climate in the process.

The registration process is fairly simple, after which you can select loans in which you want to invest. With a low barrier to entry (the minimum investment in a loan is only €25), and your first investment is guaranteed up to €100.

The upsides of Trine are the ability to invest in an environmentally and socially friendly way, helping businesses in developing countries and the environment as a whole, while making profit.

The downsides (among others which we’ll cover more in depth later on) are its non-beginner friendly loan selection process, limited options for diversification, and relatively long time periods from projects full funding to the first repayment.

If you want to find out more details, keep reading what our research team has to say after carefully analyzing Trine.

Overview

Trine was envisioned as a company that is making profit through solar energy investments, while helping the people and the planet at the same time. The company itself views it as “triple return on investment”, which clearly shows that the company’s vision is not geared towards profit alone.

The company is majority owned by its cofounders and the employees, with some outside funding. More on the ownership structure here.

This fact ties well with the growing trend of ESG (Environmental, Social, Governance) investing that has been growing in recent years. That’s why Trine’s growth has been nearly exponential since 2016 until present day (see more about it here).

At the time of this writing, Trine has provided electricity for more than 3 million people while offsetting more than 1,200,000 tons of CO2. The total amount invested is nearly €100 million, with the loan default rate of (currently) 5.0%.

The investing process is simple, starting with a standard registration procedure. Trine accepts all individual investors above the age of 18 from the EEA (European Economic Area), as well as companies. More on this later in the review.

After your account is verified, you can start investing in currently available loans on the platform by direct bank payment through the Trustly platform, or by a bank transfer.

It is essential to consider that Trine is not covered by any deposit guarantee provided by the state. However, in the case of Trine’s default, your funds are held in a separate account, and you can still pursue the outstanding repayments yourself (more on this later in the review).

Pros and Cons

Pros

- Simple registration process

- Intuitive and user-friendly platform

- An easy way to invest into solar energy with a low barrier to entry (€25)

- The possibility of investing in a socially and environmentally friendly way

Cons

- Potentially higher risk than with traditional investment classes

- The lack of guarantee for your invested funds

- Relatively long period from projects full funding to the first repayment

- Non-beginner friendly loan selection process

- Limited number of loans available at the platform at a time

- Limited opportunities for diversification

- Repayments could be considered a taxable event in your country of residency

Loan selection and investment process

Trine offers mainly investment opportunities in the Commercial & Industrial (C&I) sector, meaning small to large businesses, governments, schools, and nonprofits, among others.

Solar power is mainly used as a cheaper form of supplement electricity for the C&I sector, which decreases their business expenses, while providing clean energy. Recently, Trine also started to offer investment opportunities in the segment of E-mobility (electric forklifts).

Trine has their own assessment system for estimating investment risk connected to their partners (borrowers). The borrowers are ranked from A+ to B-, depending on various factors such as financial performance, governance, track record, management, operating environment and competition etc. Trine does not offer investment opportunities for companies rated lower than B-.

When choosing an investment opportunity on Trine, you can inspect the loan, its terms and Trine’s due diligence about the company, including its key opportunities, as well as key risks, among other info. You can read more about Trine’s due diligence process here.

It is important to note that it is very difficult to inform yourself further on the investment opportunity, other than from the mentioned info published by Trine.

