In copy trading and traditional CFD and forex trading, there is one major advantage available that can make a huge difference for ordinary people without much capital; leverage. What leverage in trading means is that you essentially borrow money from your broker so that you can take bigger positions in the market than your account size would normally allow for (if you were trading unleveraged instruments).

Leverage in trading

Leveraging allows you to invest more than the money you have. For example, if you have 1000€ in your balance and decide to trade with 100x leverage, you could operate with 100,000€.

Typical leverage in Europe (here meaning all EU and EEA countries) is 1:30 for major currency pairs you might trade. This means that for every € 1 in your account, you can take positions in the market worth € 30.

Let’s take a look at a few more examples of what leverage can mean for you as a trader in monetary terms:

| Invested amount | Leverage | Trade Size |

| 50 € | 1:20 | 1000 € |

| 200 € | 1:30 | 6000 € |

| 400 € | 1:10 | 4000 € |

As you can understand, this is extremely risky if not used properly. A single bad trade can end up leaving your balance even negative! That is why some platforms have Negative Balance Protection up to a certain amount (Ayondo is an example) to ensure that you’re protected.

For other assets, however, the amount of leverage you can get is lower than that. As of 2020, the maximum allowed leverage in Europe is:

- 1:30 for major currency pairs (i.e. EUR/USD)

- 1:20 for non-major currency pairs (i.e. NZD/USD), gold, and the biggest stock indices

- 1:10 for commodities (other than gold) and smaller stock indices

- 1:5 for single stock CFDs

- 1:2 for cryptocurrency CFDs

While in Europe, the maximum allowed leverage for major currency pairs is just 1:30, other parts of the world have different rules. Sometimes, leverage can go much higher than the 1:30 that European traders are used to, and in some cases, all the way up to 1:500 and beyond. However, with an amount of leverage like this, discipline becomes extremely important. Without experience and a highly rigid risk management system, you will likely lose all the money in your account sooner or later.

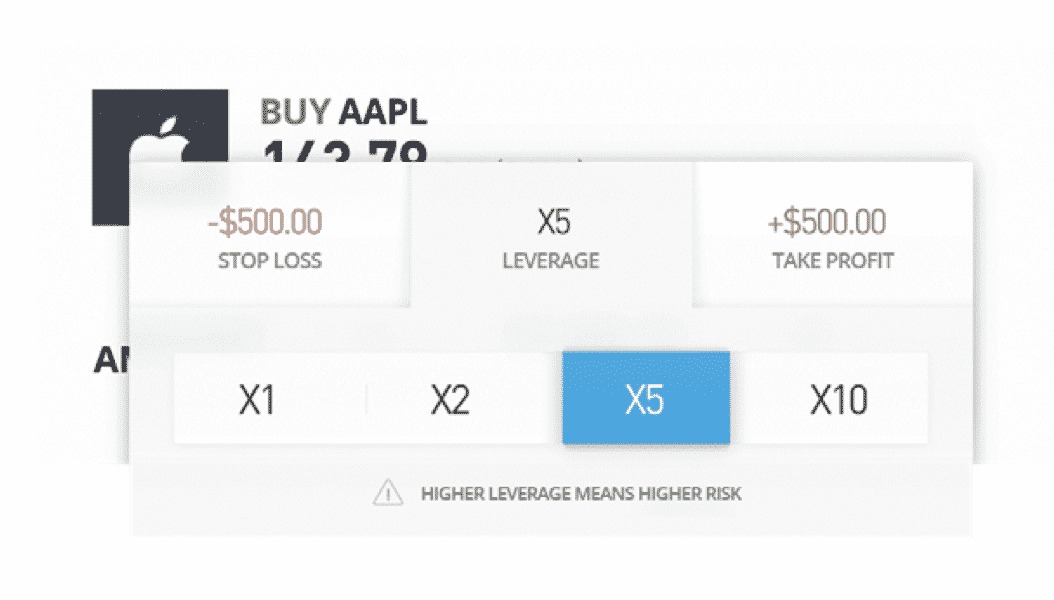

When picking your own trades (not copy trading) on eToro, you can choose the amount of leverage you want. For a stock like Apple, the available leverage ranges from X1 (no leverage) to X10 leverage.

Leverage in copy trading

Now, when it comes to copy trading specifically, you are essentially giving up control of leverage, and thus some of the control over your risk level, to the trader(s) you decide to copy.

While some traders choose to make unleveraged trades, others use the maximum allowed leverage, dramatically increasing both the profit potential and the risk.

What you can do that works similar to leveraging in trading is increase the trade amounts of the traders you are copying. While this can increase potential returns, it also increases your risk of higher losses!

Don’t abuse the leverage. It is tempting to increase the amount allocated to each trader or the trade amount. However, beware that leverage increases a lot the risk and comes at a high cost – the spreads or financing rates charged by the broker.

The bottom line

In short, leverage allows you to:

- Take bigger positions in the market than your account size would otherwise allow for.

- Get meaningful profits (and losses!) even with just a small account.

- Only put up a small amount of capital for each trade (the margin).