Capital.com is a global trading platform that offers access to thousands of financial instruments, including stocks, indices, commodities and forex. In the UK, the product suite comprises leveraged CFDs (Contracts for Difference) and spread betting, alongside the unleveraged 1X account. In all cases, traders can speculate on price movements without owning the underlying asset.

Capital.com stands out for its zero-commission structure (fees are primarily covered by the spread) and access to a wide variety of markets. It’s particularly suited for active traders who want to trade short-term price fluctuations with (or in some cases without) leverage.

On the downside, it might not be ideal for long-term investors, as it doesn’t offer ownership of physical shares or ETFs, and overnight financing fees apply if you hold leveraged positions.

1X CFDs behave a little closer to traditional investing, as you can hold unleveraged long positions without accumulating swap fees, which reduces the cost of holding positions long-term. However, the product remains a derivative rather than a way to hold physical assets.

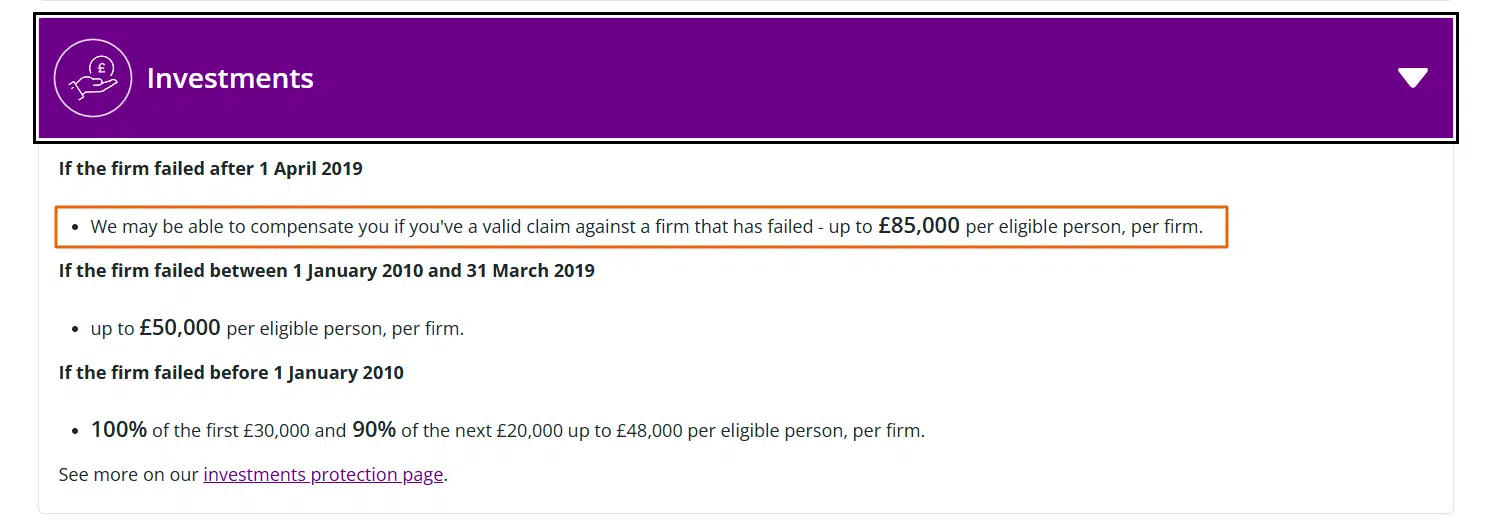

The broker is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, ensuring compliance with the UK financial laws, and has a local office in London. It offers segregated client funds for security and is subject to the Financial Services Compensation Scheme (FSCS), which protects client assets up to £85,000 per trader.

In this review, we’ll take a detailed look at the main features of Capital.com, including its fees, functionality, advantages, and limitations, to help you decide if it’s the right platform for you.

Overview

Launched in 2016, Capital.com is one of Europe’s best-known CFD brokers with over 750,000 investor accounts worldwide. The platform provides access to over 5,000 markets, including shares, ETFs, indices, forex pairs, and commodities, available in the UK as CFDs and spread bets.

Capital.com earns its revenue mainly through spreads (the difference between buy and sell prices) and overnight financing fees for leveraged positions held open after market hours (explained in detail in the “Fees and commissions” section). Fees are also payable on guaranteed stops if activated.

Capital.com doesn’t charge trading commissions: it operates a 0% trading commission model. Capital.com’s trading tools, educational resources, and sleek interface make it especially attractive to beginner and intermediate traders. For experienced investors seeking algorithmic or chart-based trading, Capital.com also integrates with MetaTrader 4 (MT4) and TradingView, expanding its functionality significantly.