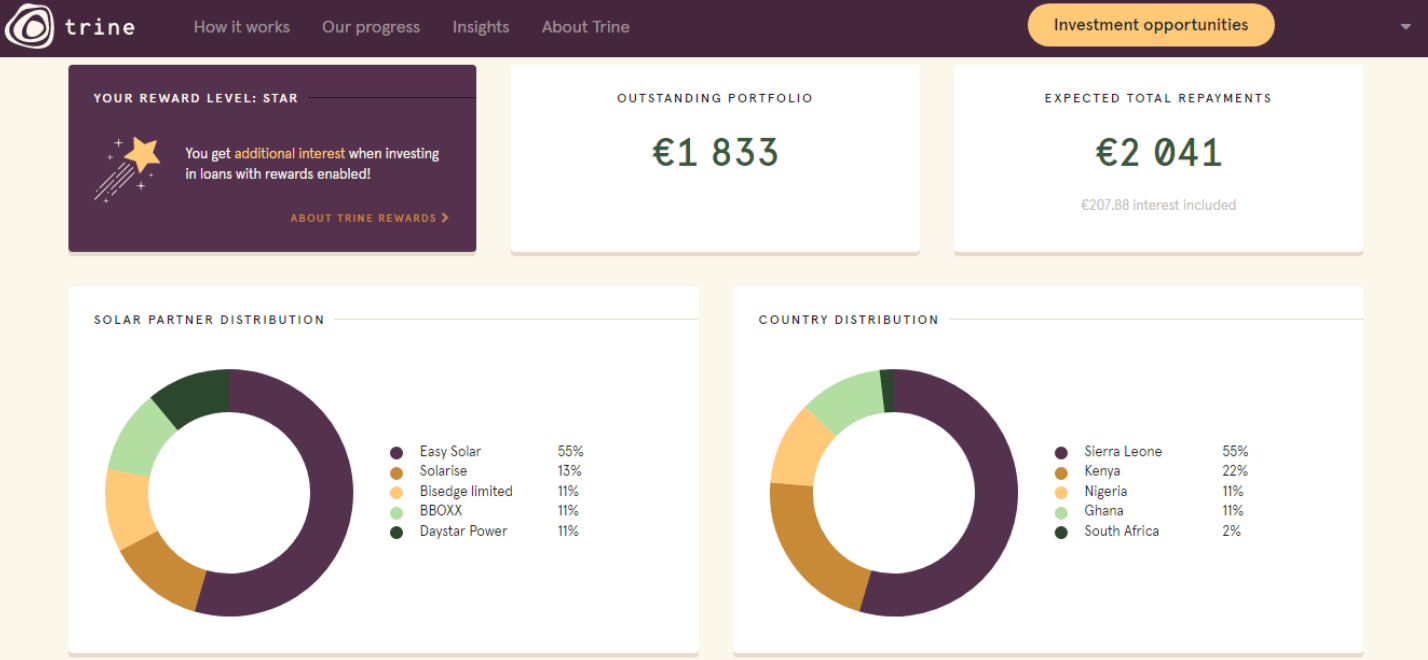

Based on the size of your portfolio, you may also be eligible for Trine Rewards, which is a benefit of additional interest on top of the base interest. You can see the general terms of the Trine Rewards here, but the specific terms are stated on each particular loan.

Fees

- Trine does not take any fees from you (the lender), but only from the borrower

- The borrower pays a one-time fee for arranging the loan, and also a management fee throughout the payback period

- The exact fees charged to the borrowers are mostly determined by the size of the loan

More on the Trine fee structure here.

Platform

The Trine platform is available inside your web browser and is easily accessible on both desktop and mobile. Currently there are no mobile apps for neither Android nor iOS.

The interface is simple and intuitive. You can see detailed info about the status of your investments, your portfolio, expected repayments, transactions, and more in your Dashboard.

Risks, safety, and protection

Trine is recognized by the Swedish Financial Services Authority (S-FSA) as a licenced payment provider.

The three major risks in investing with Trine are non-performing (delayed or defaulted) loans, the risk of Trine company bankruptcy, and currency exposure.

Mechanisms that offer some protection against these risks are First Investment Guarantee, Investment protection in collaboration with organisations SIDA and DFC.

We will go over the potential risks and protection mechanisms below.

Non-performing loans

Investing with Trine comes with the risk of capital loss. When the repayments are delayed, the loan needs to be restructured or the loan defaults. Trine manages the process of debt recovery and the default process on behalf of their investors.

They do so by deploying measures ranging from continued monitoring, contact with the borrowers, charging late fees, up until more serious measures which include restructuring a loan, hiring a debt collector, or filing for bankruptcy.

Find more on the debt recovery process here.

Company bankruptcy

In the event that Trine goes bankrupt, your funds are not covered by a deposit guarantee scheme, as is often the case with traditional brokers and robo-advisors.

However, all the funds that are in your Trine wallet and that are coming via repayments are separated from Trine’s company finances.

If Trine defaults, you can still pursue the repayments yourself, at least in theory, since the Loan Note Instrument is between the lender (you) and the borrower. However, it will probably be complicated to pursue the payments yourself in practice, considering that the borrowers are not located in the EU.

There is also the possibility of finding a third party that would manage the remaining administration of these loans.

Currency exposure

Since Trine is offering investment opportunities in various countries with different currencies, there is a currency risk involved both for the borrower and the lender (you).

The borrower’s risk lies in the fact that they are generally paid in the local currency, but have obligations to manufacturers and creditors in USD or EUR. This makes their business susceptible to currency fluctuations.

For you as a lender, you can have currency exposure if your home currency differs from EUR, which is the default currency in which the loans are issued.

You can read more about general risks here.

First investment guarantee

All new investors on Trine get their first investment guaranteed up to an amount of €100. That includes protection from the loan default by the borrower, and only includes the principal of the loan (not the interest).

If you choose to invest more than €100 for your first investment, only the amount of €100 will be protected by the guarantee. You can not combine this guarantee with others.

Find more on First Investment Guarantee here.

Investment protection provided in collaboration with SIDA or DFC

There are also investment protection mechanisms for certain loans that include the U.S. International Development Finance Corporation (DFC) or the Swedish International Development Agency (SIDA).

They both include protection from the borrower defaulting on the loan. In the case of DFC the protection would cover 50% of outstanding losses of principal, while SIDA covers 60%.

In any case, if you want to have DFC or SIDA protection for your loan, be sure to read the info about the loan in which it is stated if the loan is protected, and by which institution.

You can read more about Trine’s investment protection here.

Supported countries

Trine is available for investors over the age of 18 in all EEA (European Economic Area) countries, including Switzerland. UK investors that previously used the platform can continue investing, but the platform is not accepting new UK investors since January 2021.

List of available countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland.

The platform is only available in English.

Bottom line

To sum it up, Trine offers a simple way to invest in solar energy in developing countries, with the potential of making profit while helping communities and the environment at the same time. That fact is probably Trine’s biggest selling point.

The interface itself is simple, but it can be somewhat harder for beginners to choose the right loan to invest in and to diversify their investment with time. Especially since there is usually not a large number of available loans to choose from.

The potential impact with investing through Trine is not exclusively financial in nature, as can be seen in your investment dashboard. Positive effects on the communities include supporting good health, education, economic growth, innovation etc.

However, investing through Trine is not without its risks. Namely, there is a risk of non-performing (delayed or defaulted) loans, Trine’s company bankruptcy, and currency exposure, as explained above.

To sum up the pros and cons, Trine is a somewhat risky way to invest, with possible gains that go beyond financial ones.

Thank you for reading!