Hello, fellow investor! This article will give you our honest opinion of InvestEngine, a commission-free UK-based ETF investment platform.

It is currently offering a Welcome Bonus of up to £100 when you invest at least £100 (Capital at risk. Ts&Cs apply).

InvestEngine allows users to create a Do-It-Yourself (DIY) ETF portfolio or an automated ETF portfolio (including the “LifePlans”) according to their risk profile using an ISA, Personal Account, or Business Account.

It exclusively focuses on ETFs, with a selection of over 830 ETFs from several providers: iShares, Vanguard and other leading asset management firms. Despite this, the range of ETFs and other investment products is limited.

That’s InvestEngine in a nutshell! Keep on reading to find out what our research team has to say after a careful analysis.

Overview

Founded in 2019, InvestEngine is an ETF platform that allows you to build your portfolio using only ETFs. ETFs cover most major asset classes and sectors, providing a broader selection of investments. With a single platform, you are well diversified without selecting individual stocks or bonds.

With a minimum deposit of £100, you will have access to all their products. It also includes fractional investing, allowing you to invest as little as £1 in any ETF each month.

By using “one-click rebalancing”, you can restore your ETF portfolio to its original weight. This feature is quite handy as it allows you to reset your portfolio quickly. Suppose you allocated 30% to ETF A and 70% to ETF B. Over time, ETF A may increase more in value than ETF B, and the allocation reaches 35% and 65%, respectively. With an easy tap, you return to the initial portfolio.

Furthermore, smart orders allow you to set the investment amount and choose the weight for each ETF. The next step is to turn on Autoinvest, which will automatically invest any money you deposit into your current ETFs.

The platform is designed for UK investors, so it offers their personal accounts under the Stocks and Shares ISA and a corporate account for small to medium enterprises (SMEs).

The fee structure is extremely transparent. Only a 0.25% annual management fee will apply to managed portfolios. If you prefer to manage your own investments, it will be completely free of InvestEngine execution costs (ETF costs apply).

Finally, as detailed in the Safety section, InvestEngine is authorised and regulated by the Financial Conduct Authority (FCA) and is a member of the Financial Services Compensation Scheme (FSCS).

Highlights

| 🗺️ Supported countries | United Kingdom (UK) |

| 💰 Fees | 0%-0.25% (per year) |

| 🎮 Demo account | No |

| 📈 Fractional investing | Yes |

| 💵 Minimum deposit | £100 |

| 📍 Investment instruments | ETFs |

Pros and cons

Pros

- Simple and intuitive investment platform

- No ISA fees

- No deposit or withdrawal fees

- Fractional Investing

- One-click rebalancing

- Auto-invest

Cons

- Only offers ETFs: no bonds, shares, and other products

- No interest on cash balances (still you can invest in money market funds)

Investment products

InvestEngine only offers ETFs. Currently, there are more than 830 ETFs available. Using the following criteria, you can pre-select the range of ETFs that you wish to include in your portfolio:

Asset class

Equities, Bonds or alternatives (mainly Commodities).

Income distribution

Distributing means that on a periodic basis (usually quarterly), you will receive dividends in your account or Accumulating where the dividends are automatically reinvested within the ETF (the money never arrives at your account).

Type of Hedge

Currency-hedged to pounds, where you will be protected from exchange rate movements when holding foreign assets or Unhedged, where you may benefit or be harmed by currency movements.

ESG

You can select “Yes” or “No” for ETFs that are chosen based on a set of standards that evaluates the company’s behaviour concerning environmental, social and governance (ESG) issues.