In the UK, the platform also supports Spread Betting and a 1X (non-leveraged) mode, giving traders additional flexibility depending on their strategy and tax preferences.

That said, since all assets are CFDs, users do not acquire ownership rights or dividends from the underlying stocks or ETFs, a key distinction for anyone focused on long-term investing.

Highlights

| 🗺️ Supported Countries | Worldwide, including the UK |

| 💰 All CFDs fees | 0% (spread-only model) |

| 💰 Currency Conversion fee | 0% |

| 💰 Overnight financing fee | Applied to leveraged positions held overnight; calculations vary by asset class |

| 💰 Inactivity fee | £10 per month |

| 💰 Withdrawal fee | £0 |

| 💵 Minimum Deposit | £20 for most payment methods; higher minimums may apply for bank transfers |

| 💵 Interest on uninvested cash | 0% |

| 📍 Products offered | CFDs, spread betting, 1X |

| 🎮 Demo Account | Yes |

| 📜 Investor protection | Up to £85,000 under the FSCS |

| 📜 Regulatory entities | FCA (UK), CySEC (EU), ASIC (Australia), SCB (Bahamas), SCA (United Arab Emirates) |

Pros and cons

Pros

- 0% commission trading (only spreads apply)

- Offers a 1X (non-leveraged) account with no overnight funding fees

- Spread betting is available

- User-friendly web and mobile platforms

- Integration with MT4 and TradingView

- Wide range of tradable assets (over 5,000 markets)

- Low minimum deposit of £20

- 24/7 index CFD trading (extended hours)

- 24/7 customer support

- Excellent educational resources, including guides and webinars

- Demo account

Cons

- No ownership of underlying assets (CFD/spread betting only)

- Overnight financing fees can become expensive for long-term, highly leveraged positions.

- Not suitable for passive or dividend-focused investors

- No interest on uninvested cash

Account opening

Capital.com offers two regulatory classifications for UK clients under the Financial Conduct Authority (FCA): Retail and Elective Professional.

- Retail account: This is the default and most suitable option for the vast majority of traders. Retail clients benefit from full FCA-mandated protections, including:

- Negative balance protection;

- Restricted leverage under FCA rules (Up to 1:30 for major FX pairs, 1:20 for indices, 1:10 for commodities, and 1:5 for shares);

- Access to all available CFD products offered to UK retail traders

- Elective professional account: Experienced traders who meet the FCA’s criteria (sufficient trading activity, relevant financial experience, and a qualifying portfolio size) may apply for a Professional classification. This allows higher leverage limits, but removes certain protections, including:

- No guaranteed negative balance protection

- Limited access to the Financial Ombudsman Service (FOS)

- No FSCS protection for losses related to trading activity (FSCS still applies only for firm insolvency)

Capital.com does not use tiered account levels (such as “Basic” or “Advanced”). All UK clients access the same platform features. The only difference is their regulatory classification and associated protections.

Trading platform

Capital.com provides four main platforms:

