Established in 2018 and headquartered in South Africa, RCG Markets serves as an intermediary financial service provider.

The company offers direct market access for executing trades in various CFDs (indices, shares, commodities and energies) and FX, catering to retail traders, hedge fund managers and corporate clients.

Have you invested money with RCG Markets and are uncertain about its reliability? Or are you contemplating starting your investment journey with RCG Markets and seeking more information? Continue reading this article, as we will provide a comprehensive overview to address all your queries.

Overview

RCG Markets, established in 2018 and headquartered in South Africa, distinguishes itself as a notable brokerage offering high leverage up to 2,000, zero-commission trading accounts, and direct market access.

Specialising in a diverse range of CFDs, including indices, shares, commodities, and energies, the platform caters to retail traders, hedge fund managers, and corporate entities. Operating as an STP and ECN broker, it emphasises fair and fast execution, positioning itself as a competitive player in online trading.

Highlights

| 🏟️ Headquarters | South Africa |

| 🏟️ Founded in | 2018 |

| 💰 Account currency | GBP, ZAR and USD |

| 💰 Inactivity fee | $50 (including funding or trading, within one year) |

| 💰 Commissions | $0 for Classic, RAW and ROYAL 100 RCG accounts, $7 for RCG ECN account |

| 💰 Spread | 0.0 pips for RCG RAW and RCG ECN accounts and 1.5 pips for RCG classic and ROYAL 100 accounts |

| 💵 Minimum withdrawal | R100 |

| 💵 Minimum deposit | R50 |

| 💵 Deposit options | Ozow, Paystack, Virtual Pay, Skrill / Neteller, B2Binpay V2.1, E-MOLA (Mozambique), Wire Transfer Bank Details |

| 📜 Regulatory entities | FSCA |

| 📍 Products offered | CFDs (indices, shares, commodities and energies) and Forex |

| 🎮 Demo account | Yes |

| 🎮 Trading platforms | MetaTrader 4, MT5 Client, Android/iOS Application, Live Webtrader |

Safety and regulation

In May 2021, RCG Markets became a financial services provider authorised by the Financial Sector Conduct Authority (FSCA) under licence number FSP49769, the financial market regulator from South Africa. However, it is not regulated by any top-tier regulator from well-known countries such as the UK or the US.

Although RCG Markets is regulated by the FSCA, there are some warning flags that you need to be aware of.

- The regulatory framework in South Africa is more lenient compared to the European Union, Australia, or the United States. Brokers in South Africa are not obligated to offer negative balance protection, maintain client funds in segregated accounts, or adhere to restrictions on leverage and trading bonuses. Additionally, they are not required to participate in compensation plans or report on open and closed deals.

- The address and contact number in its regulatory details do not match those on its website.