Investments portfolios

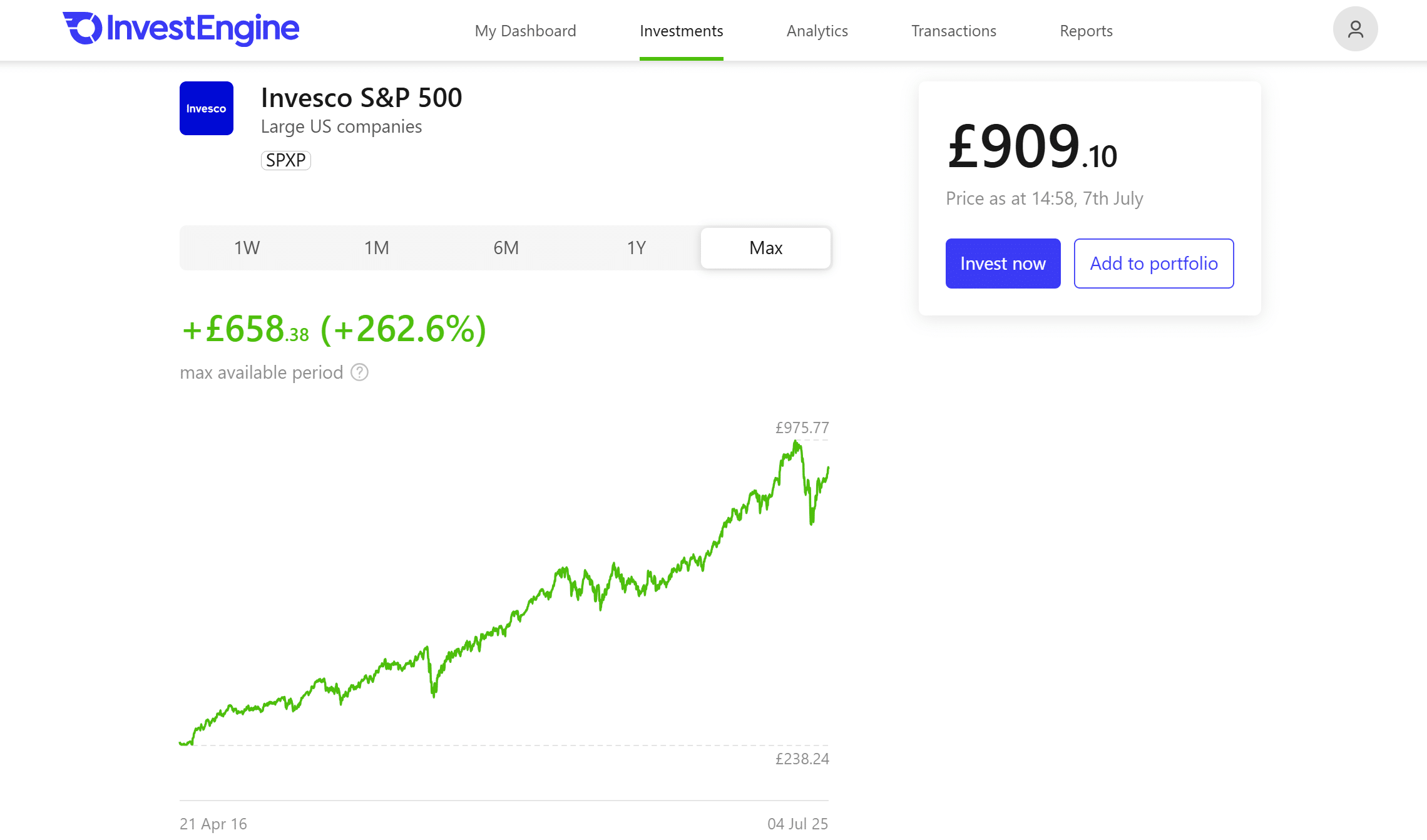

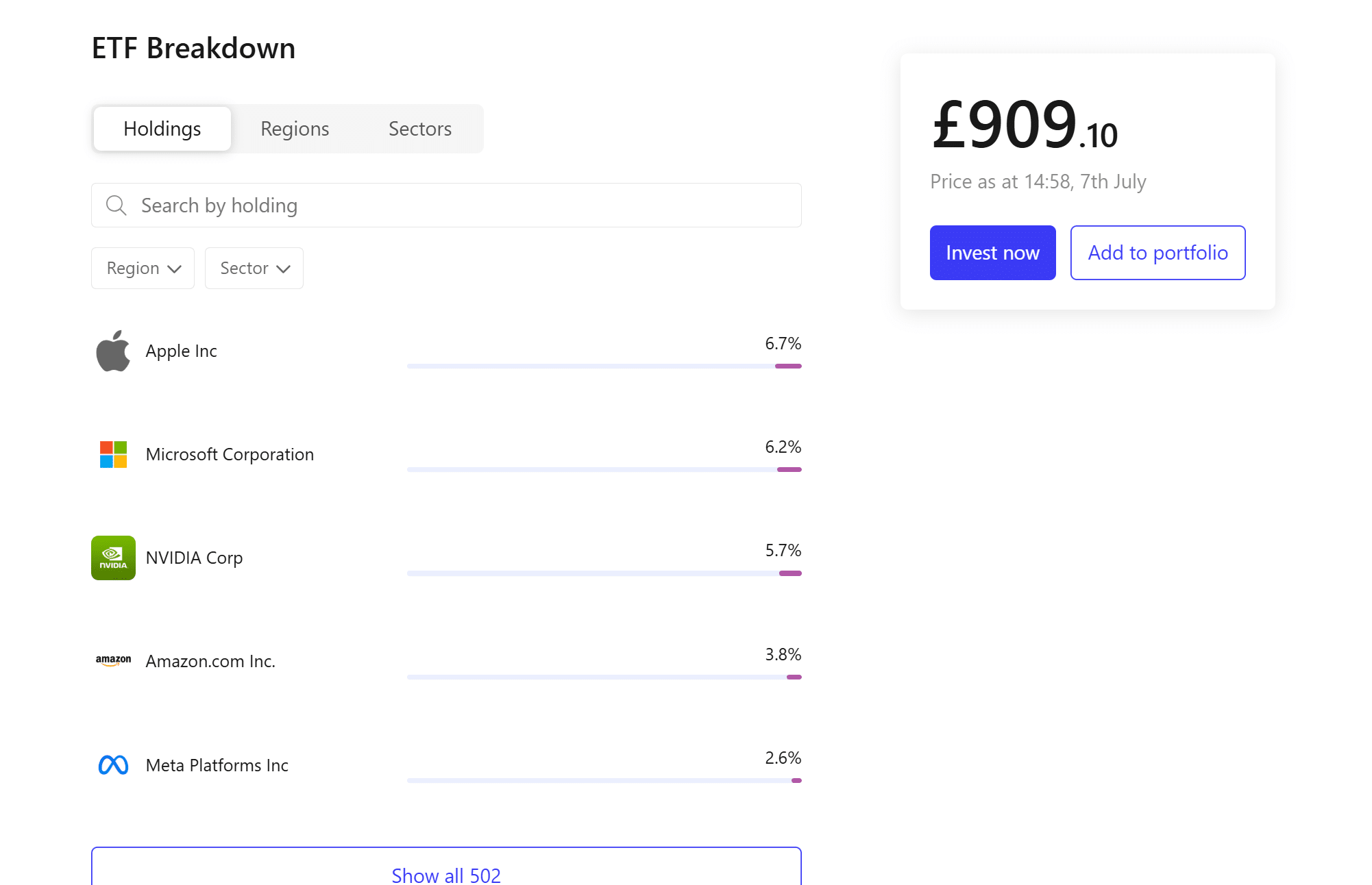

Through the “DIY” approach, you will be completely free to use the ETFs as you see fit. You can easily observe the composition of each ETF by asset classes, holdings, regions and sectors, giving you a better idea of how your portfolio might look afterwards.

Additionally, you can set your investment weights to create the right balance for your investment goals.

If you don’t want the hassle of looking for ETFs and building a portfolio, InvestEngine offers what it calls “Managed Portfolios” and “LifePlans”. For a 0.25% annual fee, you get a pre-built portfolio.

The InvestEngine LifePlan Portfolios are adaptations of their managed portfolios. They have varying equity levels (20%, 40%, 60%, 80%, 100%) and are similar to the Vanguard LifeStrategies but with less of a UK bias and safer bonds, making them more diversified! They’re available for a 0.25% fee (plus ETF costs) as any managed portfolio.