Web Platform

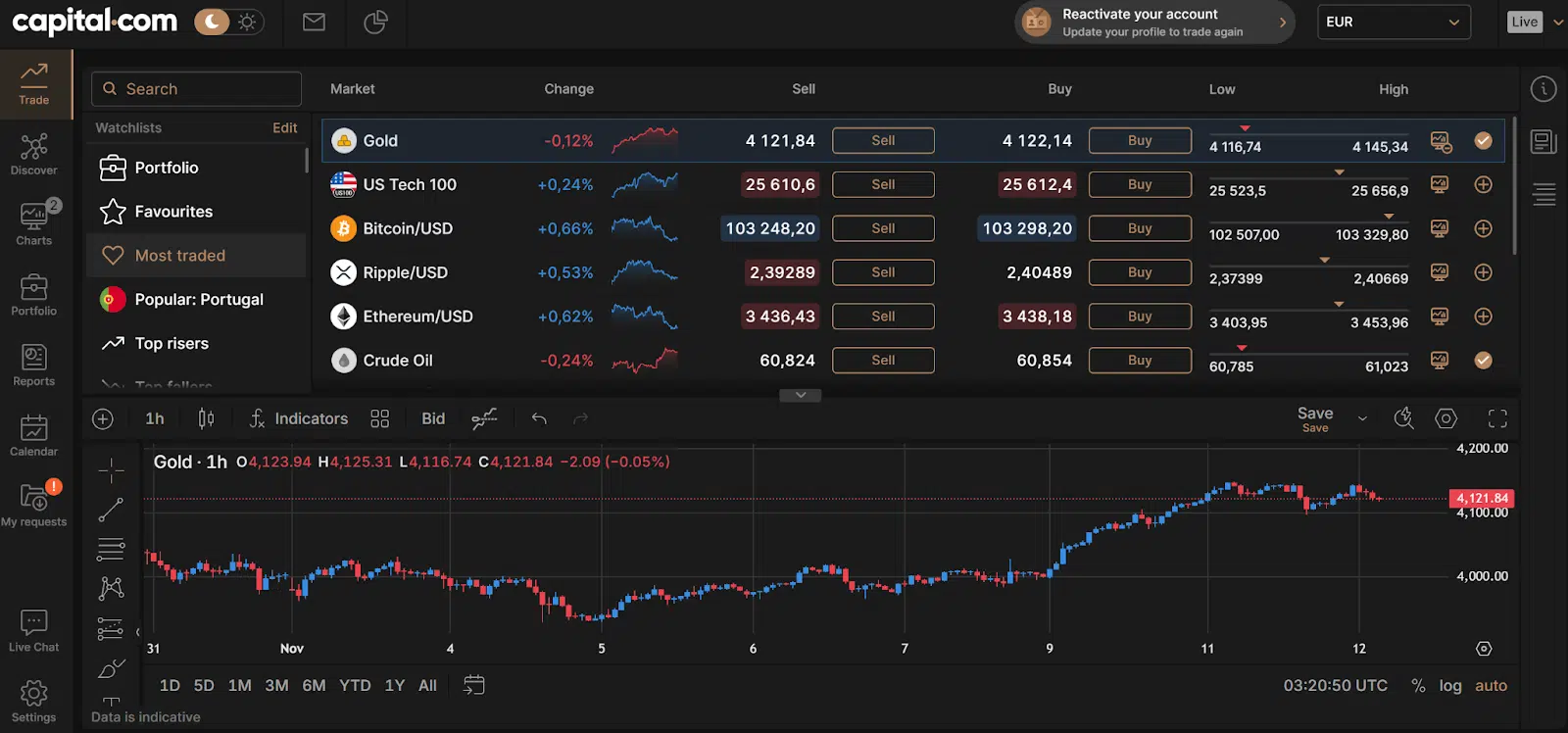

The web platform is intuitive and fast, making it straightforward to place trades or analyse markets, even if you’re not an experienced trader.

The layout is clean: on a typical screen, you’ll see your watchlists, open positions, and order tickets on one side, and a large, customisable chart in the main area.

You can search for instruments by name, ticker, or asset class (stocks, indices, forex, commodities CFDs), and add them to your favourites with a single click. Each instrument page displays key information, including current bid/ask prices, daily percentage change, price range, and fundamentals where available.

In terms of analysis, the platform includes advanced charting tools with multiple timeframes (from 1-second to daily, weekly and monthly charts), and more than 100 technical tools (trendlines, Fibonacci retracements, channels, and more). You can switch between chart types (line, bar, candlestick, etc.) and save chart layouts for future use.

Order placement is straightforward. You can open a buy or sell CFD or spread bet position, choose your position size, and set stop-loss and take-profit levels, all in one deal ticket.

The platform also shows margin requirements, estimated costs, and potential profit/loss before you confirm the order, which is especially important when trading leveraged products like CFDs. Real-time news and fundamental sentiment indicators may be available for certain markets, enabling you to stay informed about potential market movements without leaving the platform.

All in all, the trading platform is great for both beginners, as well as more experienced traders.