Account types

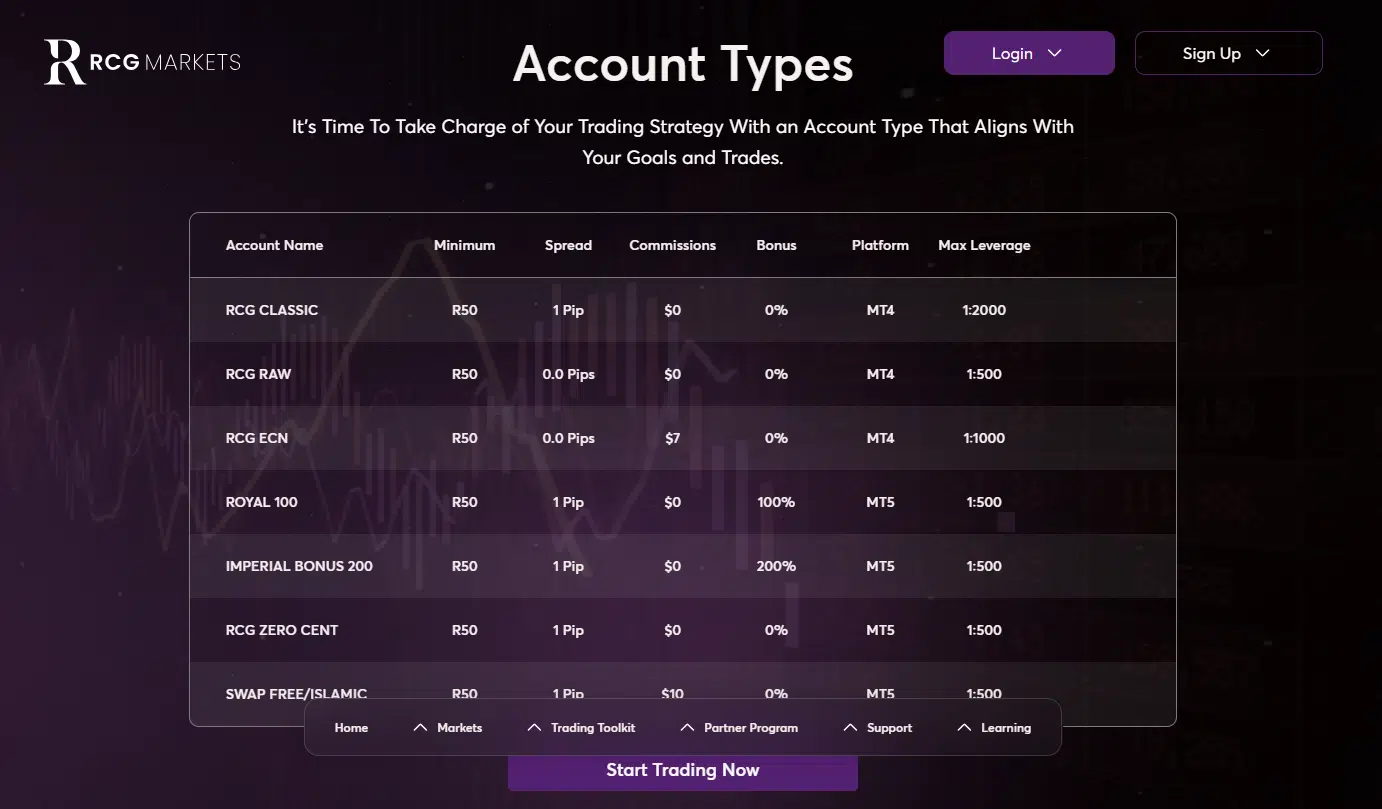

RCG Markets offers a diverse range of account options featuring fixed minimum deposits along with increased leverage and spreads. The available account types including, Classic, Raw, ECN, and Royal are tailored to accommodate various trading preferences.

One of the main attractive features offered by RCG Markets is the low minimum deposit of only R 50, high leverage up to 1:2,000 and spreads as low as 0 pips for some account types.

Beware of a prevalent strategy employed by forex brokers: promoting high-leverage and low-deposit accounts. While this increases the risk for inexperienced traders to quickly deplete their accounts, it doesn’t automatically label the broker as a scam. This approach is a standard industry marketing tactic to enhance attractiveness to potential clients.

Account opening

The process of opening an account with RCG Markets is straightforward. You just need to follow an intuitive step-by-step registration procedure.

- First, click “Login” on the homepage;

- Then, insert your First and Last name, create a password, choose the platform that you prefer (MetaTrader4 or MetaTrader5), choose the currency that you’ll trade (GBP, USD, ZAR), insert your email and finally choose the type of account that you prefer;

- Next, add your contact and address information;

- And you are ready to go:

After creating an account, there are some additional steps required:

- Identity verification: you’ll need to submit essential documents for identity verification. Once verified, you’ll unlock access to your RCG Markets dashboard.

- Compliance questionnaire: A compliance questionnaire will be administered to assess the user’s knowledge on CFDs, how they acquired this knowledge, awareness of associated risks, and relevant statistical data such as current employment status and field of expertise.

- Add funds: With your account successfully created, the sole remaining step to initiate trading is adding funds. Pick your preferred fund amount, select your currency and payment option, and deposit the chosen amount.

It’s worth mentioning that RCG Markets offers a demo account, for beginners to refine their trading abilities without any financial risk.

Fees

- Inactivity fees: In cases of account inactivity, you need to pay a fee of 50 USD (or currency equivalent) that will be subject to your account.

- Withdrawal and deposit fees: There are no withdrawal or deposit fees.

- Spreads and trading commissions: The spreads and trading commissions vary depending on the type of account. Spreads vary from 0 pips to 1.5 pips, and commissions can go as high as $7.

Products and markets

RCG Markets offers direct market access to execute trades in various CFDs (indices, shares, commodities, and energies) and FX.

| Products | Available? |

| Stocks | ✘ |

| ETFs | ✘ |

| Bonds | ✘ |

| Funds | ✘ |

| Options | ✘ |

| Futures | ✘ |

| Forex | ✔ |

| Cryptocurrencies | ✘ |

| Commodities | ✔ (CFDs) |

| CFDs | ✔ (on indices, shares, commodities and energies) |

Some examples you will encounter when trading with RCG Markets:

- Forex – EUR/USD; GBP/USD; USD/CHF; USD/JPY. Alongside with major pairs of forex, RCG Markets also offers Forex trading on exotic pairs.

- Indices – Over 10 indices from international markets such as the US, Spain, France, Germany, and more.

- Shares – CFDs on over 50 stocks from International Markets

- Commodities– Gold and silver

- Energy – Oil and Natural Gas

RCG Markets alternatives

If you find that RCG Markets may not be a suitable choice for you, below we present alternative options that align more closely with your preferences:

69-80% of retail CFD accounts lose money.

82% of retail CFD accounts lose money.

Bottom line

While FSCA authorisation provides some scrutiny, notable warnings and regulatory leniency warrant caution.

With this article, we emphasize the importance of informed decision-making, urging readers to weigh the risks associated with light regulated brokers and be aware of the company’s fee structures.

Alternative options like Interactive Brokers, XTB, and Plus500 are presented for those seeking more reputable alternatives.