As an example, let’s analyse the LifePlan 60% equity:

- Description: It a balanced risk portfolio (risk rated 4/7) designed for medium-risk long‑term investors who are comfortable choosing their own risk tolerance and capacity

- Objective: LifePlan 60 could be suited for those investing for at least 3 – 5 years, with a solid emergency fund and an understanding of ETF or stock market investing.

- Management style: Actively managed by InvestEngine using passive ETFs, including both UK and international markets (including emerging markets).

Account types

InvestEngine offers four account types:

ISA

Stands for “Individual Savings Account”, and it is a tax-efficient investment method. It allows individuals to invest up to £20,000 a year. There’s no income or capital gains tax to pay on any income or profits from your ISA investments. Tax treatment depends on individual circumstances and is subject to change.

With InvestEngine, you pay no ISA account fees (nor withdrawal or dealing fees).

SIPP

Short for “Self-Invested Personal Pension,” and it is a tax-efficient way to save for retirement. It allows individuals to manage their pension investments with flexibility, choosing from a wide range of assets. Contributions up to the annual limit benefits from tax relief, with the government adding 20% (and more, up to 45%, for higher-rate taxpayers) to your contributions. Tax treatment depends on individual circumstances and is subject to change.

You’ll pay 0.15% for your InvestEngine SIPP, capped at £200 per year, plus the costs of your investments.

Personal account

Contrary to an ISA or SIPP, there is no annual limit on how much you can put in, but depending on your circumstances, you may be subject to tax on interest earned and capital gains.

Business account

Designed to allow small to medium enterprises (SMEs) invest their surplus cash. If you are interested in exploring this topic further, look at other Business Brokerage Accounts.

In these account types, you can choose between a DIY or a Managed Portfolios approach.

Fees

Do-it-Yourself is free of trading commissions whereas managed portfolios incur a 0.25% annual management fee. Other than that, InvestEngine services are free.

There are, however, costs that are not controlled by InvestEngine (they do not benefit from them either) that will apply. Each ETF has an annual fee called Total Expense Ratio (TER). Usually, it is below 0.30% per year (“Average portfolio charge” in the table below).

Also, when buying and selling an ETF, you will notice bid and ask prices. The slight difference between those two prices is called the spread (“Average ETF spread costs” in the table below).

These charges are minimal and built into the ETFs’ performance.

Safety and reliability

InvestEngine is authorised and regulated by the Financial Conduct Authority (FCA), and all clients are covered up to £85,000 by the Financial Services Compensation Scheme (FSCS). In other words, the FSCS protects against the loss of cash and securities in the unlikely event of InvestEngine going bust.

As with most investment management firms, the company holds “all of your money in pooled client bank accounts with a recognised bank and your investments in a pooled client account at CREST (operated by Euroclear UK and Ireland), which is segregated from the firms and custodian’s investments”.

As it is standard industry practice to reduce bureaucracy and save costs, registration of your investments will be held under InvestEngine Nominees Limited. This still means they have no legal claim to your assets and cannot use it to cover any of InvestEngine’s obligations. Therefore, you are the beneficial owner.

Customer support

InvestEngine customer support is available through e-mail only ([email protected]) from Monday to Friday between 5:30 am and 9:00 pm and Saturday and Sunday from 8:30 am to 5:30 pm.

Supported countries

InvestEngine only accepts UK residents, UK tax residents (to open an ISA account), and you must be over 18 years old.

Bottom line

InvestEngine is one of the most simple and intuitive investment platforms out there. We are not surprised since they only offer ETFs, which are simple, easy to understand and transparent.

InvestEngine understands that some people know the importance of investing and like to do it by themselves. However, others don’t feel comfortable performing that task themselves, so it also gives a hand on that front.

Their transparent fee structure and all the features they provide make them a viable choice in such a competitive environment. We believe that it should definitely be on your watchlist if you simply want to invest in ETFs!

We hope our review gave you some valuable insights into the company!