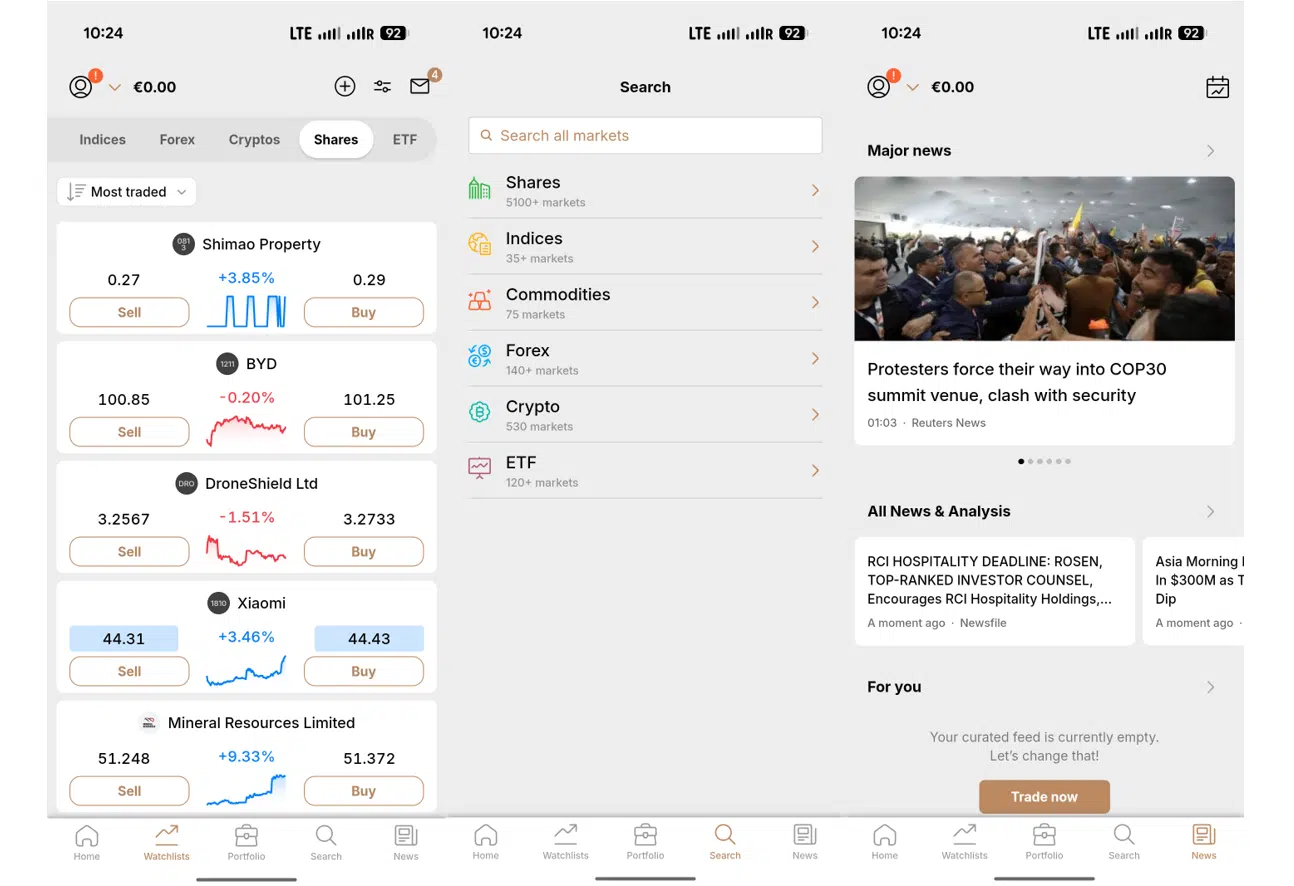

Mobile app

Available for iOS and Android, the Capital.com mobile app mirrors the desktop experience with real-time price alerts, advanced charting tools, watchlists and more. Like the web platform, the app also features a “demo mode” for practising with virtual funds.

MetaTrader 4 (MT4)

For experienced traders, Capital.com also integrates with MetaTrader 4 (MT4), a platform that differs from Capital.com’s proprietary web and mobile platforms in several ways.

While Capital.com’s own interface focuses on simplicity, clean design, and accessibility for beginners, MT4 is built for professional and algorithmic trading. It supports Expert Advisors (EAs), allowing you to automate strategies and run them 24/5 directly on your account. This makes it ideal for traders who want to backtest strategies, use custom scripts, or run automated systems without manual execution.

MT4 also offers deeper technical analysis capabilities: traders can install thousands of custom indicators, create their own analytical tools using the MQL4 scripting language, and open multiple chart windows simultaneously with advanced customisation options.

TradingView

Capital.com’s integration with TradingView offers a powerful alternative to both its native platform and MT4.

While Capital.com’s own platform focuses on simplicity and MT4 excels in automation, TradingView stands out for its charting depth and social trading features. Users can connect their Capital.com account directly to TradingView and execute trades straight from the TradingView charts.

TradingView provides access to hundreds of technical indicators, highly customisable chart layouts, and multi-timeframe analysis. It also supports Pine Script, a proprietary scripting language that allows traders to build and share custom strategies or indicators.

A unique advantage of TradingView is its global community: traders can share charts, ideas, and technical setups publicly or follow others’ analyses in real time. This social dimension adds an educational layer and helps traders discover new strategies or market perspectives.

Markets and products

Capital.com provides access to a broad range of markets and trading instruments in the UK, offering three main ways to trade: CFDs with leverage, Spread Betting, and the 1X non-leveraged CFD account.

CFDs (with leverage):

- Stocks: Trade CFDs on global companies listed on exchanges like NASDAQ, NYSE, LSE, and Euronext.

- ETFs: Exposure to popular ETFs through CFDs.

