The question of much money you can make lending money in Peer-to-Peer lending platforms is interesting, and it’s something that many people are wondering about. Many bloggers have been documenting their P2P investments and showing +20% annual returns on their investments – an example here. Let’s analyze the data to understand the potential rate of return for lenders!

Potential Returns for P2P Lenders

The rate of return for peer-to-peer loans varies depending on the amount of risk the lender is willing to assume. Each P2P loan on the platform is given a numerical “credit score” based on several factors. These factors are linked to the borrower’s credit history and overall financial profile. The interest rate is determined based on the loan’s internal score.

If the lender is willing to invest in a loan with a low score, she/he will be rewarded with a higher interest rate. Consequently, if the borrower has a “low risk” profile, the P2P platform will assign a relatively low-interest rate to the loan. If the lender decides to participate in this type of loan, she/he will receive a lower rate of return—however, the risk of default is also smaller.

Although interest rates vary across different P2P platforms, the typical annual rate of return for a “high risk” loan is 15% to 20%. However, it’s not uncommon for a high-risk borrower to pay an annual interest rate of 35%. If a loan applicant is considered a low-risk borrower, the interest rate is typically 6% to 8%. According to data provided by Bank Rate, the average annual percentage rate (APR) for all P2P borrowers in 2019 was 13,9%. The range was 5,9% to 36,0%. Of course, lenders do not receive the full value of the APR. Why? Because the P2P company collects its fees from the APR charged to the borrower. As a general rule, P2P firms reduce the APR by 2% to collect the loan origination fee and other charges.

The most commonly asked question by new P2P lenders is, “Should I invest in a high-interest rate loan or a low-interest rate loan?” Quite honestly, it depends on your tolerance for risk. If you are a risk-averse investor, the best course of action is to invest in a low-interest rate loan in exchange for the security of knowing that your investment carries a low risk of default.

An excellent strategy is to spread your P2P investment across several different loans with different levels of risk. Several P2P platforms will allow lenders to invest as little as 25 Euros in a loan. This is a great way to diversify your investment.

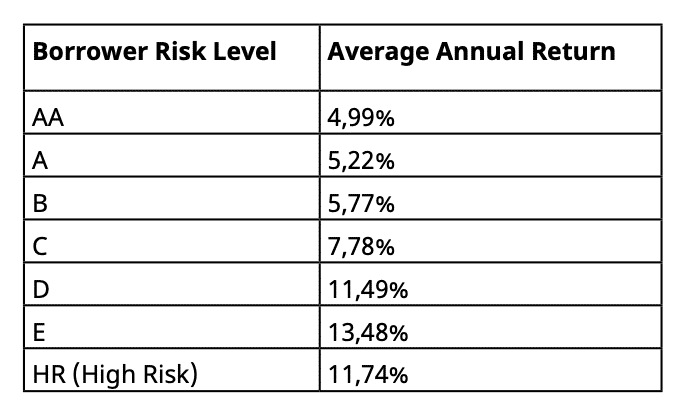

In 2019, Prosper released an internal report outlining the average rate of return for all Prosper lenders.

Average rate of return for Prosper Lenders in 2019

As you can see from the table, the annual return increases along with the level of risk. Of course, the risk of default rises in unison with the risk level.

The risks involved in Peer-to-Peer Lending

All investments have risks. P2P lending is no exception. Of course, the biggest risk with P2P lending is that the borrower fails to repay the loan.

There are also other risks involved. For example, peer-to-peer lending is not government-guaranteed or government-insured. Consequently, if a lending firm becomes insolvent, there is no safety net for the lenders. Another risk to consider is the ability of the P2P company to review the financial stability of the loan applicant properly.

As a participating lender, you rely 100% on the firm’s ability to scrutinize the borrower’s financial background thoroughly. If the P2P firm is careless in analyzing each loan applicant, the loan delinquency ratio will definitely increase.

Another risk to consider is the overall macro environment of the global economy. If the macroeconomy is unstable, the risk of default will certainly increase. As a potential P2P lender, you should consider all of the risks before moving forward.