- Indices: Major indices such as DAX 40, CAC 40, FTSE 100, S&P 500, and Euro Stoxx 50.

- Forex: Over 130 currency pairs, including EUR/USD, GBP/USD, and EUR/JPY.

- Commodities: Precious metals, oil, natural gas, and agricultural products.

Because all these instruments are CFDs, you don’t own the underlying assets, but can trade both long and short with leverage.

Spread Betting

UK clients also have the option to trade through spread betting, which provides access to more than 4,700 markets across indices, forex, commodities and shares.

Spread betting on Capital.com is integrated into the same platform used for CFDs, providing traders with access to advanced charts, risk management tools, watchlists, and educational resources.

A key advantage for many UK residents is its tax-efficient nature: profits from spread betting are generally exempt from UK Capital Gains Tax and Stamp Duty, although tax treatment depends on individual circumstances.

Like CFDs, spread betting is a leveraged product, meaning both potential gains and losses are amplified.

Example of a Spread Betting trade:

Suppose the UK 100 index is quoted at 7,500/7,501. You decide to place a £1-per-point buy bet at 7,501 because you believe the index will rise. If the UK 100 moves up to 7,531 and you close your position, the market has moved 30 points in your favour. Your profit would be 30 points × £1 = £30.

If instead the UK 100 drops to 7,471 and you close the position, the market has moved 30 points against you, resulting in a £30 loss.

This example illustrates how Spread Betting works: your profit or loss depends on how many points the market moves and the amount you stake per point.

1X Account (non-leveraged CFDs)

The 1X account offers a simpler, lower-risk way to trade by allowing clients to use non-leveraged CFDs.

Instead of borrowing funds or trading on margin, traders only use the money they deposit, making this approach closer to traditional investing.

This structure removes the impact of leverage, meaning your losses are limited to the amount you’ve invested.

Furthermore, with 1:1 positions, overnight fees don’t apply. Since you’re not using borrowed money, the platform doesn’t charge the daily financing cost typically applied to leveraged CFD trades. This type of trading is closer to the general “investing”, even though it’s still a derivative.

24/5 Index CFD Trading

Capital.com offers 24/5 trading on major global index CFDs. This feature enables continuous access from Sunday to Friday (UTC), letting you trade before markets open and after they close.

Indices available for 24/5 trading include popular benchmarks such as the EU Stocks 50, Germany 40, UK 100, US 500, US Tech 100, Japan 225, and Hong Kong 50. Prices are derived from live futures markets, ensuring ongoing price action even when underlying exchanges are shut.

Execution quality remains the same as during regular hours, with transparent spreads, fast order execution (average 0.014 seconds, October 2025), and no additional trading restrictions. However, trading outside standard hours may involve lower liquidity and wider spreads, increasing volatility and potential risk.

Fees

| Fee type | Amount |

| CFD trading (Stocks & ETFs) | 0% commission (spread only) |

| Indices, Commodities, Forex, CFDs | 0% commission (spread only) |

| Overnight financing (Swap) | Variable depending on asset class |

| Currency conversion fee* | 0% |

| Deposit/withdrawal fees | £0 |

| Inactivity fee | £0 |

| Guaranteed Stop-Loss | Available (premium applies) |

| Minimum deposit & withdrawal | £20 |

How Capital.com makes money

Capital.com operates under a zero-commission model, meaning you don’t pay a fixed trading commission when opening or closing positions.

Instead, the broker earns revenue through several channels built into its CFD pricing and trading structure.

Here’s how Capital.com makes money:

1. Spreads

The spread is the difference between the buy (ask) and sell (bid) price of a tradable instrument, and it’s the primary source of Capital.com’s revenue. Every time you open a position, you effectively pay this difference as the cost of entering the trade.

Spreads vary depending on:

- Market liquidity: popular markets like EUR/USD or gold typically have tighter spreads than less-traded assets like agricultural commodities.

- Volatility: during highly volatile periods, spreads may widen as market conditions change.

Capital.com show this example for CFDs on Apple stocks:

- You hold a position of 10 shares on Apple, with a bid/offer quote of $240.00 / $240.13.

- The spread on this market is therefore 0.13 points ($240.13 − $240.00).

- When you open the position, you pay half of the spread (0.065 points).

- When you close the position, you pay the other half (0.065 points).

- The total cost of the spread is 10 shares × 0.13 points = $1.30 (or the currency equivalent).

This simple example illustrates how spreads directly translate into trading costs: the larger your position size or the wider the spread, the greater your total cost. In highly liquid markets such as Apple shares, spreads tend to be tight, meaning your effective trading costs remain relatively low compared to less liquid instruments.

For major forex pairs like EUR/USD, spreads can be ~0.6 to 0.8 pips under normal market conditions.

2. Overnight funding

When you hold a leveraged CFD position overnight, Capital.com applies a daily financing charge (or sometimes pays interest if you’re in a position that earns funding). This overnight funding fee compensates the broker for the cost of loaning money used to maintain leveraged positions outside market hours.

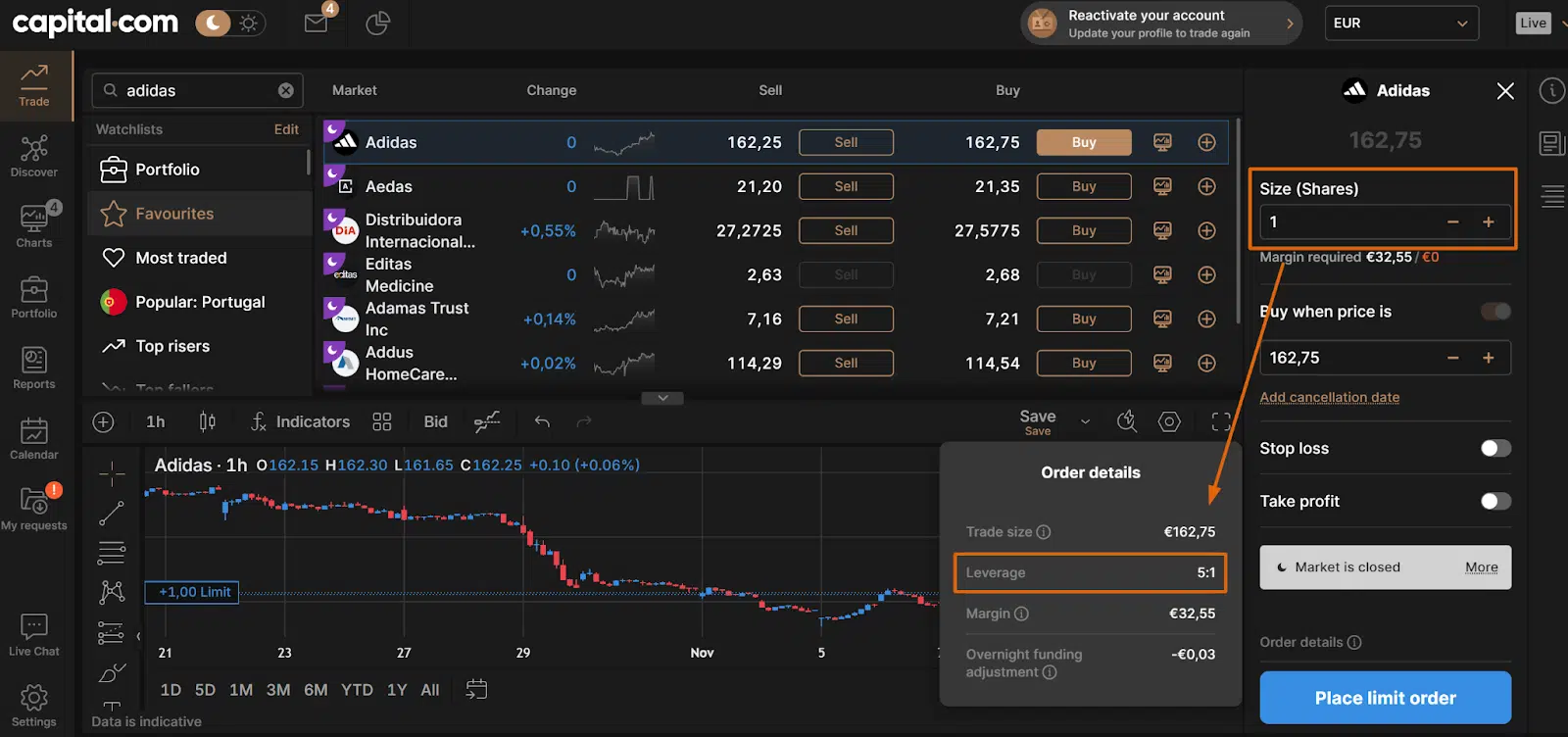

Example of buying a CFD on one Adidas stock:

As you can see, one Adidas share is at “€162.75”, but my margin requirement is only “€32,55”. In other words, I only need €32.55 of my own money to invest €162.75. The difference of €130.20 (€162.75 – €32.55) is borrowed money.

You can see where this amount of leverage comes from if you look at the “order details” and read “leverage 5:1”.

All in all, funding rates depend on the:

- Type of asset (forex, index, stock, or commodity)

- Direction of your trade (long or short)

- Applicable benchmark interest rate (e.g., SONIA or SOFR)

- Daily Capital.com fee

Why overnight fees add up for long-term investors:

Swap (overnight) fees are charged every single day you hold a CFD or spread betting position open.

Over weeks or months, these small daily costs accumulate into a significant percentage of your capital.

That means:

- Even if the underlying index or stock rises, your financing cost eats away at your profit.

- If markets move sideways, the swap fees alone can turn your trade into a loss.

For indices, Capital.com charges an annual daily fee of around 4%, plus or minus the relevant interest-rate benchmark (such as SOFR or SONIA). In practice, that means the total annual cost can reach around 9% of your total position value – not just your invested capital.

If you’re using leverage, the swap is applied to your full market exposure, not the smaller amount you actually deposited. For example, if your margin is $1,000 with 1:10 leverage, your total exposure is $10,000, and the daily financing cost is calculated on that $10,000.

While the fees may seem small daily, they can add up quickly, making holding CFDs and spread betting an expensive long-term strategy.

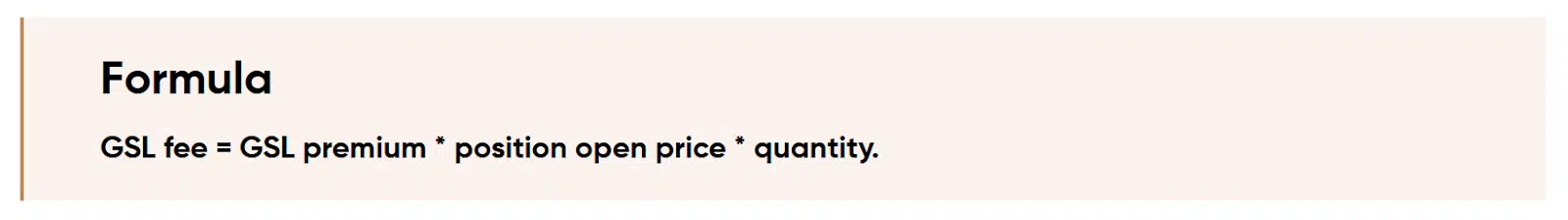

3. Guaranteed Stop-Loss Orders (GSL)

A Guaranteed Stop-Loss Order ensures that your trade closes at your specified price level, even if the market gaps or moves sharply against you. This eliminates the risk of “slippage”, when a standard stop order executes at a worse price than expected.

However, the guarantee comes at a premium fee that is only charged if the GSL is triggered. It’s an optional risk-management tool that provides certainty about potential losses, but it incurs a small additional cost when used.

Formula for the GSL fee:

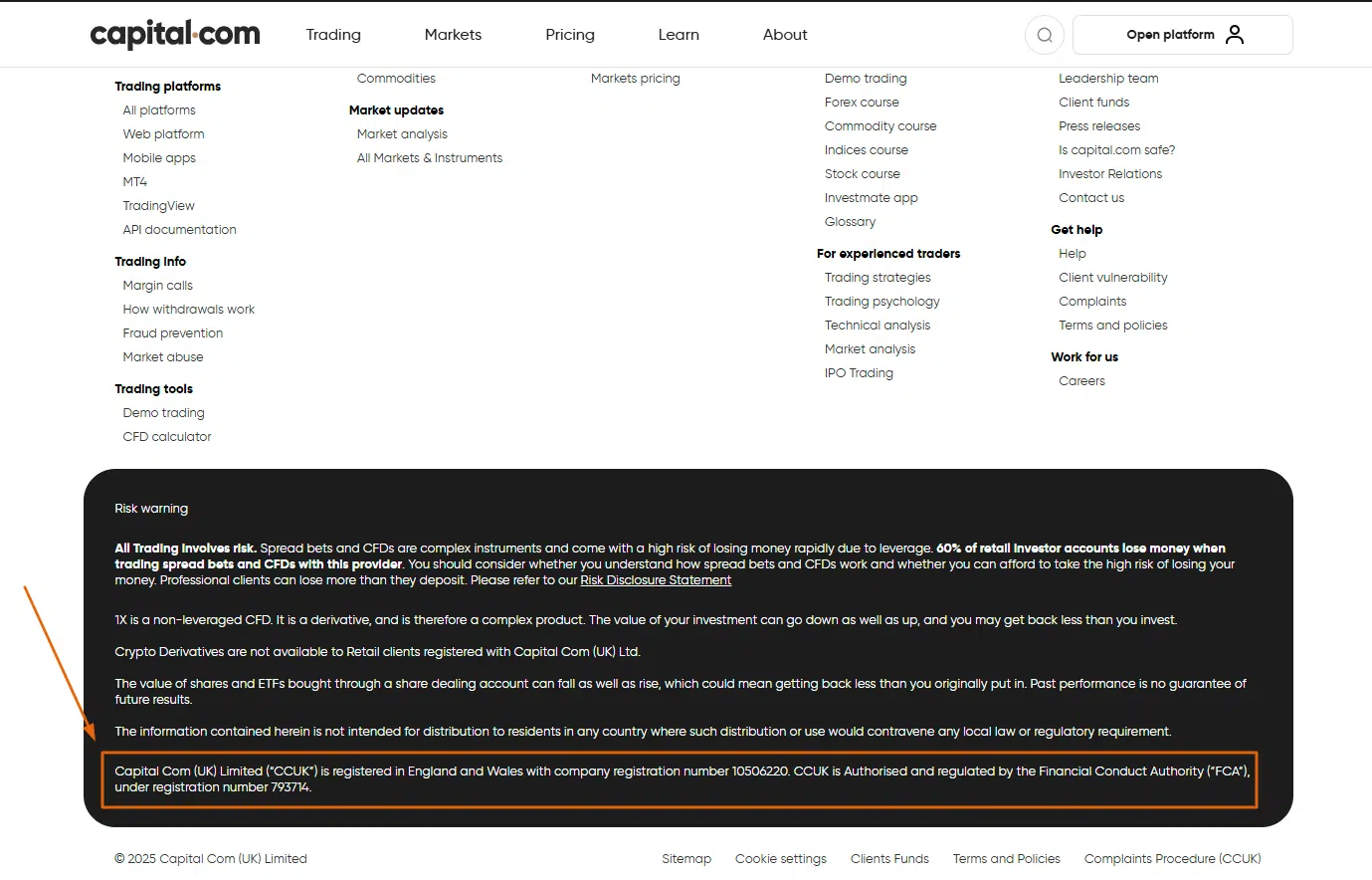

Security and regulation

Capital.com operates in the United Kingdom through Capital Com (UK) Limited (“CCUK”), a company authorised and regulated by the Financial Conduct Authority (FCA) under licence number 793714.

All client money is protected under the FCA’s Client Assets Sourcebook (CASS) rules. This means that all retail client funds are kept in segregated client bank accounts at authorised, reputable UK or EEA financial institutions. Segregation ensures your money is fully separated from Capital.com’s own corporate funds and cannot be used by the firm for its business activities or investment purposes.

In practical terms, if Capital.com were ever to become insolvent, segregated accounts mean that client funds should remain ring-fenced and be returned to clients, provided there is no shortfall.

In cases where a regulated firm fails and client money cannot be fully returned, clients receive compensation through the Financial Services Compensation Scheme (FSCS). Under the FSCS, retail clients are protected up to £85,000 per person, per firm, in the event that Capital Com (UK) Limited is unable to meet its financial obligations.

It is important to understand that the FSCS does not cover trading losses. If the value of your trades falls due to market movements, those losses remain your responsibility. FSCS protection applies only if the firm itself fails and cannot return your money, not if a trade moves against you.

Additionally, under FCA rules for CFD and spread-betting providers, all UK retail clients benefit from mandatory negative balance protection. This prevents your account balance from dropping below zero, ensuring that you cannot lose more money than you deposit in your trading account. However, negative balance protection does not apply to Professional clients.

Opening an account

Opening a Capital.com account is fast and fully digital:

- Sign up via email or social login.

- Verify your identity with an official document and proof of address.

- Complete a suitability questionnaire (required by UK law).

- Deposit funds via bank transfer, card, or e-wallet.

Account verification is usually completed within 24 hours, and users can start with a demo account before trading with real money.

Customer support

Capital.com offers 24/7 customer support in multiple languages via:

- Live chat (on web and mobile)

- Phone support (during business hours)

- Help center and FAQs

Support quality is generally rated as good, though response times can vary during high-traffic periods.

Final verdict: Is Capital.com worth it?

Capital.com offers a modern, regulated, and user-friendly CFD trading platform that’s ideal for UK traders seeking to speculate on short-term price movements in stocks, ETFs, forex and commodities.

Its zero-commission structure, advanced charting tools, and integration with MT4 and TradingView make it appealing to active traders who understand leveraged products.

However, it might not be ideal for long-term investors seeking to own real assets or collect dividends. Overnight financing fees can accumulate, and CFD trading inherently carries a higher level of risk.

If your goal is active trading, Capital.com is a strong contender among the UK’s CFD brokers.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of UK retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money